Internal Revenue Service

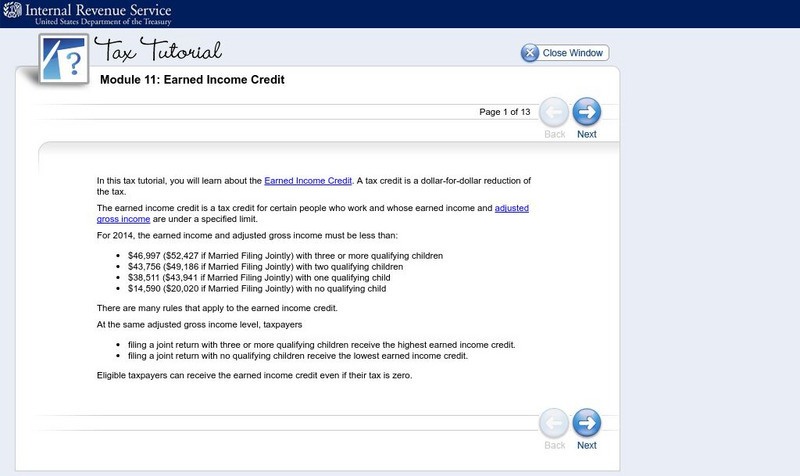

Irs: Tax Tutorial: Module 11: Earned Income Credit

This tax module explores what the earned income credit is and how taxpayers qualify for the credit.

Internal Revenue Service

Irs: Tax Credit for Child and Dependent Care Expenses Lesson Plan

This lesson plan help students understand the tax credit for child and dependent care expenses.

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help students understand the earned income credit.

Internal Revenue Service

Irs: Claiming a Child Tax Credit Lesson Plan

This lesson plan will help students understand the child tax credit and additional child tax credit.

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Digital History

Digital History: The Clinton Presidency

Short, but comprehensive, synopsis of Clinton's two terms as president. Included in the article is the 1992 campaign, successful and controversial legislation, and the scandals that would eventually become part of his presidential legacy.