Curated OER

"Tarantula Shoes," by Tom Birdseye

Pupils read a book and explore spending, saving, opportunity cost, and trade-offs. They keep a diary of expenses to track their spending and examine their opportunity costs.

Curated OER

Saving For Retirement

Students examine the fundamentals related to saving for retirement and investing such as return on investment, compound interest, and planning for different rates of savings. They see the importance of setting long term saving goals.

Curated OER

Jesse's Big Change

Students explain assets, liabilities and expenses. They record information on income statements and balance sheets and brainstorm opportunities to make money work for them.

Curated OER

Budgeting 101

Students identify various sources of income and discern between needs and wants as they also learn to create a personal budget. In this personal budget lesson, student understand financial scenarios as they relate to different ways...

Curated OER

Unit Pricing

Students explore unit pricing to determine the best buy for their money. In this personal finance lesson, students calculate cost per wear examples and create a list of criteria for picking clothes. Students visit a story and use their...

Curated OER

Under the Bed or in the Bank?

Students explore personal finance. In this consumer /financial mathematics lesson plan, students compare interest rates as they explore savings.

Curated OER

Retirement: Show Me the Money!

Students explore the concept of retirement finances. In this retirement finances lesson, students discuss what it means to save, invest, risk, or the time value of money. Students play the stock market game. Students interview a parent...

Curated OER

You Can Bank on Me!

Students identify reasons people choose to donate. In this donating lesson plan, students contrast the words spend, save, and donate. Students learn a song about donating, brainstorm reasons to give, and make sound choices with their money.

Curated OER

Real Life Challenge ~ Budget

In this consumer mathematics worksheet, students complete one month of budgeting by completing each of the statements with the appropriate information. Then they calculate their total expenses for the month minus their savings account...

Curated OER

Term Deposits: Worth the Wait?

Students study term deposits and the attributes of long and short-term savings. They examine their spending habits while looking at how different types of accounts meet different economic goals. They complete worksheets that are provided...

Curated OER

Sources of Finance for Development

Young scholars identify the positives and negatives of foreign aid. They explain the main functions of the World Bank and the IMF. They discuss concepts related to these in class.

Curated OER

Meet the Financial Institution Representative

Learners listen to a financial institution representative discuss how to open a savings account, and fill out an application for a new account. Students practice creating a savings deposit slip and determine the differences between the...

Curated OER

Lesson 2: Savings Accounts and U.S. Savings Bonds

Students explore the importance of savings accounts and U.S. Savings Bonds. They study the concept of simple interest through a math activity.

Curated OER

Selling, Spending, or Saving

Learners examine and discuss vocabulary dealing with finances. They write and develop commercials promoting savings practices and spending habits that incorporate emotional appeals.

Curated OER

Thinking About Shopping and Spending

Students list and discuss recent commercials they have viewed. They identify advantages and disadvantages of the advertised items, and write about the effects of advertising, planned spending and spontaneous spending.

Curated OER

"The Leaves in October", by Karen Ackerman

Pupils read a story about a family living in a shelter. They explore different places to save their money and the advantages and disadvantages of each.

Curated OER

"Four Dollars and Fifty Cents," by Eric Kimmel

Students use the book, "Four Dollars and Fifty Cents" to discover ways that creditors can obtain payment from reluctant debtors

Curated OER

Reno's Dilemma

Students explain proportions as it relates to principle and interest. They use proportions to explain relationships and analyze relationships by identifying patterns.

Federal Reserve Bank

Federal Reserve Bank of St. Louis: The Piggy Bank Primer [Pdf]

A workbook for children on how to save and manage their money, and how to create a budget.

University of Missouri

University of Missouri St. Louis: Wise Pockets World

Join the adventures of Wise Pockets, a curious koala, to learn about money concepts. Great elementary website to explore earning, saving, and credit. The website includes a student, teacher, and parent section with resources.

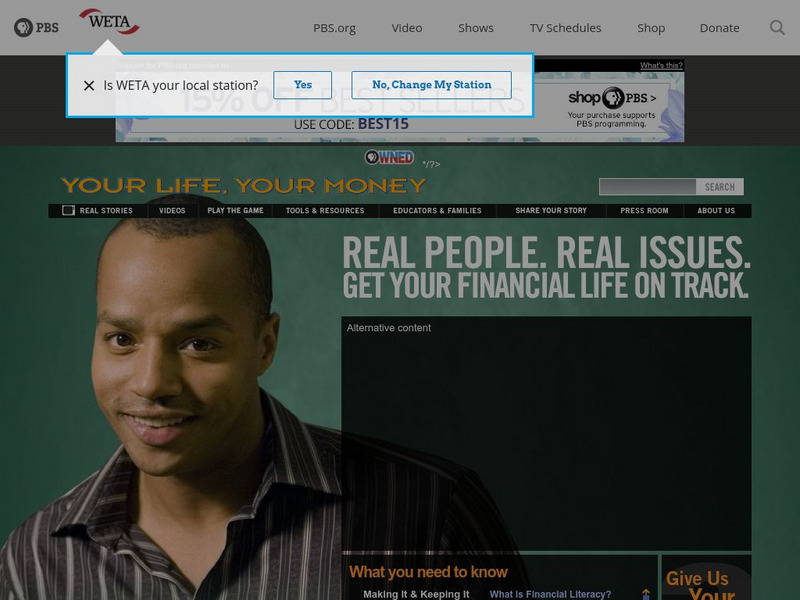

PBS

Pbs: Your Life Your Money

PBS presents an abundance of financial information and helpful tips; real stories from real people on managing your money. Some of the financial challenges include getting out of debt, saving money, insurance, and investments.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Consumer Tools

Useful age-appropriate lessons and activities meant to educate kids about their finances as they grow. Geared toward ages 3 through 18+, each module identifies 4 specific milestones students should understand in order to achieve...

Other

Actuarial Foundation: Building Your Future: Financing [Pdf]

In book 2 from the Building Your Future series, students and teachers get resources and practice on how financing works, such as getting loans and buying insurance.

Other

Actuarial Foundation: Building Your Future: Investing [Pdf]

In book 3 of the Building Your Future series, students and teachers work on the concept of investing, including stock and bonds, mutual funds, risk and diversification, and inflation, through a combination of information and practice.

![Federal Reserve Bank of St. Louis: The Piggy Bank Primer [Pdf] Activity Federal Reserve Bank of St. Louis: The Piggy Bank Primer [Pdf] Activity](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)