iCivics

Mini Lesson A: Monetization

Advertising is everywhere! Does your class know that their attention span is for sale, even when they're watching a simple news story? The second installment in a five-part series from iCivics examines the relationship between news...

CK-12 Foundation

Area Between Curves: Income and Expenses

Use the area of polygons to calculate the area between curves. Pupils calculate areas under income and expense curves by filling the space with squares and right triangles. Using that information, they determine the profit related to the...

Arizona Department of Education

Be Independent / Life Management Skills

Living independently is about more than managing money. Learn how to manage time, balance responsibilities, and calculate overtime and income with a set of activities about life management skills.

Practical Money Skills

Making Money

Prepare your class for a life of financial literacy and stability with a unit about making money. Three lessons guides learners through the process of preparing a resume, interviewing for a job, and reading a pay stub.

Practical Money Skills

Living on Your Own

Every teen dreams of living independently, but often without thinking about the details and costs involved with moving out. Three lessons in a unit about living on your own focus on moving costs, fixed and flexible costs associated...

Practical Money Skills

Budgeting Your Money

How do you make sure that your income doesn't disappear before you have a chance to save it? Use a creative budgeting activity to teach learners in both special education and mainstream classes how to keep track of their expenditures and...

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson plan on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Wells Fargo

Hands on Banking

Cha-ching! You just hit the jackpot with this interactive consumer math unit. Supported by a series of online lessons and activities, these lessons engage students in applying their math skills to real-life personal...

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Federal Reserve Bank

The Case of the Shrunken Allowance

An allowance is an important thing! Make sure your kids know how to save and spend their own money. Using the book The Case of the Shrunken Allowance as a starting point, this plan covers income, spending and saving, counting, and more.

Federal Reserve Bank

Little Nino's Pizzeria

Engage your youngsters in basic economics by connecting the terms to dessert and pizza! After a discussion about intermediate goods and natural resources, learners read and connect a pizzeria to economic terms.

Federal Reserve Bank

U.S. Income Inequality: It's Not So Bad

What is the difference between a flat tax, progressive tax, tax deduction and transfer payments? Pupils examine the ability-to-pay principle of taxation through discussion, problem solving, and a variety of worksheets on topics from US...

Federal Reserve Bank

Beatrice’s Goat: A Lesson on Savings Goals

Youngsters learn the meaning of saving and how to reach savings goals by first reading a story of a young Ugandan girl who is gifted a goat, and then discovering the opportunity costs of savings decisions made by her and her family.

Federal Reserve Bank

Journey to Jo’burg: A South African Story

How did South African apartheid affect the ability of people of color to increase their human capital? Here is a rich lesson in which learners come to understand the relationship between investment in human capital and income, while also...

Federal Reserve Bank

Would Increasing the Minimum Wage Reduce Poverty?

Here is a fantastic and relevant question to discuss with your class members. Using detailed reading material and a related activity, your learners will learn about labor markets, equilibrium wages, price floors, and...

Curated OER

My Monthly Budget

Here's a nice layout to work on a monthly budget. There's a section to write income: where it comes from, the amounts, and any other notes. Then there's a section to write about expenses: what is purchased, the amount it costs, and...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Budget Mania

Students examine several examples of budgets to develop a facility with the components of its formation. Income, expenses, and expenditures are considered and itemized for this lesson.

Curated OER

Circular Flows

To study circular flow, learners use the plans to trace through a series of interconnected economic and financial flows to explain the workings of the American economy. They use the model developed to comprehend the effects of Federal...

Curated OER

Progressive Reforms

Tenth graders analyze editorial cartoons focusing on progressive reform. They compare their analysis and research. Students discuss the cost of reform leading to the creation of a national income tax through the passage of the 16th...

Curated OER

Labor Markets

Students examine labor markets by participating in an employer/employee simulation and in group discussions. They discuss mandated employee benefits and predict the effect they have on various parties.

Curated OER

Race, Education, and Income: Comparing Carter & Reagan

High school learners compare economic outcomes for 3 racial groups under the presidencies of Jimmy Carter and Ronald Reagan by analyzing a series of graphs, answering questions from a worksheet, and participating in a discussion.

Curated OER

Income and Outcomes

Bring financial literacy into your classroom. Learners use peer support to reflect on their spending and how it reflects their income and their values.

Curated OER

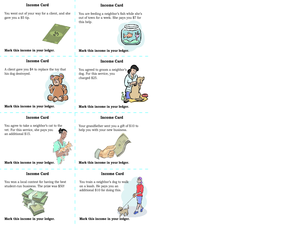

Income and Expenses

Young scholars discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.