Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important...

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

Texas Education Agency (TEA)

Importance of Being Accurate

Accuracy is key! Using the detailed resource, scholars practice their presicion skills, taking online spelling and typing tests. Next, they demonstrate accuracy by calculating the gross and net pay of five hypothetical employees.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough instructional activity on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds...

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

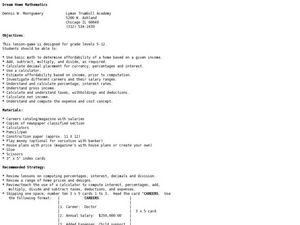

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Graphing It Out

Young scholars create bar graphs. In this graphing lesson, students explore the concepts of net pay, gross pay, income and expenses. They create a bar graph to designate financial outlay during a specified period.

Curated OER

Basic Budgeting

Students create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

Curated OER

Taxes: Where Does Your Money Go?

Young scholars explore the concept of taxes. In this tax instructional activity, students investigate types of taxes and deductions taken out of a paycheck before they see it. Young scholars calculate the tax on a given dollar amount. ...

Curated OER

Taxes: Where Does Your Money Go?

Young scholars study taxes and the role that they place in our lives. In this economic lesson, students explore the reality of taxes, how they work, why we pay them, where the money goes and how to make the most of the money you pay into...

Curated OER

Money and Percentage

Fifth graders examine use of percentages in real world situations. They complete worksheet about using percentages after reviewing the concept. They look through newspapers to find examples of percentages used over the course of three...

Other

Uncle Fed's Taxes: Tax Topic 401, Wages and Salaries

This site from Uncle Fed's Tax board explains withholding tax from wages and salaries. Mentions various forms that are used when filing taxes.

Thinkport Education

Maryland Public Television: Sense and Dollars

Engaging, fun tutorials and interactive games related to earning, spending, saving, and budgeting money.

Other

Treasury Direct: Money Math: Lessons for Life: Math and Taxes:a Pair to Count On

Students have the opportunity to see how the money they earn is dependent, to a great extent, on the education they gain, by examining occupations and salaries. They then will use pay stubs and tax tables to learn what happens to the...

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Calculating the Numbers in Your Paycheck

Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they take home.

Khan Academy

Khan Academy: Interpreting the Income Statement

Practice interpreting an Income Statement in this seven-question exercise.