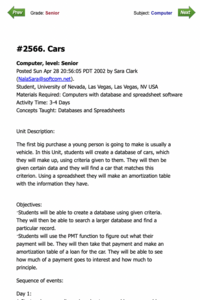

Curated OER

Cars: Math, Research, Economics, Loans

Students investigate what the purchasing of a car entails. They explore car criteria and financing options.

Federal Reserve Bank

Federal Reserve Bank of Philadelphia: What Is the Federal Reserve? [Pdf]

Questions like "How does the bank hold reserves?" or "How do banks make deposits?" are examples of what is explained through this banking simulation lesson plan to illustrate the purpose of the Federal Reserve.

Other

Canadian Bankers Association: Getting Started in Small Business

This resource discusses the possible sources of financing when starting a small business, debt financing (borrowing money) and equity financing (investing money).

The Federal Reserve System

Federal Reserve Board: A Consumer's Guide to Mortgage Refinancings

A comprehensive go-to guide for understanding refinancing and shopping for a new mortgage or loan. Poses guestions that will help the consumer decide if refinancing a mortgage is the way to go.

US Department of Education

Federal Student Aid: Fafsa

If a student wants to receive any sort of financial aid, they must complete a Free Application for Federal Student Aid. This site explains how and allows you to submit it electronically.

PBS

Pbs: Frontline: The [Credit] Card Game

Information and analysis on the practices of the loan industry in America. Focus is on the wave of financial services legislation, which attempts to curb abusive tactics of banks and credit card issuers, that came into effect in 2010.

Utah Education Network

Uen: How Credit Works

Learn credit terminology and analyze an actual loan application.

Next Gen Personal Finance

Next Gen Personal Finance: Types of Credit Data Crunch

Data Crunches feature one chart or graph followed by five scaffolded questions to guide students through analyzing the data and drawing conclusions. These sets of data help students understand credit concepts.

Practical Money Skills

Practical Money Skills: Financial Calculators

Explore your own financial information in greater detail by using these powerful tools for forecasting and assessing your financial choices. During the process, you might discover expenses you can eliminate or more effective ways to...

Other

Afsaef: Personal Loans 101: Understanding Personal Loans [Pdf]

This brochure will help you understand the terms of financing and issues to consider before entering into a personal loan.

Practical Money Skills

Practical Money Skills: Lessons: College

Ten financial literacy lesson plans allow college students to build on their skills and cover topics such as budgeting, living on your own, managing credit cards, cars and loans, and saving and investing.

iCivics

I Civics: Banks, Credit & the Economy

This lesson focuses on the relationship between money, banks, and lending in our economy.

Other

My Money

This Federal Government website provides consumers with many resources and much information to help them to manage their money better. Topics include budgeting, taxes, saving, investing, retirement planning, credit, and checking...

Other

Ndsu Extension Service: Kids & Money Newsletter

A newsletter for young people and their parents about managing money.

Other

Biz Kids: Break the Bank

In this interactive game, you are a worker at a community bank, helping customers get good loans and save for their future. However, the terrible Mr. Boar and his clerks from a payday loan company have infiltrated your bank! Rally the...

Other

Hamilton Project: Undergraduate Student Loan Calculator

Want to figure out a student loan payment? Try this loan calculator to determine an estimate for an individual situations.

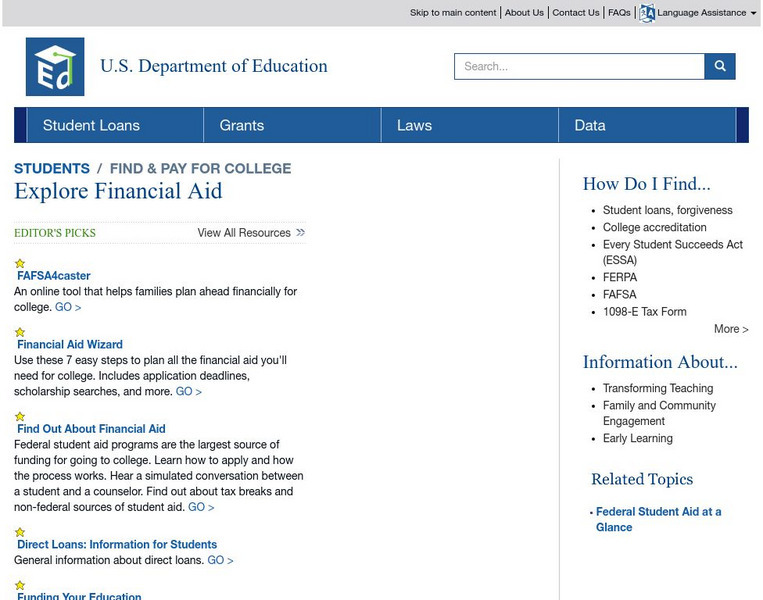

US Department of Education

Us Department of Education: Explore Financial Aid

This site from the US Department of Education provides this comprehensive government publication on grants, loans, and work-study programs. Each piece of information can be accessed by clicking on the corresponding link.

Council for Economic Education

Econ Ed Link: Show Me the Money!

Students will investigate unforeseen costs of car loans and/or house loans. They will then evaluate the economics of decision making, the ramifications of their choices, and options available to them. Students will compute costs and...

Council for Economic Education

Econ Ed Link: u.s. Senate Mulls Over Bankruptcy Legislation

During the week of September 20, 1998, the US Senate agreed to debate a bill (S 1301), intended to make it more difficult for people of means to use bankruptcy to walk away from debt. Those who could pay at least 20 percent of their...

Practical Money Skills

Practical Money Skills: Asking for a Loan

Students deliver a persuasive monologue on why a family member should lend them money.

Federal Trade Commission

Federal Trade Commission: Buying a New Car

Most students won't be buying a new car while in high school, or just out of high school, but it would be good practice for them to go through the motions on paper.

Federal Trade Commission

Federal Trade Commission: Credit Scores

Explanation of credit scores, including what credit scores are, how they are created, how they are used, and how consumers can improve them.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Being a Responsible Borrower

Students watch a role-play to learn about the behaviors of a responsible borrower and answer questions about borrowing.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Telling the Difference Between Loan Myths

Knowing the difference between loan myths and realities can help you become a responsible borrower. Students analyze statements about loans and decide whether they're a myth or reality.

![Federal Reserve Bank of Philadelphia: What Is the Federal Reserve? [Pdf] Lesson Plan Federal Reserve Bank of Philadelphia: What Is the Federal Reserve? [Pdf] Lesson Plan](http://content.lessonplanet.com/resources/thumbnails/409975/large/bwluav9tywdpy2symdiwmduymc0xmdqxmc03zmj5zmguanbn.jpg?1589982798)

![Pbs: Frontline: The [Credit] Card Game Activity Pbs: Frontline: The [Credit] Card Game Activity](https://content.lessonplanet.com/knovation/original/485357-9c79222bfad54d7b497f15c394b1bb12.jpg?1661520669)