Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Module 13-Electronic Tax Return Preparation and Transmission

Students explain the electronic preparation and transmission of tax returns. They describe the ways to prepare and transmit tax returns and explain the benefits of electronic tax return preparation and transmission.

Curated OER

Circular Flows

To study circular flow, learners use the plans to trace through a series of interconnected economic and financial flows to explain the workings of the American economy. They use the model developed to comprehend the effects of Federal...

Curated OER

Proportional Taxes

Students are able to define and give an example of a proportional tax and the impact that it can have on different income groups and explain how a proportional tax takes the same percentage from all tax groups.

Curated OER

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Progressive Reforms

Tenth graders analyze editorial cartoons focusing on progressive reform. They compare their analysis and research. Students discuss the cost of reform leading to the creation of a national income tax through the passage of the 16th...

Curated OER

Public Choice Theory and The Economics of Taxation

Let your learners know how our economy works, what taxation is, and how Public Choice Theory affects the economics of taxation. This is a comprehensive and well defined presentation that includes links to additional information provided...

Curated OER

Understanding Tax: Your Role as a Tax Payer

Every adult should know that it is their responsibility to help fund public goods and services by paying taxes. Help young people get a handle on the history, evolution, purposes for, and reasons why they should pay taxes too.

Curated OER

Completing Simple Tax Forms

Twelfth graders practice filling out IRS 1040 EZ forms. They discuss various ways people pay taxes. They assess the importance of W-2 forms and apply skills using the IRS tax table to compute how much money is owed or returned.

Curated OER

Taxes and Social Security

Students practice filling out the United States Federal 1040EZ tax form and share examples in a class discussion. A written exam is provided to help assess cumulative comprehension.

Curated OER

Calculate Percentages

Sixth and seventh graders study the concept of finding the percent of a number. They calculate the percent of any given number. Pupils describe ways to use calculating percents in their daily life, and change percents into decimals,...

Curated OER

Your Tax Dollars at Work

In order to understand how tax dollars are spent, young economists use given data and graph it on a circle graph. Circle graphs are highly visual and can help individuals describe data. A class discussion follows the initial activity.

Curated OER

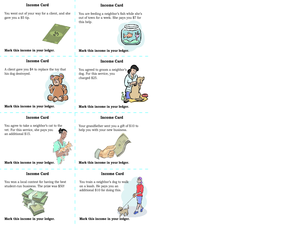

Income and Expenses

Students discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

Curated OER

Debate Topics and Ideas

Students examine both sides of arguments surrounding given debates. They use the internet and other research to collect information to support their stand on the controversial issue. Students debate their chosen topic. This lesson plans...

Curated OER

Basic Concepts of Democracy

Bring the government to your classroom with this challenging activity. Great as either a review activity or a quiz, the worksheet contains ten questions about the philosophy and characteristics of a democratic government.

Curated OER

People and Government

Introduce your elementary students to US Government. This slide show briefly defines the three levels and branches of government, and taxes. Tip: Use this resource to introduce the topic by asking students what they know, clearing up...

Curated OER

Percents: What's the Use?

Learners explore percentages in real world situations. In this percents lesson, students determine the final sales price after discounts. Learners interview community members and determine how percentages are used in the real world.

Curated OER

We The People: A History

Students play a game about taxation where they have tax collectors that simulate the feelings and reasons that led to the American Revolution. For this taxation lesson plan, students learn about why the people in the colonies were so...

Curated OER

Tax Problem: Percents

For this tax worksheet, students solve 1 problem about taxes. Students find the federal and state tax on a given amount of money.

Curated OER

Taxes, Tips, and Salaries

In this taxes, tips and salaries worksheet, students read story problems and determine the sales price, percent of change, amount of tax, and final price. This four-page worksheet contains 8 multi-step prolems. Answers are provided on...

Curated OER

Taxing Taxes

Students complete math word problems. For this taxes lesson, students discuss taxes and why they are necessary. Students research the history of taxes, write a summary of their findings, determine the sales tax in their area and...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics lesson, students explore how math is used in various careers, how income takes are calculated and other important life lessons in math.

Curated OER

Government Goods and Services

Fifth graders investigate the connection between taxes and government services. In this economics lesson, 5th graders discuss the process and benefits of paying sales and income taxes. Using calculators, students compute the amount of...

Curated OER

Simulation: The King's Candy

Students examine the British tax laws in Colonial America. In this U. S. history lesson, students participate in a simulation that replicates the taxes levied by the British.