Curated OER

Your Land is My Land: A Look at Bootleg Coal Mining During the Depression

Students examine the extreme conditions of unemployment during the Great Depression. In this multiple perspectives lesson, students analyze photographs of coal mining, research and adopt the perspective of a person affected by...

Curated OER

Markup, Discount and Tax

In this selling price worksheet, 6th graders solve and complete 24 different types of problems. First, they find the selling price for each item described. Then, students determine the discount rate using the original price and...

Curated OER

Are Taxes "Normal?"

Students explore the concept of normal distribution. In this normal distribution lesson plan, students find the normal distribution of taxes in the 50 US states. Students make histograms, frequency tables, and find the mean and median of...

Curated OER

Wealth

Third graders read the story The Day I Was Rich and learn about the role of money and taxes. In this money lesson plan, 3rd graders count large sums of money, group them, and give it away in the form of taxes. They discuss wealth and how...

Curated OER

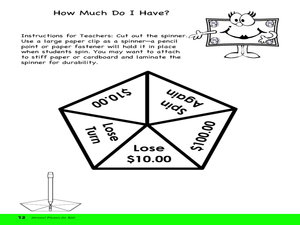

Sales Tax and Discounts

Students explore the concept of sales tax and discounts. In this sales tax and discounts lesson, students pretend to gamble in groups to win fake money. Students must tax their winnings. Students collect receipts. Students discuss the...

Curated OER

Sales Tax

Students explore the concept of sales tax. For this sales tax lesson, students work in groups to spend $500. Students calculate the discount and sales tax on each item. Students buy between 5 to 10 items.

Curated OER

Taxes: Where Does Your Money Go?

Young scholars explore the concept of taxes. In this tax lesson, students investigate types of taxes and deductions taken out of a paycheck before they see it. Young scholars calculate the tax on a given dollar amount. Students...

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types of taxes...

Curated OER

Shopping Spree

Students calculate discounts, sale price, and sale tax. In this consumer math instructional activity, students visit mock stores which have items for sale. Students calculate the final prices of items.

Curated OER

The American Revolution: Causes

Students investigate taxation of the American colonist by the British which led to the revolution. In this American Revolution lesson, students analyze a poem called Revolution Tea, and then work in small groups to present an oral...

Curated OER

Reteach: Sales Tax and Discounts

In this sales tax worksheet, 6th graders read steps to finding sales prices, sale tax amounts, and total cost of sale items. They solve twelve problems using those steps.

Curated OER

Solving Algebraic Equations

In this algebraic equations worksheet, 6th graders solve and complete 9 different word problems that include various types of equations. First, they find consecutive even numbers and write an equation to solve. Then, students write a...

Curated OER

Taxes

In this word search worksheet, students solve a word search by locating forty words related to taxes. The word list includes IRS, jail, and law.

Curated OER

Word Problems

In this mathematics worksheet, 5th graders solve a number of word problems by selecting the best answer for each. They read each problem and fill in the bubble next to the answer selected.

Curated OER

Debt and Deficits

Learners identify, research and interpret the national debt and deficits of the past through today and why it has risen significantly in the last 20 years. They analyze the size and impacts and discuss the various policy measures for...

Curated OER

A Look at Individual Federal Income Tax

Students investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...

Curated OER

Lesson Plan: Figuring Sales Taxes

Students define and discuss sales tax, identify items for which they do or do not have to pay sales tax, research information online about sales tax in their state, and complete practice sheet that requires calculating sales tax percent...

Curated OER

Finding Sales Tax

Seventh graders investigate sales tax. Following a teacher demonstration, they find sales tax and the total cost of items. In groups, classmates choose items from a menu that they would like to purchase. Each student figures the sales...

Curated OER

Good News and Bad News: Income and Taxes

Students examine Internal Revenue Service (IRS) Form 1040, citing particular line items that are pertinent to an artist acting as an entrepreneur. They explore various sources of income and the importance of keeping accurate income records.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Shop 'Til You Drop: Food for Thought

Middle schoolers shop in a virtual grocery store. Students choose items for their shopping cart and check out. They determine the tax, delivery fees, and total cost. Middle schoolers discuss the advantages and disadvantages of shopping...

Curated OER

Understanding Taxes

Students engage in a variety of lesson plans published by the IRS. They participate in lessons involving how taxes apply and why taxes exist. They view Power Point presentations, complete worksheets, and participate in activities on tax...

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Students explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Module 12-Self-Employment Income and the Self-Employment Tax

Students explain self-employment income and the self-employment tax. They distinguish between an employee and an independent contractor and explain how to compute and report self-employment profit.