Internal Revenue Service

Irs: Self Employment Income and the Self Employment Tax Lesson Plan

This lesson plan will help students understand self-employment income and the self-employment tax.

Internal Revenue Service

Irs: Exemptions Lesson Plan

This lesson plan will help students understand personal and dependency exemptions and how exemptions affect income that is subject to tax.

Internal Revenue Service

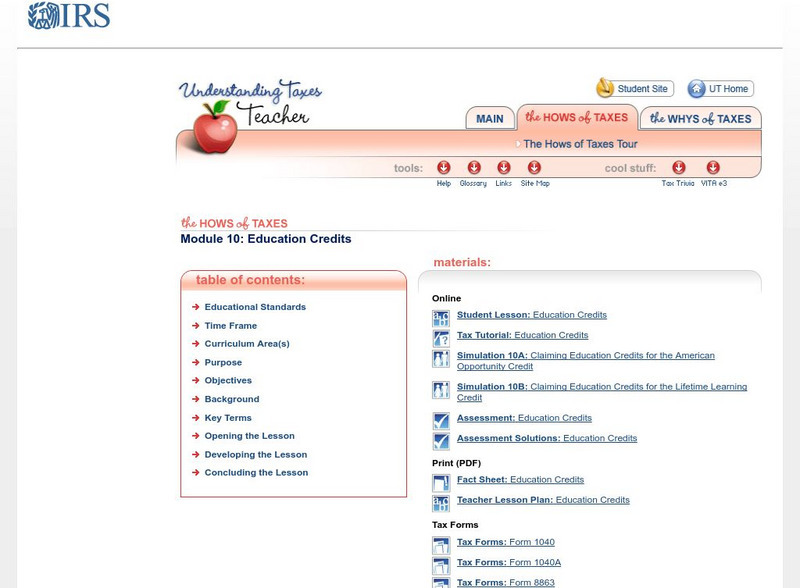

Irs: Education Credits Lesson Plans

This lesson plans will help students understand refunds, amounts due, and recordkeeping requirements.

Internal Revenue Service

Irs: Why Pay Taxes? Lesson Plan

This activity will help students understand the basic rationale, nature, and consequences of taxes.

Internal Revenue Service

Irs: Evolution of Taxation in the Constitution Lesson Plan

This lesson plan will give students an overview of the role and purpose of taxes in American history.

Internal Revenue Service

Irs: Taxes and a Market Economy Lesson Plan

This lesson plan will help students understand the role of taxes in the market economy.

Internal Revenue Service

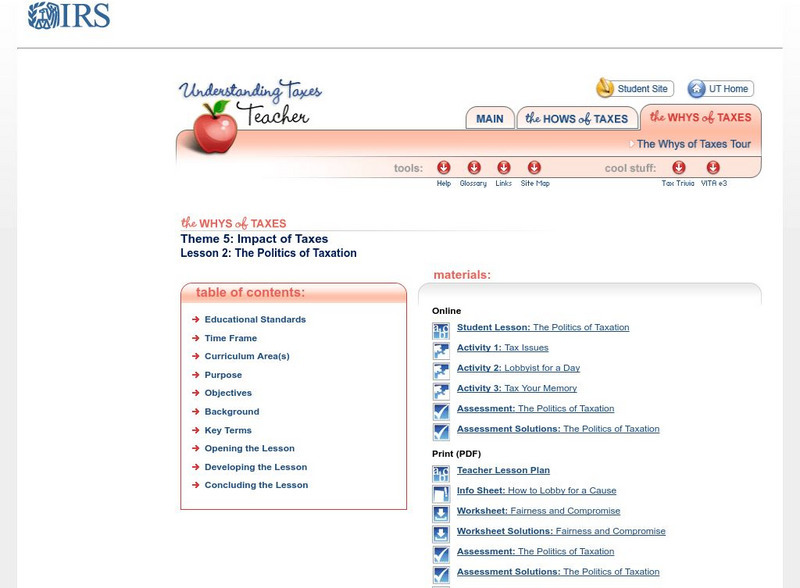

Irs: The Politics of Taxation Lesson Plan

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes.

Internal Revenue Service

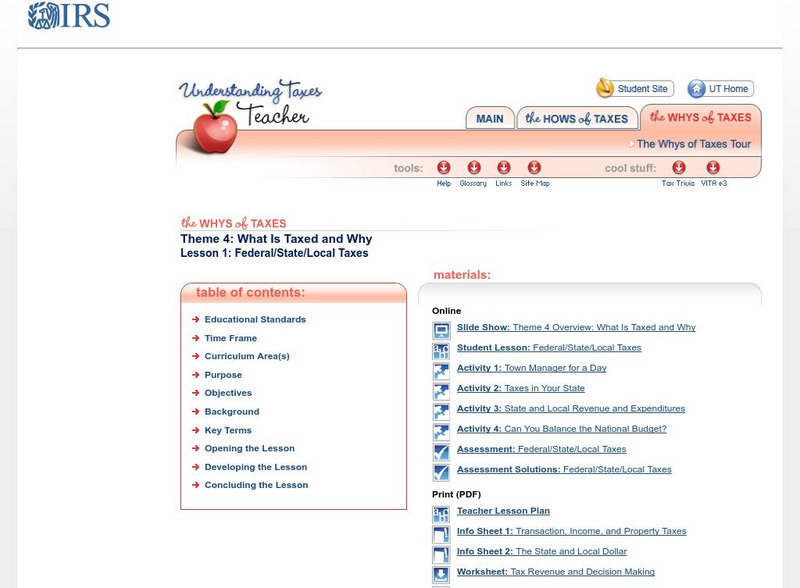

Irs: Federal/state/local Taxes Lesson Plans

This lesson plan will help young scholars understand that federal, state, and local governments need revenues to provide goods and services for their residents.

Internal Revenue Service

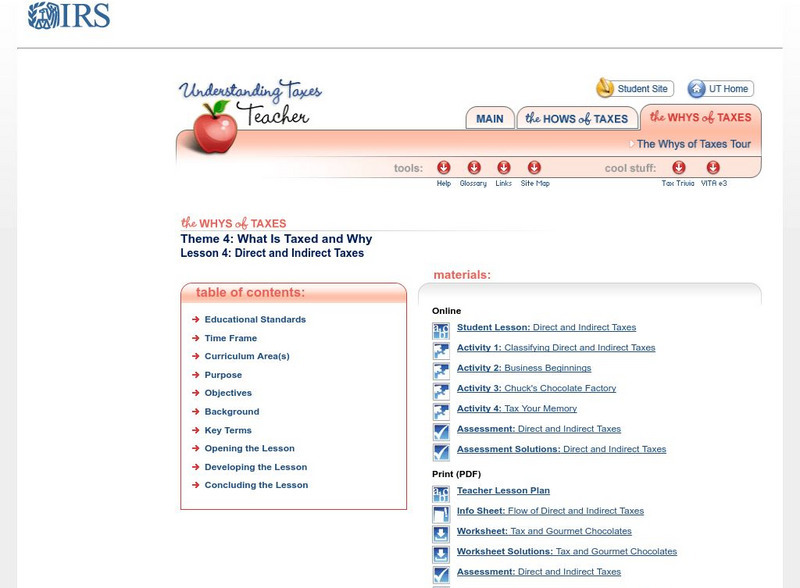

Irs: Direct and Indirect Taxes Lesson Plan

This lesson plan will help students understand that a tax levied on one person or group may ultimately be paid by others.

Internal Revenue Service

Irs: Standard Deduction Lesson Plan

This lesson plans will help young scholars understand the standard deduction and how it affects income that is subject to tax.

Other

State Taxes: State Tax Guide

This resource contains links to state tax websites, and information about filing taxes.

CNN

Cnn Money: Investing in Bonds

Information about investing in bonds. Including why buy bonds, how they work, the risks and a glossary.

Internal Revenue Service

Internal Revenue Service (Irs)

The Internal Revenue Service is the nation's tax collection agency. Explore this site to find tax statistics, recent news, and specific tax information for individuals, businesses, charities, and nonprofits.

Other

National Endowment for Financial Education: Smart About Money

On this site students can learn about financial planning and the many decisions adults have to make during life events and their money. Helpful tips, printable worksheets and links to additional resources are provided on a wide variety...

Council for Economic Education

Econ Ed Link: Clean Land Thanks to Us! (Student Page)

How does the government raise money to fund government agencies like the EPA? Through taxes. This lesson looks at the different taxes that are paid by US citizens and how the money is used for things such as cleaning up the environment.

CNN

Cnn Money: Tax Guide

Information about taxes including paying taxes, filing a return, audits, tax planning.

Other

The Virginia Tax Web Site

This Virginia Department of Taxation home page contains various tax links.

PBS

Pbs Learning Media: Farm and City

This video from Wide Angle reports on the increasingly difficult conditions for farmers in China that have caused many rural Chinese to flee the countryside.

Other

Iris: Hrm: How to Read Your Payroll Advice and Yearly W 2 Earnings Statement

This site provides an example of pay stub and explains each entry; it also explains a W-2 statement.

Other

The University of Southern Mississippi: Aaec Editorial Cartoons Digital Collect

The Editorial Cartoon Digital Collection contains examples of the work of member artists of the American Association of Editorial Cartoonists (AAEC). Created primarily in the 1960s and 1970s, the cartoons reflect changes in American...

Other

Uncle Fed's Taxes: Tax Topic 401, Wages and Salaries

This site from Uncle Fed's Tax board explains withholding tax from wages and salaries. Mentions various forms that are used when filing taxes.

Next Gen Personal Finance

Next Gen Personal Finance: Taxes Data Crunch

Data Crunches feature one chart or graph followed by five scaffolded questions to guide students through analyzing the data and drawing conclusions. These sets of data help students understand tax concepts.

PBS

Pbs Learning Media: Primary Source Set: Shays' Rebellion

A collection that uses primary sources to explore Shays' Rebellion.

Practical Money Skills

Practical Money Skills: Financial Calculators

Explore your own financial information in greater detail by using these powerful tools for forecasting and assessing your financial choices. During the process, you might discover expenses you can eliminate or more effective ways to...