Visa

Keeping Score: Why Credit Matters

How does one get credit, and who provides credit? What is a credit score, and how can an understanding of a credit score help you to make smart financial decisions? Through discussion and worksheets, class members will identify the...

Visa

In Trouble

What are some of the financial risks associated with using credit? Pupils learn the warning signs of incurring financial hardship, and through PowerPoint presentations, worksheets, and discussion, discover the implications of such events...

Curated OER

Debit and Credit Logs

Supplement your class money system with this logbook. The resource includes cover page as well as the log page, which focuses on attendance and classroom behavior. Each week, kids can add up their credits and debits to determine how much...

Visa

Credit Cards

Choosing your first credit card can often be an intimidating and confusing experience for young adults. Give your pupils the foundational knowledge they need for tackling this process head-on, including learning to distinguish different...

Visa

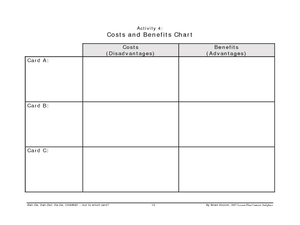

Credit

What are the advantages and disadvantages of having a credit card? Don't miss this important life skills and financial literacy activity, which focuses on consumer responsibilities, creditworthiness, and establishing a credit history.

Federal Reserve Bank

Credit Cards - A Package Deal

Arm your learners with the information they will need to make smart decisions regarding credit cards and personal savings.

Federal Reserve Bank

Keep the Currency

Each day, people throw currency away in different ways because of a lack of financial knowledge. Introduce your learners to the importance of financial literacy and assess their understanding of banking and personal finance.

PwC Financial Literacy

Credit Reports

Middle schoolers discover why it's important to establish a positive credit history and understand the value of credit reports to lenders and borrowers. They apply legal guidelines to establish the uses of a credit report other than...

Agile Mind

Isabella’s Credit Card

An in-depth activity that involves a real-world problem about credit card debt. Learners are given a scenario in which Isabella plans to stop using her credit card and pay off the balance by paying a fixed amount each month. The first...

Curated OER

My Credit Card Plan

Remember all those credit card tables lined up on your college campus? So alluring and dangerous, if you don't know what you're doing. Prepare your pre-college attendees for life by offering a lesson on credit management. They discuss...

Curated OER

I Can Buy Anything I Want: Consumer Debt and Social Responsibility

A clear, comprehensive overview of consumer debt, credit, interest, international currency, and social responsibility, this 45-minute session falters in the application stage. You'll need to create a way for learners to demonstrate their...

Curated OER

'I'm Just Totally Lost' About Finances

Explore the concept of financial planning with your class. High schoolers read an article about planning for the financial future and discuss what steps the family in the article took to be financially sound. They consider where they...

Curated OER

Credit Cards: The Good, the Bad, and the ugly

Students study how dangerous credit cards can be. They see why it is important to pay off credit card bills as soon as they can. They use MS Excel to display and understand the data. They fill out questions using the data from their...

Curated OER

"House of Cards"

Students explore different aspects of credit card use and discover some tools to help them use credit wisely. They listen to a scenario that students might encounter once they "get out into the real world." Students are given a copy of a...

Curated OER

Breaking News English: Credit Cards

In this credit cards worksheet, students read the article, answer true and false questions, complete synonym matching, complete phrase matching, complete a gap fill, answer short answer questions, answer discussion questions, write, and...

Curated OER

Charge Cards!

Students identify and define the various types of credit cards and credit card offers. For this credit cards lesson, students identify the pros and cons of managing a credit card account. Students locate information on the Federal...

Curated OER

Spending Money

Fourth graders become familiar with the ways people exchange goods and services. In this spending money lesson, 4th graders listen to a chapter from Henry and Beezus and record Henry's earnings and money spent. Students use correct...

Curated OER

Using Credit: Not for a Billion Gazillion Dollars

Fifth graders explore the concept of credit. In this consumer education lesson, the teacher uses the book Not for a Billion Gazillion Dollars to lead the class in a discussion about credit, debit, and income. Students then analyze their...

Curated OER

Credit Interview

Student determine a safe debt load. In this credit interview lesson, students explore the importance of budgeting, saving and investing. They examine the pros and cons of using a credit card. Students discuss how to build credit, apply...

Curated OER

Buying on Credit

Students determine how buying on credit adds to the total cost of an item by computing the interest. They find a major item advertised in a magazine and identify the price. Then they identify the rate of a credit card and calculate the...

Curated OER

Charge!?

Students compare/contrast the features of three different types of credit cards. They discuss the pros and cons of credit cards, answer discussion questions, and complete a worksheet evaluating three credit cards.

Curated OER

Credit Card Scare

Students examine credit cards and how they work, analyze credit card applications, and practice good spending habits in a credit card simulation.

Curated OER

EBT-rimental

Students engage in a instructional activity that gives them the tools needed to become knowledgeable credit consumers. The companion website for the ITV program TV-411 is used to provide learners with an interactive experience of what...

Curated OER

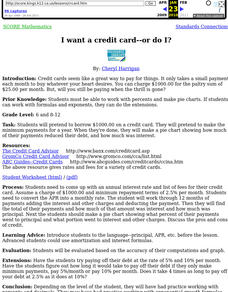

I want a credit card--or do I?

Students pretend to borrow $1000.00 on a credit card. They pretend to make the minimum payments for a year. When they're done, they make a pie chart showing how much of their payments reduced their debt, and how much was interest.