Curated OER

Budgeting Your Financial Resources

Students explore the aspects of making a budget. In this money management lesson, students learn the importance of budgeting and what all goes into creating a budget by eventually creating a budget of their own including how much they...

Curated OER

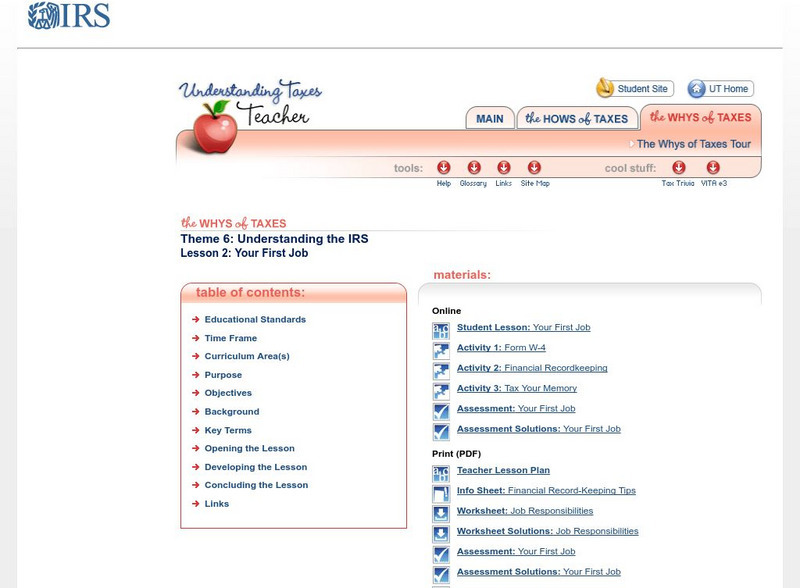

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help learners understand the earned income credit.

Internal Revenue Service

Irs: Your First Job Lesson Plan

This lesson plan will help students understand that they are responsible for paying income taxes through withholding as they earn income and that it is important that they keep accurate records of their earnings and expenses.

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Council for Economic Education

Econ Ed Link: Money Doesn't Grow on Trees

This lesson plan helps students distinguish between earned and unearned income by identifying methods for getting money.

Consumer Financial Protection Bureau

Cfpb: Distinguishing Between Earned and Unearned Income

Learners play a game to help them learn the difference between earned and unearned income.