Curated OER

The Five W's of Tax Day

Use April 15th to teach your students the fundamentals of the American federal tax system.

Curated OER

A Look at Individual Federal Income Tax

Students investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...

Other

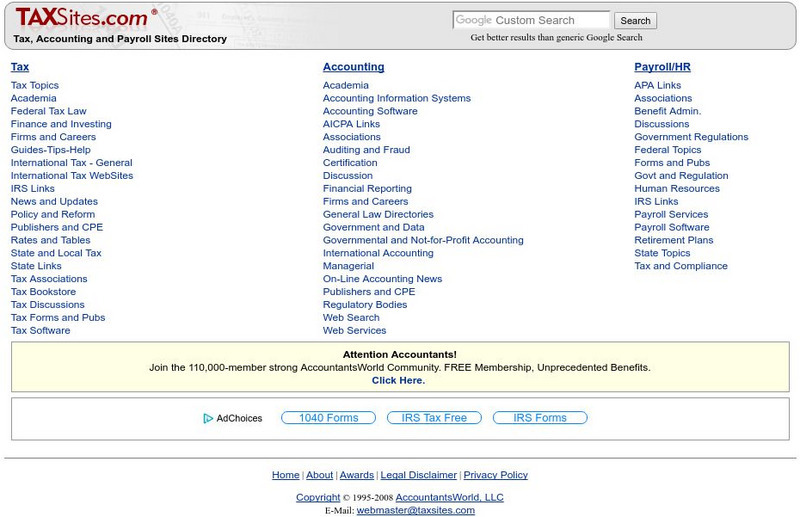

Tax and Accounting Sites Directory

This is a tax and accounting site directory. Includes links to varied tax information.

Internal Revenue Service

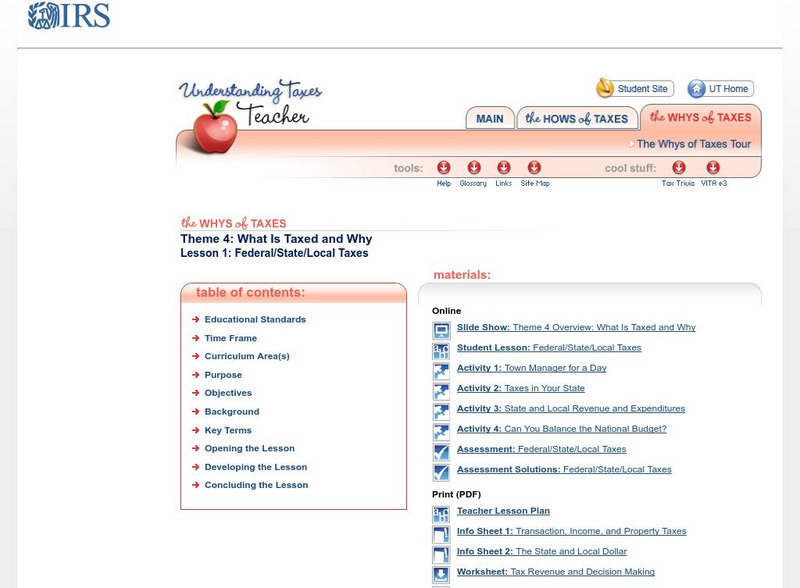

Irs: Federal/state/local Taxes Lesson Plans

This lesson plan will help young scholars understand that federal, state, and local governments need revenues to provide goods and services for their residents.

Other

Aicpa: Taxes: u.s. Federal Government

This resource contains links to federal tax information.

Council for Economic Education

Econ Ed Link: Where Does the Money Come From?

With very few exceptions, the U.S. federal government does not have an "income" to spend providing goods and services. The money used for federal spending programs must be collected as federal taxes, or it must be borrowed. This lesson...

Council for Economic Education

Econ Ed Link: Government Spending: Why Do We Spend the Way We Do?

This lesson plan reviews how the government spends money. It shows how the government's needs have changed over the years. To learn more about this area of economics use this informative website.

Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

ProProfs

Pro Profs: How Much Do You Know About Taxes?

Find out how much you know about taxes with this quick 5-question quiz.