Curated OER

Taxes in U.S. History: The Social Security Act of 1935

Learners explain the history of the Social Security Act and the FICA tax. They describe what Social Security is and whom it is intended to help. They explain the purpose of the FICA tax.

Internal Revenue Service

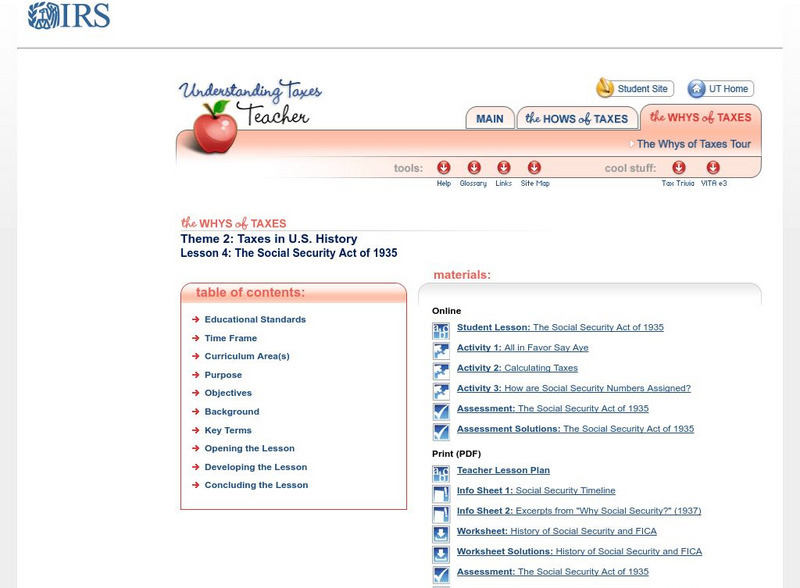

Understanding Taxes: The Social Security Act of 1935

This very complete lesson plan explains the history of the Social Security Act of 1935, its history and importance to the elderly during the Great Depression, and its importance today. Everything necessary to teach the lesson plan and...

Internal Revenue Service

Irs: The Social Security Act of 1935 Lesson Plan

This lesson plan will help learners understand the history and purpose of the Social Security Act of 1935 and the Federal Insurance Contributions Act (FICA).

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Social Security Administration

Social Security Administration: Social Security Educator Toolkit

Two lesson plans with ancillary materials; covers the whats, whys, hows of Social Security.

The Balance

The Balance: Learn About Fica, Social Security, and Medicare Taxes

Without understanding FICA, many high school students who begin working are shocked when they get their first paychecks. This article clearly explains these payroll taxes and what they mean for both employees and employers.

Digital History

Digital History: Social Security, Unemployment Insurance, and Welfare [Pdf]

After reading a brief history of Social Security and its inception in the United States during the Great Depression, find out about the various programs that provide a social safety net to its citizens. See how these programs are funded,...

Other

Entrepreneur: Taxing Matters

This Entrepreneur Magazine article provides "Everything you wanted to know about payroll taxes, and then some," and includes a good explanation of FICA (social security and medicare) withholding.

![Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)