Council for Economic Education

Econ Ed Link: Buy a Bond, James: A Lesson on Us Savings Bonds

This site is extremely informative for teaching children the value of saving money. "You will write a persuasive letter telling why people use savings bonds as a way to save their money."

Council for Economic Education

Econ Ed Link: You've Won the Lottery! Now What?

You won the lottery! The lottery officials have given you a choice. You can either receive the $10 million now in one lump sum, or you can receive $1 million a year for the next 20 years. Now what do you do?

Council for Economic Education

Econ Ed Link: A Penny Saved Is a Penny at 4.7% Earned

There are lots of ways to receive income, and lots of ways to spend it. In this EconomicsMinute you will develop two budgets to help you decide how to allocate your income. Assuming you do not love making dollar bill rings.

Council for Economic Education

Econ Ed Link: Climbing the Savings Mountain

Students discover how saving money can be compared to a mountain climb. The climb can be fast or slow, safe or hazardous, scenic or thrilling. You will find out that there is more than one way to get to the top!

Auburn University

Auburn University: Glossary of Political Economy Terms: Monetary Policy Defined

This site provides a very thorough definition of the economic concept of monetary policy. The explanation is by Dr. Paul Johnson of Auburn University

Other

Prime Rate: Rate, Definition, Historical Graph

Find a graph and chart showing the historical prime interest rate from 1998 to the present.

Council for Economic Education

Econ Ed Link: The Credit Card Mystery

Credit Cards are a risky business these days, especially for students and those holding multiple cards. Interest rates on credit card balances have always been high relative to other rates, for several reasons. Despite this, there is...

Thinkport Education

Maryland Public Television: Charge! Just Charge It!

Stores and credit card companies make it seem so easy. How often have you seen advertisements to buy something and only pay $20 a month? So what's the real cost of credit? Let's go shopping and find out.

Wolfram Research

Wolfram Math World: Simple Interest

This math site explains and defines the concept of "simple interest" and gives a formula for finding this value in terms of time and rate.

Other

Car Ads: Low Interest Loans & Other Offers

This page, provided by a law firm, gives Federal Trade Commission warnings on advertised low-interest rates and questions to consider before signing for a low-interest rate.

Other

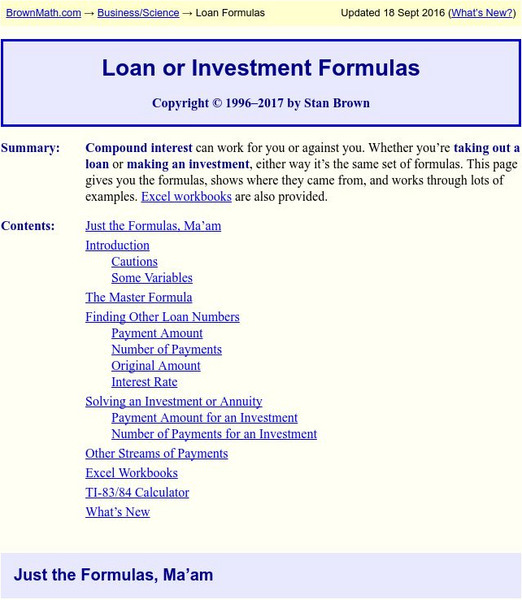

Brown Math: Loan and Investment Formulas

This site is provided for by the Oak Roads Systems. Compound interest can work either for or against you whether you're taking out a loan or making an investment. Either way, the set of formulas for interest is the same and they are...

University of Nebraska Omaha

Ec Ed Web: M&m Interesting [Pdf]

This site from the University of Omaha provides a lesson plan indicated for 6-8th grades. "During this lesson, students use the economic concepts of trade-offs and opportunity costs to decide between savings accounts with simple interest...

Texas Education Agency

Texas Gateway: Macroeconomics: Chapter 4: Labor and Financial Markets: Key Terms

This is a list of key terms and definitions pertaining to labor and financial markets.

University of Nebraska Omaha

University of Omaha: Why We Save [Pdf]

Why do people need to save money? This lesson plan is geared for Kindergarten through 2nd grade and helps students understand the reasons for saving.

Calculator Soup

Calculator Soup: Loan Calculator

Use this loan calculator to determine your monthly payment, interest rate, number of months or principal amount on a loan. Find your ideal payment by changing loan amount, interest rate and term and seeing the effect on payment amount.

Calculator Soup

Calculator Soup: Savings Calculator

Calculates the future value of your savings account. With a starting balance and regular deposits, learn how much can you save.