Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Curated OER

Math Skills for Everyday: Filling Out Income Tax Forms

Students accurately assess their own income taxes using actual tax forms. They read and fill out the proper forms.

Federal Reserve Bank

Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf]

A lesson unit that teaches students all about income tax: what it is, why we have it, how taxes are structured, factors that affect one's tax bracket, and what would happen if the tax structure were changed.

Internal Revenue Service

Irs: Tax Tutorial: Module 2: Wage and Tip Income

Do you understand how your tip income is taxed? This tutorial will explore the taxation of wages, salaries, bonuses, and tips.

Internal Revenue Service

Irs: Tax Tutorial: Module 3: Interest Income

Learn about interest income and what income is considered tax exempt in this module.

Internal Revenue Service

Irs: Tax Tutorial: Module 5: Filing Status

This module reviews over the filling statuses that taxpayers may list when filling their taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 6: Exemptions

Learn the difference between a personal exemption and a dependency exemption in this tax tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Module 7: Standard Deduction

Learn about the standard deduction a single person may take on their income taxes with this tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Claiming Child Tax Credit and Additional Child Tax Credit

This tutorial will help you understand how a child tax credit is claimed on taxes.

Internal Revenue Service

Irs: Tax Tutorial: Module 9: Tax Credit for Child and Dependent Care Expenses

Learn the requirements for claiming the child care tax credit in this tax tutorial.

Internal Revenue Service

Irs: Tax Tutorial: Module 10: Education Credits

A learning module exploring how education credits can be applied to income taxes.

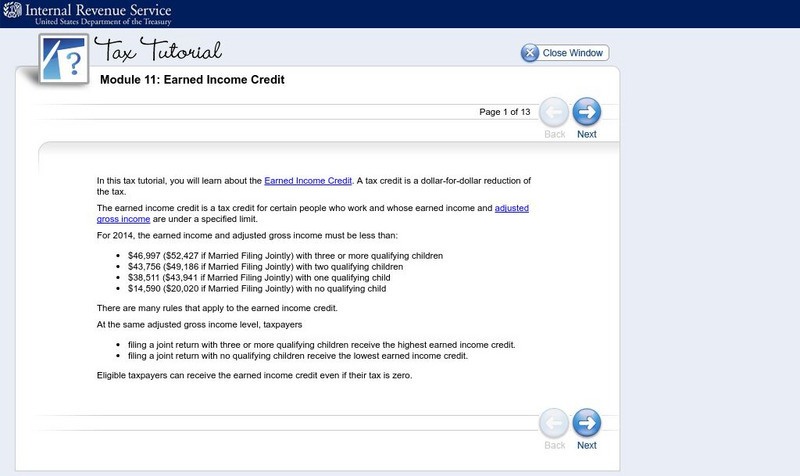

Internal Revenue Service

Irs: Tax Tutorial: Module 11: Earned Income Credit

This tax module explores what the earned income credit is and how taxpayers qualify for the credit.

Internal Revenue Service

Irs: Tax Tutorial: Module 12: Refund, Amount Due and Recordkeeping

Learn about how refunds are processed in a tax return with this module.

Internal Revenue Service

Irs: Tax Tutorial: Module 13: Electronic Tax Return Preparation and Transmission

This tutorial explores e-filing your income taxes.

Internal Revenue Service

Irs: The Irs Yesterday and Today Lesson Plan

This lesson plan will help students understand why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Cornell University

Cornell University: Law School: Income Tax Law: An Overview

A collection of resources for understanding income tax law, including its roots in the Constitution, federal and state statutes and regulations, judicial decisions, and links to the websites of government and tax agencies.

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Thomson Reuters

Find Law: Annotation 2: Sixteenth Amendment

This resource describes the different types of income that are taxable by the government based on numerous court cases in which definitions of the 16th amendment Corporation Tax Act of 1909 were applied.

Country Studies US

Country Studies: The Booming 1920s

A good overview of the policies of the Republican administrations in the 1920s that promoted favorable conditions for U.S. industry. Read about how these policies were a disaster for the farm economy.

Council for Economic Education

Econ Ed Link: Taxes and Income

Review progressive, regressive and proportional taxes with this interactive.

Next Gen Personal Finance

Next Gen Personal Finance: Taxes

Lessons and activities to teach students about federal taxes.

Khan Academy

Khan Academy: Your Guide to Key Tax Terms by Better Money Habits

Knowing tax vocabulary can make filling out the paperwork less intimidating when it's time to file. This content is brought to you by our partner, Better Money Habits.

ProProfs

Pro Profs: How Much Do You Know About Taxes?

Find out how much you know about taxes with this quick 5-question quiz.

ProProfs

Pro Profs: Do You Know Where Your Taxes Are Going?

On April 15, millions of Americans file their income taxes. Find out where your federal income taxes go. Note: This quiz looks only at federal income taxes, not payroll taxes.

![Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf] Lesson Plan Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf] Lesson Plan](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)