Curated OER

Understanding Tax: Your Role as a Tax Payer

Every adult should know that it is their responsibility to help fund public goods and services by paying taxes. Help young people get a handle on the history, evolution, purposes for, and reasons why they should pay taxes too.

Internal Revenue Service

Irs: Self Employment Income and the Self Employment Tax Lesson Plan

This lesson plan will help learners understand self-employment income and the self-employment tax.

Internal Revenue Service

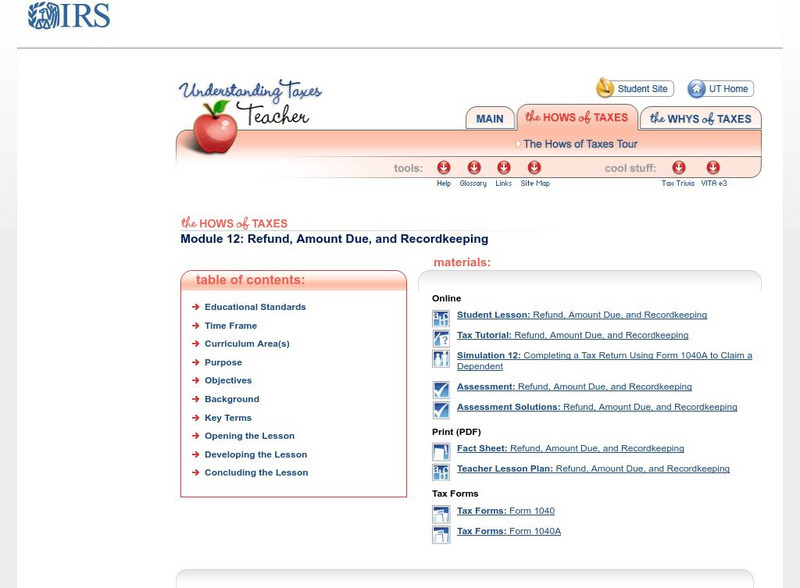

Irs: Refund, Amount Due, and Recordkeeping

This lesson plan will help students understand refunds, amounts due, and recordkeeping requirements.

Internal Revenue Service

Irs: Electronic Tax Return Preparation and Transmission

This lesson plan will help students understand the electronic preparation and transmission of tax returns.

Internal Revenue Service

Irs: Why Pay Taxes? Lesson Plan

This lesson will help learners understand the basic rationale, nature, and consequences of taxes.

Internal Revenue Service

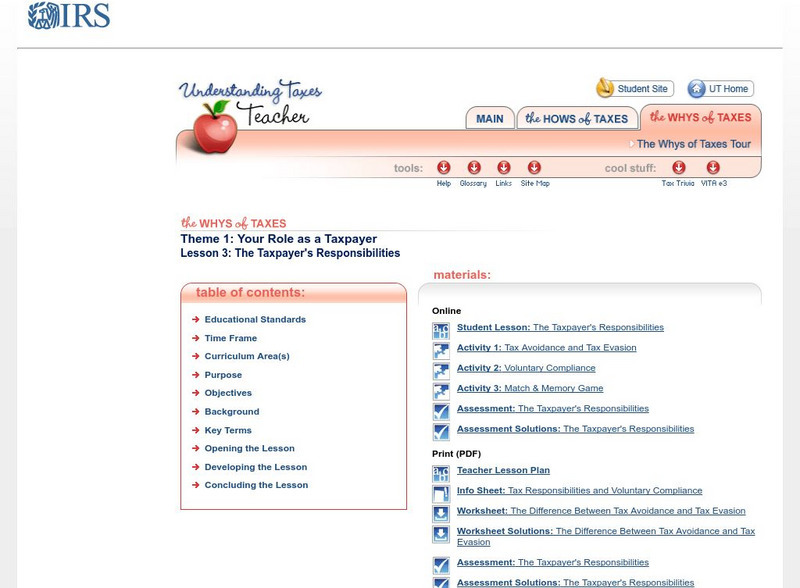

Irs: The Taxpayer's Responsibilities Lesson Plan

This lesson plan will help students understand that they have basic responsibilities as taxpayers.

Internal Revenue Service

Irs: Evolution of Taxation in the Constitution Lesson Plan

This lesson plan will give young scholars an overview of the role and purpose of taxes in American history.

Internal Revenue Service

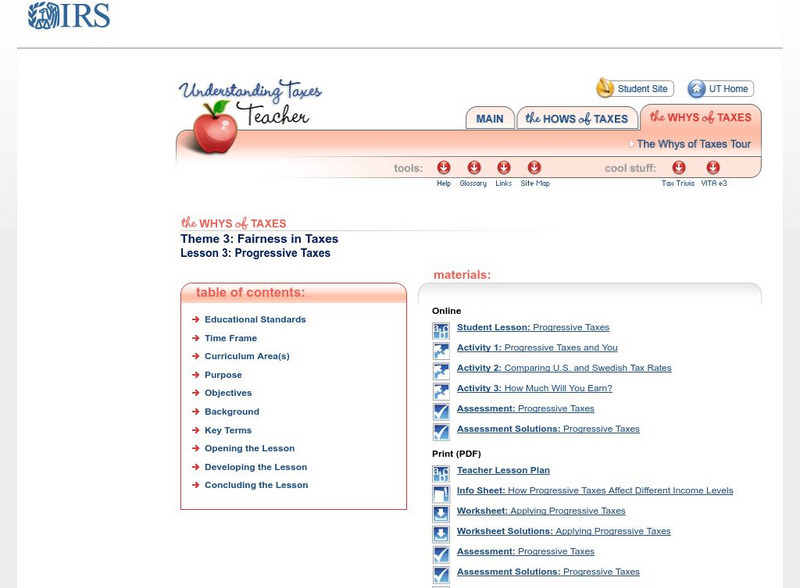

Irs: Progressive Taxes Lesson Plan

This lesson plan will help students understand that progressive taxes can have different effects on different income groups.

Internal Revenue Service

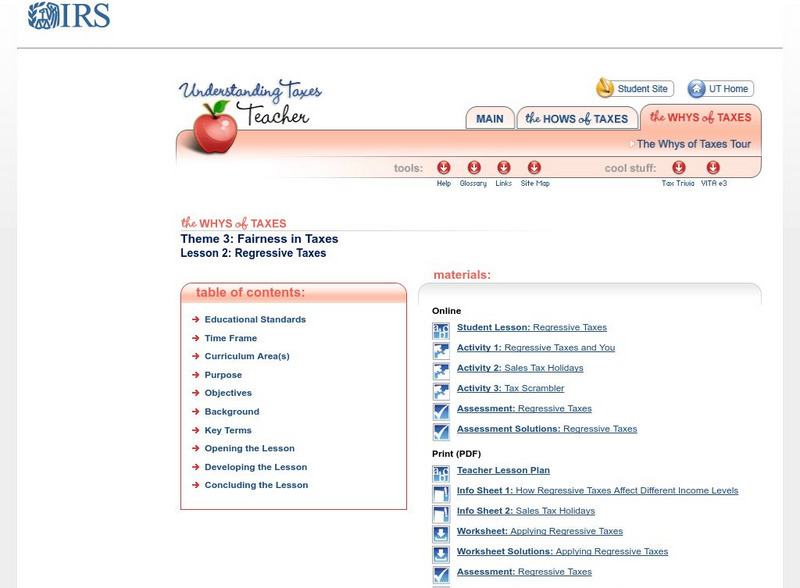

Irs: Regressive Taxes Lesson Plan

This lesson plan will help students understand that regressive taxes can have different effects on different income groups.

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Annenberg Foundation

Annenberg Classroom: Federal Taxation

Check out this interactive timeline documenting the history of federal taxation in the United States.

Library of Congress

Loc: America's Story: Tax Day (April 15, 1913)

How did this day come to be the national day for taxes being due? What is it for? To find out the answers to these and other questions, visit this site from the Library of Congress.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Calculating the Numbers in Your Paycheck

Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they take home.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Taxes and Your Paycheck

Students analyze statements about taxes to better understand how taxes affect people's paychecks.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Investigating Taxes in Your Life

Students play a game to explore how tax revenues pay for various events and services they encounter in daily life.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Jobs, Teens, and Taxes

Students review Internal Revenue Service webpages and respond to questions to explore the relationship between working and taxes.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Becoming Familiar With Taxes

Students match tax types to definitions and then apply their knowledge to tax scenarios. Includes teaching guide and student handouts.

Independence Hall Association

American Government: Financing State and Local Government

Taxes are collected by federal, state, and local governments to pay for a wide variety of services. This article helps students understand where their tax money goes.

PBS

Pbs: Where Does Your Paycheck Go?

Using real copies of pay stubs, students will examine them to see where all the deductions go. An extensive teacher's guide can be downloaded - the lessons are also intended for other sections of this website.

Bankrate

Bankrate: Are Taxes Voluntary?

Provides a commentary on whether paying taxes is voluntary or required. Good information, especially for younger taxpayers. (2001)