Internal Revenue Service

Module 1: Payroll Taxes and Federal Income Tax Withholding

Students complete lessons and worksheet to identify the different types and uses of payroll taxes. They examine how federal income taxes are used, determine the difference between gross and net pay, and determine how employers withhold...

Other

Tax and Accounting Sites Directory

This is a tax and accounting site directory. Includes links to varied tax information.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

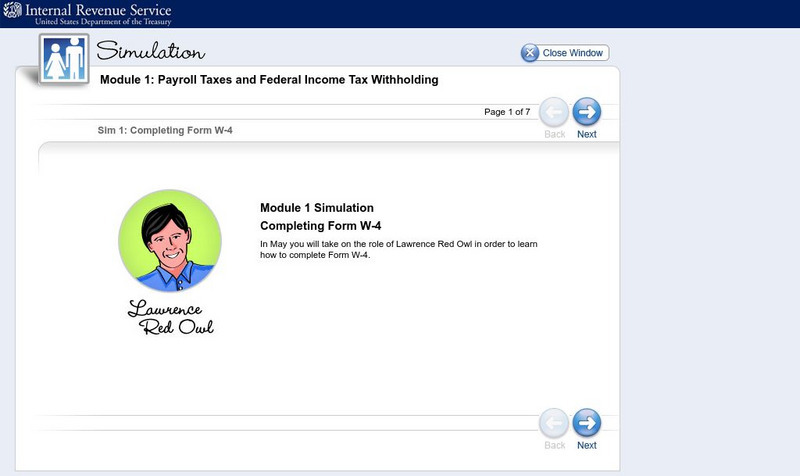

Internal Revenue Service

Irs: Completing a W 4

In May you will take on the role of Lawrence Red Owl in order to learn how to complete Form W-4.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Other

Payroll taxes.com:federal Payroll Tax Forms and Filing Addresses

This site explains the purpose of the W-2 form, special situations that affect it, and where and when to file it.

Other

Economic Awareness Council: Your First Paycheck [Pdf]

Learn what all that information on your paycheck means, and learn to make smart decisions about how to use the money you earn.

Texas Workforce Commission

Texas Workforce Commission: Tax Information and Transactions

The Texas Workforce Commission provides "Unemployment Compensation and Tax Information" plus specific and general information about employment-related taxes. Click on any topic for lots of questions, answers, tips, and examples.

Wolters Kluwer

Business Owner's Toolkit: Federal Unemployment Tax

This article offers useful information regarding the correct payment of payroll taxes under the Federal Unemployment Tax Act.

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Young scholars analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Calculating the Numbers in Your Paycheck

Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they take home.

Social Security Administration

Social Security Online: A Tea Party That Changed History

Essay discussing how Frances Perkins was involved in passage of the Social Security Act. Also contains a link to a speech given by Perkins to SSA employees.

PBS

Pbs: Where Does Your Paycheck Go?

Using real copies of pay stubs, students will examine them to see where all the deductions go. An extensive teacher's guide can be downloaded - the lessons are also intended for other sections of this website.

![Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)