Carolina K-12

Learning About the Federal Budget: “Get a Pencil, You’re Tackling the Deficit!”

Your class members have been selected by the president to help solve the budget crisis as part of a special deficit commission. After learning about fiscal policy, economic theories, and the federal budget through a detailed PowerPoint...

Curated OER

Fairness in Taxes: Progressive Taxes

Learners define and give an example of a progressive tax. They explain how a progressive tax takes a larger share of income from high-income groups than from low-income groups. They examine taxation in other countries.

Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

Students are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes could...

Internal Revenue Service

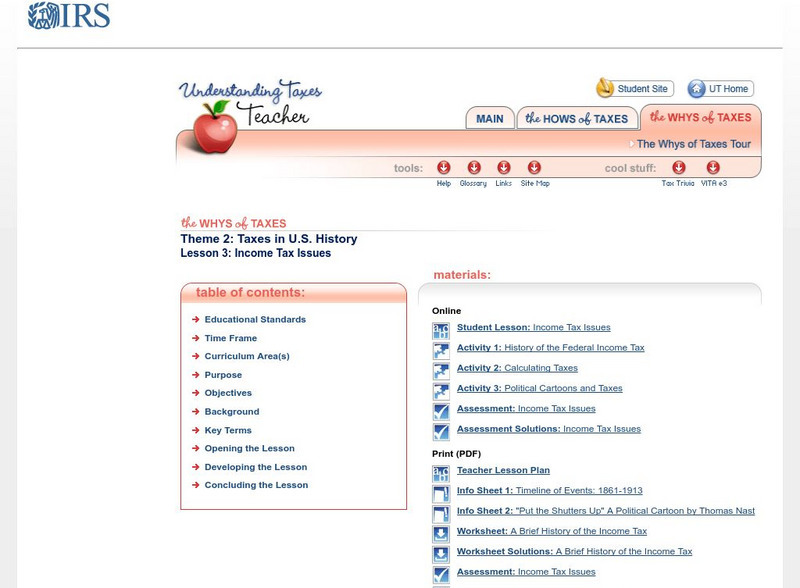

Irs: Income Tax Issues Lesson Plan

This lesson plan will help students understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Internal Revenue Service

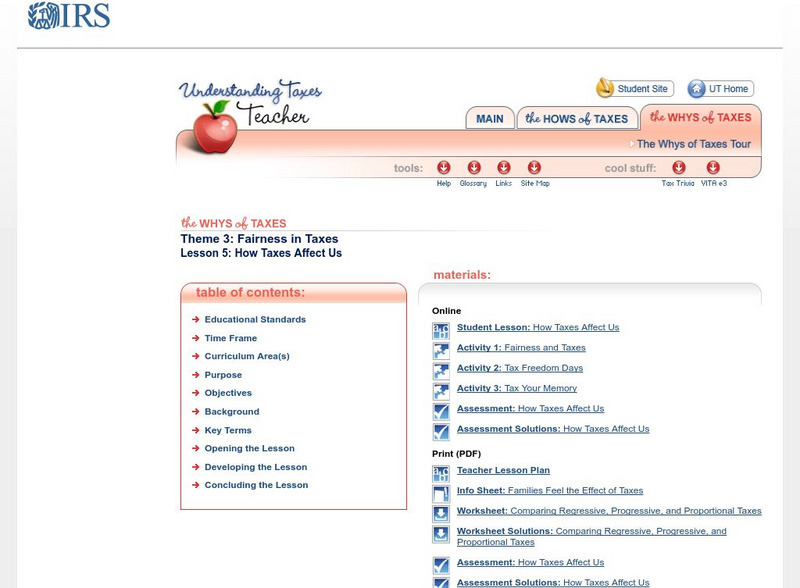

Irs: How Taxes Affect Us Lesson Plans

This lesson plan will help students understand that taxes can have different effects on different income groups.

Internal Revenue Service

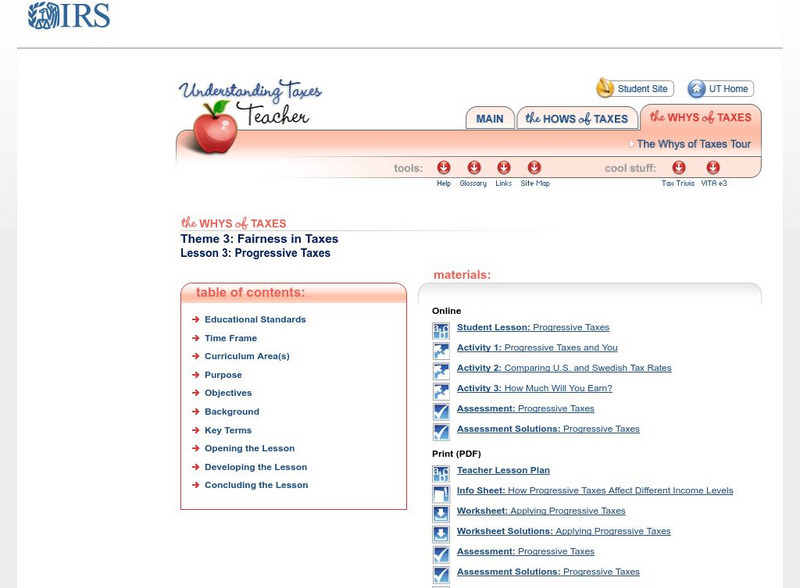

Irs: Progressive Taxes Lesson Plan

This lesson plan will help students understand that progressive taxes can have different effects on different income groups.

Council for Economic Education

Econ Ed Link: Ncee: Tapped Dry: How Do You Solve a Water Shortage?

Water is a limited and sometimes scarce resource. What do you do when the supply is limited?

Auburn University

Auburn University: A Glossary of Political Economy Terms: Progressive Taxes

A definition of what a progressive tax is. Also gives examples of what is considered to be a progressive tax.

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Taxation

By the end of this section, you will be able to do the following: Differentiate between a regressive tax, a proportional tax, and a progressive tax and Identify the major sources of revenue for the U.S. federal budget.

Curated OER

Vat Theories Progressive or Regressive Who Pays What?

Explains progressive, regressive, and proportional taxes and applies them to the value added tax (VAT).