Internal Revenue Service

Fairness in Taxes: How Taxes Affect Us

High schoolers are able to compare the effects of the following, using income as a measure of ability to pay: a progressive tax, a regressive tas, and a proportional tax. They explain how a mixture of regressive and progressive taxes...

Curated OER

Economic Recessions

Students examine the characteristics of recessions and explore the role of government in encouraging business investment. They discuss why the services segment of employment has increased and list companies in their area that qualify as...

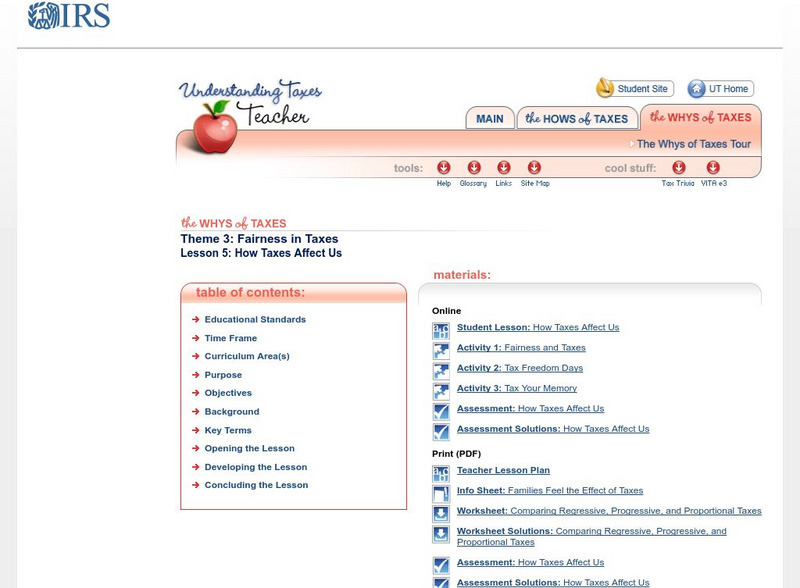

Internal Revenue Service

Irs: How Taxes Affect Us Lesson Plans

This lesson plan will help students understand that taxes can have different effects on different income groups.

Internal Revenue Service

Irs: Proportional Taxes Lesson Plan

This lesson plan will help students understand that proportional taxes can have different effects on different income groups.

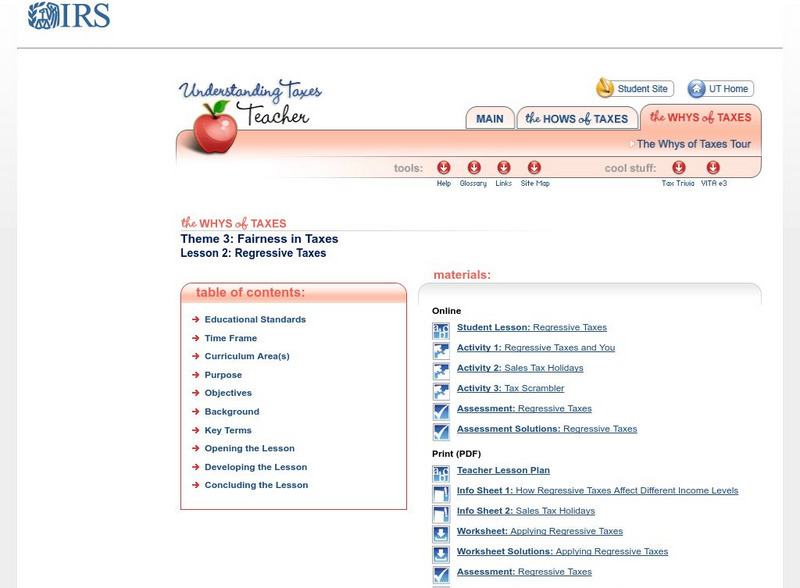

Internal Revenue Service

Irs: Regressive Taxes Lesson Plan

This lesson plan will help students understand that regressive taxes can have different effects on different income groups.

Other

Cbpp.org: Are State Taxes Becoming More Regressive?

This article from Center on Budget Policies and Priorities shows the correlation between state's reduction of taxes and regressive taxes.

Texas Education Agency

Texas Gateway: Ch.16: Government Budgets and Fiscal Policy: Taxation

By the end of this section, you will be able to do the following: Differentiate between a regressive tax, a proportional tax, and a progressive tax and Identify the major sources of revenue for the U.S. federal budget.

Auburn University

Auburn University: A Glossary of Political Economy Terms: Regressive Taxes

Basic definition and examples given for what a regressive tax is.

Curated OER

Vat Theories Progressive or Regressive Who Pays What?

Explains progressive, regressive, and proportional taxes and applies them to the value added tax (VAT).