Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help learners understand the earned income credit.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

Internal Revenue Service

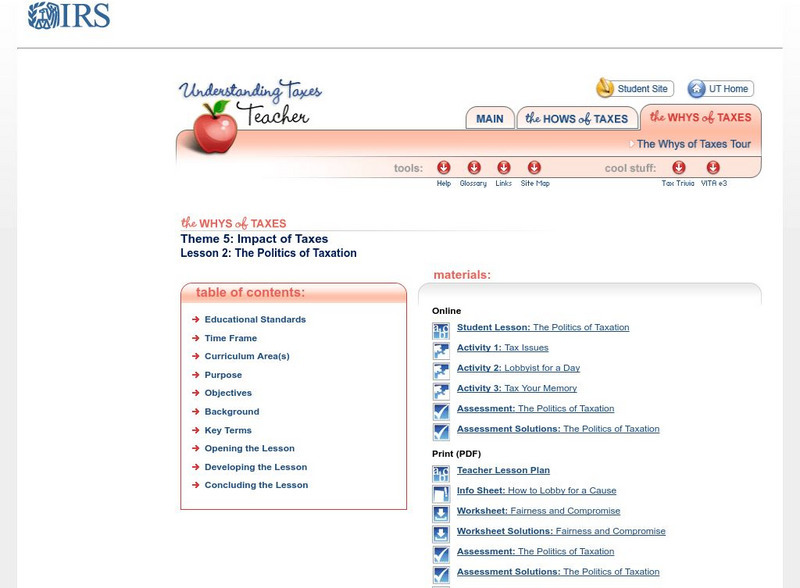

Irs: The Politics of Taxation Lesson Plan

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes.

Internal Revenue Service

Irs: Claiming a Child Tax Credit Lesson Plan

This lesson plan will help young scholars understand the child tax credit and additional child tax credit.

Schools of California Online Resources for Education

Score: Seeking a Balance in International Trade

Students work to solve problems involving international trade, then seek to improve the balance of trade with other countries. At this site, you can develop and make decisions similar to those in international business. Includes links to...