Curated OER

Module 13-Claiming Child Tax Credit

Learners examine the difference between a refundable tax credit and a nonrefundable tax credit. They explain how the nonrefundable child tax credit affects the tax liability. They apply the requirements to claim the child tax credit and...

Internal Revenue Service

Irs: The Taxpayer's Rights Lesson Plan

This lesson plan will help students understand the rights of taxpayers and the procedures the IRS uses to process tax returns.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

Internal Revenue Service

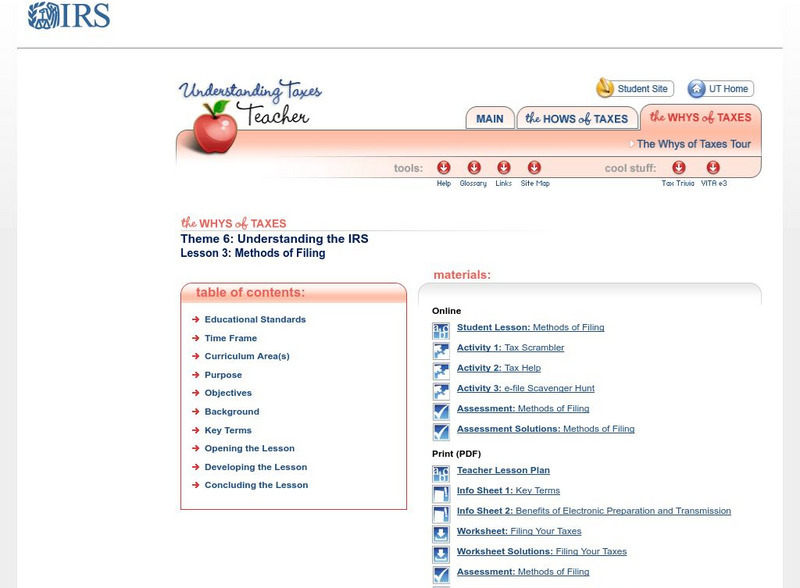

Irs: Methods of Filing Lesson Plan

This lesson plan will help students understand the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically.