Other

State Taxes

This site provides tax information about each state in the United States simply by clicking on the name of the state. Links further down the page can be used to find specific state taxes, such as payroll and sales taxes.

Internal Revenue Service

Irs: Proportional Taxes Lesson Plan

This lesson plan will help students understand that proportional taxes can have different effects on different income groups.

McGraw Hill

Glencoe: Self Check Quizzes 2 Percent Discount and Sales Tax

Use Glencoe's Math Course 2 randomly generated self-checking quiz to test your knowledge of percent discount and sales tax. Each question has a "Hint" link to help. Choose the correct answer for each problem. At the bottom of the page...

Other

Lease Guide: Sales Tax and Other Fees

This site provides information on the fees involved in leasing an automobile. The following terms are defined: First Payment, Security Deposit, Aquisition Fee, Disposition Fee, Sales Tax, Down Payment, Documentation Fee, Registration...

Council for Economic Education

Econ Ed Link: Clean Land Thanks to Us! (Student Page)

How does the government raise money to fund government agencies like the EPA? Through taxes. This lesson looks at the different taxes that are paid by US citizens and how the money is used for things such as cleaning up the environment.

Yale University

Solving Problems by the Hundreds

This site contains a study of percentage and its applications in the study of consumer related problems. Problems involving sales tax are included. Examples, explanation, solutions and a bibliography are also included in the site.

Next Gen Personal Finance

Next Gen Personal Finance: Taxes Data Crunch

Data Crunches feature one chart or graph followed by five scaffolded questions to guide students through analyzing the data and drawing conclusions. These sets of data help students understand tax concepts.

Other

Tax Foundation: State and Local Sales Tax Rates, 2021

This explanation of state and local sales taxes is accompanied by charts which show the state sales taxes in all the states in 2021, along with information about local sales tax rates.

AAA Math

Aaa Math: Consumer Math

From basics such as adding and subtracting money, converting coins, and making change to more advanced topics such as sales tax and simple interest, this interactive tutorial offers help with consumer math issues.

Yale University

Yale New Haven Teachers Institute: Commission

This site from Yale University provides a description of commission with example problems. Additional topics can be found on the same page.

Yale University

Yale New Haven Teachers Institute: Solving Problems "By the Hundreds"

The Yale-New Haven Teachers Institute site contains various math exercises relating to percentage and consumer-related problems. An explanation of sales tax, a related problem and answer are given.

Illustrative Mathematics

Illustrative Mathematics: 7.rp Tax and Tip

This site provides a problem with completed solutions for that problem. This problem covers the topic of sales tax and tips. The problem aligns with 7.RP.A.3.

Mangahigh

Mangahigh: Number: Money Management

This site provides students practice with the concept of money management, such as tax and inflation. Students can learn about the topic by completing an interactive tutorial. Students can then take a ten question timed test to practice...

Wolters Kluwer

Small Business Guide: Your Sales Tax Obligations

This site gives an overview of sales taxes. Links on the page provide additional information. Click on "What Are Sales Taxes" for an explanation of what kinds of sales are subject to sales taxes. There is also a link for sales tax...

CK-12 Foundation

Ck 12: Arithmetic: Prices Involving Sales Tax Grade 8

[Free Registration/Login may be required to access all resource tools.] Find retail prices given wholesale prices, markups and sales tax.

CK-12 Foundation

Ck 12: Arithmetic: Prices Involving Sales Tax

[Free Registration/Login may be required to access all resource tools.] Have you ever had to calculate a tip in a restaurant? Figure out the amount with taxes and estimate appropriate tips.

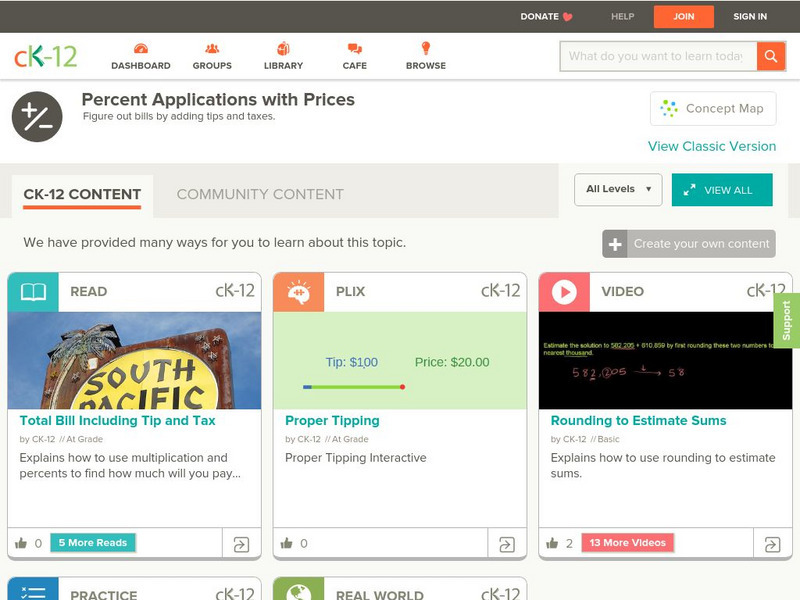

CK-12 Foundation

Ck 12: Arithmetic: Prices Involving Sales Tax Grade 6

[Free Registration/Login may be required to access all resource tools.] Find the percentage of a total price in order to determine an amount of sales tax.

CK-12 Foundation

Ck 12: Arithmetic: Total Bill Including Tip and Tax

[Free Registration/Login may be required to access all resource tools.] In this lesson students calculate total bills including tips and taxes. Students examine guided notes, review guided practice, watch instructional videos and attempt...

Goodwill

Gcf Global: Shopping

Get tips for buying everything from laundry detergent to your dream home.

Goodwill

Gcf Global: Percentages in Real Life

Learn how to calculate percentages in real-life situations, from sales tax to discounts to tips.

Illustrative Mathematics

Illustrative Mathematics: 6.rp Kendall's Vase Tax

Students use percentage and addition to answer this real-world math performance task: Kendall bought a vase that was priced at $450. In addition, she had to pay 3% sales tax. How much did she pay for the vase?

Next Gen Personal Finance

Next Gen Personal Finance: Taxes

Lessons and activities to teach students about federal taxes.

iCivics

I Civics: Taxation

This activity teaches the basics of taxes: what they are, who pays them, what kinds exist, and what they're used for. Students learn how people's income is taxed, how much revenue taxes generate, and how taxes and government services are...

Bankrate

Bankrate: Sales Tax: Definition, How It Works, and How to Calculate It

Forty-five states and many local government impose sales taxes on most goods and some services. This article explains the difference between sales taxes and income taxes, and how sales taxes are levied.