Curated OER

The Five W's of Tax Day

Use April 15th to teach your students the fundamentals of the American federal tax system.

Curated OER

Understanding Tax: Your Role as a Tax Payer

Every adult should know that it is their responsibility to help fund public goods and services by paying taxes. Help young people get a handle on the history, evolution, purposes for, and reasons why they should pay taxes too.

Curated OER

Your Tax Dollars at Work

In order to understand how tax dollars are spent, young economists use given data and graph it on a circle graph. Circle graphs are highly visual and can help individuals describe data. A class discussion follows the initial activity.

Curated OER

Taxes, Tips, and Salaries

In this taxes, tips and salaries worksheet, students read story problems and determine the sales price, percent of change, amount of tax, and final price. This four-page worksheet contains 8 multi-step prolems. Answers are provided on...

Curated OER

Percent Applications

In this percent application learning exercise, learners solve word problems containing concepts such as percent, proportions, sale price, discounts, interest, commission, tax, and more. Students complete 11 problems.

Curated OER

Sales Tax and Discounts

Students explore the concept of sales tax and discounts. In this sales tax and discounts lesson, students pretend to gamble in groups to win fake money. Students must tax their winnings. Students collect receipts. Students discuss the...

Curated OER

Sales Tax

Students explore the concept of sales tax. For this sales tax lesson, students work in groups to spend $500. Students calculate the discount and sales tax on each item. Students buy between 5 to 10 items.

Curated OER

Shopping Spree

Students calculate discounts, sale price, and sale tax. In this consumer math instructional activity, students visit mock stores which have items for sale. Students calculate the final prices of items.

Curated OER

Debt and Deficits

Learners identify, research and interpret the national debt and deficits of the past through today and why it has risen significantly in the last 20 years. They analyze the size and impacts and discuss the various policy measures for...

Curated OER

Finding Sales Tax

Seventh graders investigate sales tax. Following a teacher demonstration, they find sales tax and the total cost of items. In groups, classmates choose items from a menu that they would like to purchase. Each student figures the sales...

Curated OER

Shop 'Til You Drop: Food for Thought

Middle schoolers shop in a virtual grocery store. Students choose items for their shopping cart and check out. They determine the tax, delivery fees, and total cost. Middle schoolers discuss the advantages and disadvantages of shopping...

Curated OER

Taking Taxes

Students discuss the role of taxes and tax deductions in the maintence of community services. A practice W-4 form is completed by students who identify their exemptions. This lesson is intended for students acquiring English.

Curated OER

Was the Stamp Act Fair?

Students examine British and Colonial perspectives on the Stamp Act.

They determine whether or not the act was fair. Students are intrdouced to the social and economic forces that pushed Americans toward Revolution.

Curated OER

Filing Status

Students examine then discuss the rate at which income is taxed and the five filing statuses. They complete online simulation worksheets then they answer a list of questions.

Curated OER

Spending Public Money

Learners work in small groups. They imagine that they are the council committee. Students choose from a list of projects to be funded. They have one hundred thousand dollars to spend and they have to spend the money on a project that...

Curated OER

Who Burned the Peggy Stewart?

Students conclude findings from various political and social sources regarding the burning of the Peggy Stewart. Students explore the various opinions of Maryland colonists and strategies used to protest the British tax and policies of...

Other

State Taxes

This site provides tax information about each state in the United States simply by clicking on the name of the state. Links further down the page can be used to find specific state taxes, such as payroll and sales taxes.

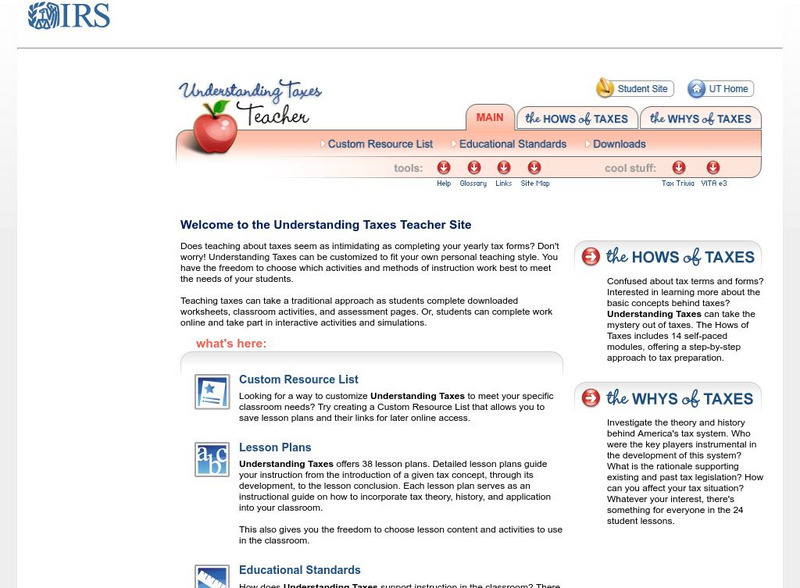

Internal Revenue Service

Irs: Understanding Taxes

The teacher companion to understanding taxes that includes a resource list, lesson plans, and educational standard. The lesson plans discuss how to explain tax theory, applications, and history in the classroom.

Other

Save Wealth: A Guide to Reducing Taxes

Financial and Investment Education website provides ways to reduce taxes. Great Site developed to educate clients on wealth preservation strategies.

Other

State Taxes: State Tax Guide

This resource contains links to state tax websites, and information about filing taxes.

Internal Revenue Service

Internal Revenue Service (Irs)

The Internal Revenue Service is the nation's tax collection agency. Explore this site to find tax statistics, recent news, and specific tax information for individuals, businesses, charities, and nonprofits.

Other

National Republican Congressional Committee

The official site of the National Republican Congressional Committee.

Council for Economic Education

Econ Ed Link: Clean Land Thanks to Us! (Student Page)

How does the government raise money to fund government agencies like the EPA? Through taxes. This lesson looks at the different taxes that are paid by US citizens and how the money is used for things such as cleaning up the environment.

CNN

Cnn Money: Tax Guide

Information about taxes including paying taxes, filing a return, audits, tax planning.