Curated OER

Sticking to a Budget

Set scholars up for financial success by throwing them into the hypothetical real world.

Curated OER

Understanding the Bush Tax Cut Plan

The class examines the new tax cut plan proposed by President Bush. They practice calculating income tax rates and interpreting the data. Then they research topics that are of interest to them related to taxes.

Council for Economic Education

You Can BANK on This! (Part 2)

This is part two in a four-part instructional activity on banking and personal finance. For this instructional activity, learners analyze whether or not they have made a good purchase, then discuss how to make an informed decision about...

Federal Reserve Bank

Government Spending and Taxes

What types of government programs are designed to improve economic inequity in the United States? Introduce your learners to government programs, such as low-income housing, Social Security, and Medicaid, how they work to improve...

Curated OER

Tax Forms and Deductions

Because many of your older students are probably getting their first jobs, it could be an appropriate time to discuss taxes. This presentation defines deductions, types of taxes, purposes of paying taxes, and the forms required to file...

Curated OER

Module 13-Electronic Tax Return Preparation and Transmission

Students explain the electronic preparation and transmission of tax returns. They describe the ways to prepare and transmit tax returns and explain the benefits of electronic tax return preparation and transmission.

Curated OER

Circular Flows

To study circular flow, learners use the plans to trace through a series of interconnected economic and financial flows to explain the workings of the American economy. They use the model developed to comprehend the effects of Federal...

Curated OER

Proportional Taxes

Students are able to define and give an example of a proportional tax and the impact that it can have on different income groups and explain how a proportional tax takes the same percentage from all tax groups.

Curated OER

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Taxes and Social Security

Students practice filling out the United States Federal 1040EZ tax form and share examples in a class discussion. A written exam is provided to help assess cumulative comprehension.

Curated OER

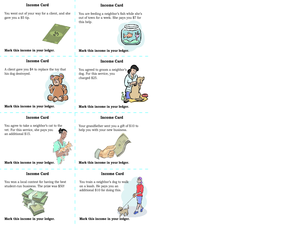

Income and Expenses

Students discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

Curated OER

People and Government

Introduce your elementary students to US Government. This slide show briefly defines the three levels and branches of government, and taxes. Tip: Use this resource to introduce the topic by asking students what they know, clearing up...

Curated OER

We The People: A History

Students play a game about taxation where they have tax collectors that simulate the feelings and reasons that led to the American Revolution. For this taxation lesson plan, students learn about why the people in the colonies were so...

Curated OER

Tax Problem: Percents

For this tax worksheet, students solve 1 problem about taxes. Students find the federal and state tax on a given amount of money.

Curated OER

Taxing Taxes

Students complete math word problems. For this taxes lesson, students discuss taxes and why they are necessary. Students research the history of taxes, write a summary of their findings, determine the sales tax in their area and...

Curated OER

Money Math: Lessons for Life

Students explore money as it applies to salary, paychecks, and taxes. In this essential mathematics lesson, students explore how math is used in various careers, how income takes are calculated and other important life lessons in math.

Curated OER

Simulation: The King's Candy

Students examine the British tax laws in Colonial America. In this U. S. history lesson, students participate in a simulation that replicates the taxes levied by the British.

Curated OER

Labor, Choice, and Sales Tax

Students consider the idea of earning and spending money. For this money management lesson plan, students discuss the concept of saving and spending money through the reading of a story and by completing several activities that involve...

Curated OER

Taxes

Fourth graders read Stone Fax and explore earning money, saving, credit and taxes. In this taxes lesson, 4th graders complete a worksheet to develop understanding of paying off debts, keeping a checkbook, calculating sales tax and...

Curated OER

Death and Taxes

Students explore the "death tax" and analyze statistical information about how the government taxes dead people. They research sources to determine the validity of a anti-tax group campaign and John McCain's claims about taxes. ...

Curated OER

Bossy Britain Upsets Colonists

Students examine the causes of dissatisfaction that led to the American Revolution. Then they make a Flap Vocabulary Book and glue on a map of the thirteen colonies and make a title page called "Road to War in it." Students also...

Curated OER

Can't You Make Them Behave, King George?

Fifth graders describe the changes in King George III's policy toward the American colonies by sequencing key events between the French and Indian War and the American Revolution. They explain the colonial reactions to command decisions...

Curated OER

Sales Spreadsheet

Students use Excel spreadsheets to organize purchases, discounts, sales prices, and sales tax. Students follow step by step instructions and enter formulas as well as use the auto sum feature to calculate required calculations.

Curated OER

Stone Fox

Students use the book, Stone Fox, to explore income, capital, saving, taxes, and credit. Stone Fox tells the story of Little Willy, a ten year old who enters a challenging dog-sled race in hopes of winning money to pay the back taxes on...