Internal Revenue Service

Irs: Tax Tutorial: Module 6: Exemptions

Learn the difference between a personal exemption and a dependency exemption in this tax tutorial.

Internal Revenue Service

Irs: Exemptions Lesson Plan

This lesson plan will help students understand personal and dependency exemptions and how exemptions affect income that is subject to tax.

Internal Revenue Service

Irs: Income Tax Facts

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that people who have the same income may not pay the same amount in taxes.

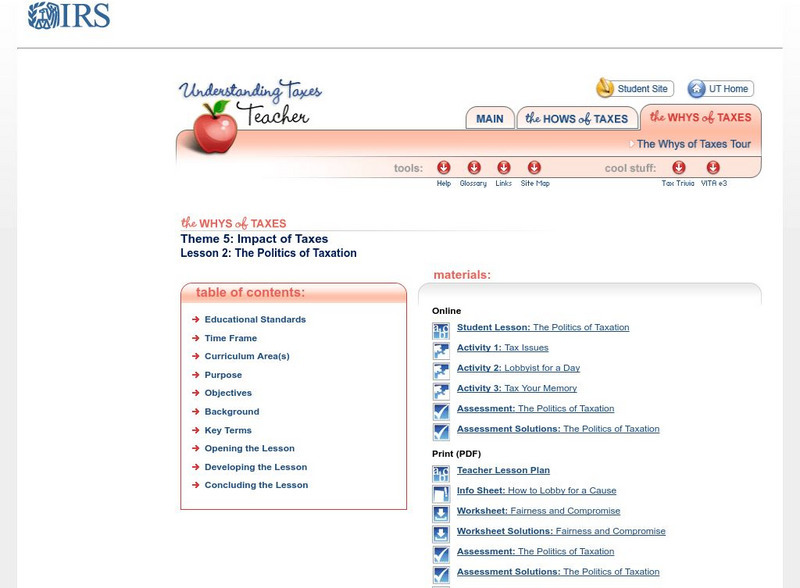

Internal Revenue Service

Irs: The Politics of Taxation Lesson Plan

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes.

Wolters Kluwer

Business Owner's Toolkit: Determing Which Payroll Taxes Apply to Your Employees

This resource contains pertinent information regarding withholding exemptions for employees and how the tax is withheld. Links are also provided for additional information on related subjects.