Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important personal...

Council for Economic Education

Timing Is Everything

Learners discuss the incentives and opportunity costs of spending vs. saving. They follow an interactive website which shows them the how much money they could end up with by saving instead of spending.

Curated OER

Budgeting Your Financial Resources

Students explore the aspects of making a budget. In this money management instructional activity, students learn the importance of budgeting and what all goes into creating a budget by eventually creating a budget of their own including...

Curated OER

Recession Lesson: The Silver Lining of the Economic Downturn

Students discuss money and interest. For this discussing money and interest lesson, students discuss positives of an economic recession. Students discuss how savings rates have increased over time and the general attitude towards...

SaveandInvest.org

The True Cost of Owning a Car

Almost every teen wants a car, but can they really afford one? The lesson walks pupils through how to identify a budget, find all of the costs associated with car ownership, and determine if they should buy the car or keep looking.

Curated OER

Savings and Stocks

Work together to brainstorm answers to different questions related to the savings of American people. Draw a bar graph representing stocks. Practice using new economic terms as well.

Curated OER

The Art of Budgeting

Students create a plan to achieve personal and financial goals. In this budgeting goals lesson, students identify their sources of income and discuss being financially independent. Students record their monthly expenditures and present a...

Curated OER

I'm in the Money - Practical Money Skills

Learners make a budget and utilize math skills to keep a record of what they spend. They use technology and spreadsheets to help them keep track of their money.

Curated OER

Planning A Household Budget

Students experience real life by utilizing math skills to plan a household budget and enhance their financial planning skills.

Curated OER

Stretching Your Money with Coupons

Students examine ways to extend their budget with coupons. In this budgeting lesson, students read information about using coupons at the given website. Students make a list of 30-50 products they use in their homes and use online...

Curated OER

Energizing Our School

Students explore energy usage in home and in school. They examine the types of non-renewable sources and discover alternate sources of energy. Through group activities, students calculate the perimeter and area of a given room. They make...

Curated OER

Month 5 Budget

In this consumer mathematics worksheet, students complete the following statements with their appropriate information. Then they calculate their total expenses and subtract a portion for savings.

Curated OER

Money Math

Young scholars explore the use of money in daily life. Through activities and real-life simulations, students write and balance a checkbook, explore the importance of budgeting, saving, and expenses. Using spreadsheet technology, they...

Curated OER

Reality Store: How to Plan a Budget, Pay Bills, and Manage Your Money

Students plan a budget and pay bills when they visit the "Reality Store," a series of classroom studying stations. The use of paying bills and running a class store is used to help students grasp the concept of business.

Curated OER

Where Does All the Money Go?

Students explore the concept of uses for money. In this uses for money lesson, students discuss ways in which money can be utilized such as spending, saving, investing, donating, etc. Students discuss the differences between needs and...

Curated OER

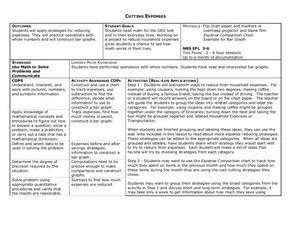

Cutting Expenses

Learners explore budgeting. In this finance and math lesson, students brainstorm ways in which households could save money. Learners view websites that give cost reducing ideas. Students complete an expense comparison chart and use the...

Curated OER

Learning to Spend, Learning to Give

Middle schoolers create a monthly budget. In this finances lesson, students learn the terms budget, income and expenses. Middle schoolers create a monthly spending plan and keep track of what they make and spend for the next 30 days. ...

Curated OER

The Leaves in October

Students determine whether or not to save or spend and defend a decision. In this personal finance lesson, students identify opportunity cost of various spending and saving decisions. Students read a story where two girls share profits...

Curated OER

Money Museum Tour

Twelfth graders explore the importance of banks in the United States. In this Economics lesson, 12th graders participate in a simulation of what happens at a bank. Students discuss their findings.

Curated OER

Budget: Don't Go Broke (NEFE)

Students examine how to plan and maintain a balanced budget. In this financial literacy instructional activity, teacher students follow the PowerPoint and answer questions based on learned information in order to understand where their...

Curated OER

Banking for Your Future

Young scholars get a handle on their own personal finances. They discover how banks work, how to plan and stick to a budget, and other helpful tips on managing money. They study the Federal Reserve System, which oversees the nation's banks.

Curated OER

Family Member

For this worksheet on family members, students describe what is meant by family, their duty to family, and family meetings. In addition, they create a budget for their family for one month keeping track of all expenses for 7 days....

Curated OER

Money Lessons That Cash In

Every child is fascinated by money. Teachers can use money lessons that expand on this inherent interest.

Curated OER

Kermit the Hermit

Young scholars consider money management. In this personal finances lesson, students read Kermit the Hermit and discuss what was done with the unexpected money that Kermit received. Young scholars examine methods of saving money and...