Curated OER

How Do You Spend Your Money?

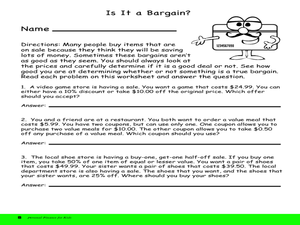

Fifth graders examine ways to save and spend money. They look at ways that people earn, save, and spend money using chapters from Tom Birdseye's Tarantula Shoes. They add and subtract decimals to fill in a worksheet entitled, "Is It a...

Curated OER

Money Math Lessons for Life

An outstanding instructional activity on financial literacy is here for you. Learners are presented with six scenarios, then compute the amount of savings they will have in their accounts. They complete a series of exercises designed to...

Visa

Money Responsibility

Introduce young learners to the important life skill of responsibly managing money and recording how much they spend and save.

Curated OER

Family Faces a Real Struggle In Saving Money For College

Explore the concept of savings with your high schoolers. They read an article about saving money for retirement and as a way to pay for college. They discuss the financial needs of the family in the article in regards to saving for...

Federal Reserve Bank

Your Budget Plan

What do Whoosh and Jet Stream have in common? They are both characters in a fantastic game designed to help students identify various positive and negative spending behaviors. Through an engaging activity, worksheets, and...

Federal Reserve Bank

A Penny Saved

Budgeting, net vs. gross pay, savings, and fees are all key elements of personal financing and essential for your class members to learn about as young adults.

Practical Money Skills

Budgeting Your Money

How do you make sure that your income doesn't disappear before you have a chance to save it? Use a creative budgeting activity to teach learners in both special education and mainstream classes how to keep track of their expenditures and...

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific lesson which has pupils explore how to come up with a personal budget. They consider income, saving, taxes, and their...

Curated OER

Buying New Stuff

Young spenders take a look at the best ways to save and spend money. This type of financial education is lacking in schools, so implementing this lesson would be of great value to your students. Things like bank checking account fees,...

Curated OER

Budget Mania

Students examine several examples of budgets to develop a facility with the components of its formation. Income, expenses, and expenditures are considered and itemized for this lesson.

Curated OER

Saving and Investing

Fifth graders participate in activities to promote understanding of investing and saving. In this saving and investing lesson, 5th graders design a portfolio, play a card game and write a skit about the importance of investing.

Curated OER

Marriage and Financial Goals, Budgeting Strategies

There is no more useful life skill to learn than budgeting and setting financial goals. It's math that is used by every person, everyday. Learners examine the responsibilities and costs involved in family economics. Through a series of...

Curated OER

Savings and Earnings

Fifth graders complete several activities to learn about earning, budgeting, and saving money. In this saving money lesson, 5th graders read a book about saving money and complete a 'Savings and Earnings' worksheet. Students work in...

Curated OER

Scarcity and Choice

After reading the book A Bargain for Frances, young economists discuss how money is exchanged for goods or services. They demonstrate effective financial decision-making by listing ways to save money for a product they would like to buy.

Curated OER

Short-Term and Long-Term Savings Goals

Fifth graders discover how saving money can apply to their lives. In this personal finance lesson, 5th graders use the book The Leaves in October, as a conversation starter on income, savings and setting goals. Students explore the...

Curated OER

The Berenstain Bears Trouble with Money

Students will explore good and services, income and saving listening to the story The B. Bears Trouble With Money. In this early economic lesson, students discuss what it means to earn money doing services and save money to...

Curated OER

Savings Accounts and Interest

First graders study money, banks, and getting interest on money. In this consumer math lesson, 1st graders listen to Stan and Jan Berenstain's, Berenstain Bears' Trouble With Money. They use the concepts in the book to discuss...

Curated OER

Money, Money, Honey Bunny!

Students read a story about spending and saving money and talk about the difference between goods and services. For this money lesson plan, students also play a matching game to review the story and practice rhyming words from the story.

Curated OER

Budgeting

Students explore what butgeting means. In this mathematics lesson, students determine that certain things need to be part of a budget like food and clothing by answering real-life types of questions on whether one should save money and...

Curated OER

Personal Savings: Saving Money for Those Items you Really Want

Students explore how to save money to buy the things they want.

Curated OER

Take Time to Save Now

Students brainstorm reasons to save money, investigate impact of saving regularly using interactive, on-line calculators, explain how compounding interest affects savings, explore different strategies for saving money, and write personal...

Curated OER

Budgeting: You Can't Manage What You Don't Know

Students discuss budgets. In this mathematics lesson, students watch an episode of Biz Kid$ about budgeting, participate in a guided group discussion, and create a pamphlet to teach others how to budget their money. Extension activities...

Curated OER

What Can You Do With Money?

Students watch a Biz Kidz video about money, learn what they can do with money, and fill out worksheets on what they learn. Students learn about spending, saving, donating, and investing.

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.