Curated OER

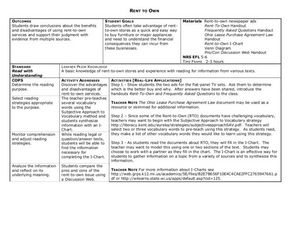

Rent To Own

Reading can be a good way to learn about many different things, like rent-to-own housing programs. Learners read informational resources about rent-to-own programs and how they work. They complete graphic organizers using the facts they...

PBS

Could You Start a Business?

High schoolers learn how a business starts and finds financial independence. For this lesson, students learn the struggle of financial management, the costs of running a business and how to keep a budget.

Curated OER

Financial Planning for Catastrophe

Students examine the case of The Gulf Coast and relate it financial importance. In this financial planning lesson plan, students watch a video and then begin to analyze how to plan for the unexpected by reviewing the financial components...

Curated OER

Take Charge of Your Financial Future

Students discuss Biz Kids understanding that it is a program to help people become financially educated. In this mathematics lesson, students view an episode and discuss what they would do if given various situations like going out or...

Curated OER

Stonewall and Beyond: Gay and Lesbian Issues

Help learners understand their own biases and how their perspectives may have been influenced by biased media sources. They keep a journal while viewing videos, exploring websites, and engaging in class discussions related to gay and...

Curated OER

The Business of Interest

Students learn about finance and money management and use math to solve problems, communicate, and explore real life situations as they deal with banks. In this financial management lesson, students apply their math skills to real life...

EngageNY

The Mathematics Behind a Structured Savings Plan

Make your money work for you. Future economists learn how to apply sigma notation and how to calculate the sum of a finite geometric series. The skill is essential in determining the future value of a structured savings plan with...

Practical Money Skills

Protecting Your Money

How can you tell if a commercial or salesperson is being misleading? Encourage your learners to protect themselves and their money with a lesson about consumer rights. They review laws that keep consumers safe from faulty claims and...

Curated OER

Decisions, Decisions

Young scholars open their own financial management consulting firm, which offers a variety of financial advice. They prepare a financial plan for a simulated client.

Curated OER

Reality Store: How to Plan a Budget, Pay Bills, and Manage Your Money

Students plan a budget and pay bills when they visit the "Reality Store," a series of classroom studying stations. The use of paying bills and running a class store is used to help students grasp the concept of business.

Visa

Dream Big: Money and Goals

Whether their objective is independent living, going to college, or buying a car, pupils will participate in discussions and complete worksheets to gain an understanding of how short- and long-term goals play a large role in helping...

Federal Reserve Bank

The Fed - Helping Keep Banks Safe and Sound

What does an examiner look for when analyzing a bank's financial condition? In addition to learning about the 5-Cs for reviewing loans and CAMELS (capital, assets, management, earnings, liquidity, and sensitivity to risk), your learners...

K20 LEARN

Identity Theft: Don't Let This Happen to Your Grandma!

Class members consider how people steal online identities as they discover the essential elements of identity theft and consumer fraud. Pupils demonstrate learning by creating a poster or video about how to avoid identity theft.

Curated OER

A Computer Model For a Recycling Center

Students develop a working model computer program of a recycling center addressing the material management, work schedules and business finances of running the recycling center.

Curated OER

FINANCE AND RESPONSIBLE LENDING.

Learners study the role of banks, lending and their services. In this analysis lesson, students learn about savings, checking accounts and lending and the importance of banks as financial intermediaries.

Curated OER

"The Roadmap To Purchasing My First New Car"

Students examine the decision-making process of purchasing a car. They conduct Internet research, determine a monthly car payment based on loan information, e-mail various online car websites, research insurance, and determine the best...

Curated OER

The Business of Credit

Learners explore the concept of credit. For this credit lesson, students discuss the necessities to start-up a new business. Learners discuss cost of a new business, loans, and credit. Students create their own business and apply what...

PLS 3rd Learning

Complete Adjustment Column of a Worksheet

Accounting is a vital skill for personal finance management and when running a business. As part of a larger lesson, learners fill out the adjustments column of an accounting worksheet. They practice keeping records on a real budgeting...

Curated OER

Income and Outcomes

Bring financial literacy into your classroom. Learners use peer support to reflect on their spending and how it reflects their income and their values.

Curated OER

Financial Literacy - Consumer Rights & Responsibilities

Students explore consumer rights and responsibilities.

Curated OER

Consumer Credit

High schoolers investigate he concept of consumer credit by explaining the benefits of using credit. The costs of their use is discussed in the lesson and the criteria that is used in order to establish credit. They work in cooperative...

Curated OER

The Planning Commission

Students design a sound community. In this communities lesson, students take on the role of city planners and identify the needs of the community. Students develop a blue print to meet the needs of the community and include new...

Curated OER

The REAL Cost of College

Students explore the cost of college and how to plan and save. In this money management lesson students do research on the cost of college, learn about making financial choices, earning, spending, saving, investing and how they apply to...

Curated OER

Investment Investigator

Students investigate and model how to invest money. In this business lesson, students investigate 4 methods to investment. They discuss risky and safe investment.