Curated OER

Dependents and Tax Credits

Students identify "count" and "non-count" nouns, and examine and discuss the Earned Income Tax Credit. They define key vocabulary words, complete various worksheets, read a newspaper article, and answer discussion questions.

Federal Reserve Bank

“W” Is for Wages, W-4 and W-2

Don't let your young adults get lost in the alphabet soup of their paychecks and federal income taxes. Using sample pay stubs and reproductions of government forms, your class members will identify the purpose of such forms as a W-4 and...

Curated OER

Earned Income Credit

Learners distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Taxes

Fourth graders read Stone Fax and explore earning money, saving, credit and taxes. In this taxes lesson, 4th graders complete a worksheet to develop understanding of paying off debts, keeping a checkbook, calculating sales tax and...

Curated OER

Taxes in U.S. History: The Social Security Act of 1935

Students explain the history of the Social Security Act and the FICA tax. They describe what Social Security is and whom it is intended to help. They explain the purpose of the FICA tax.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

The Wealth Tax of 1935 and the Victory Tax of 1942

Students explain that during the Great Depression and World War II, the Roosevelt administration implemented new, broader, and more progressive taxes in order to cover the costs of the New Deal programs and the war.

Curated OER

Stone Fox and Economics

Students read the novel Stone Fox and review economic concepts including income, goods, and services. They define the following terms: capital, credit, credit risk and summarize their reading by reading several chapters at a time. They...

Curated OER

Basic Budgeting

Students create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

Curated OER

Money Math

Students define human capital and income earning potential. In this algebra lesson, students analyze the relationship between income and capital resources. They calculate tax rates and understand how to read a tax table.

Curated OER

Hey, Mom! What's for Breakfast?

Students examine how he world eats breakfast. In this food choices lesson, students work in groups to list breakfast foods and their ingredients and find goods and consumers on the list. The, students use the Internet to complete a...

Curated OER

Saving Strawberry Farm

Learners explore U.S. History by analyzing the Great Depression. In this economic instability activity, students read fictitious accounts of a farm dealing with the loss of a Strawberry Farm and discuss the reasons behind the loss....

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Internal Revenue Service

Irs: Earned Income Credit Lesson Plans

This lesson plan will help students understand the earned income credit.

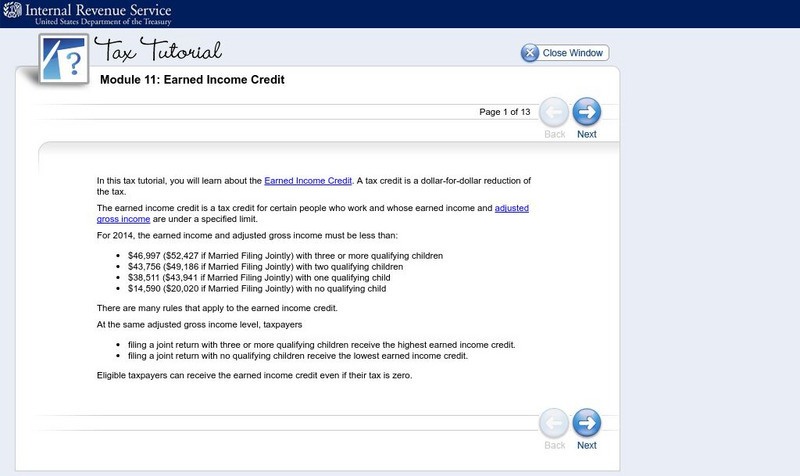

Internal Revenue Service

Irs: Tax Tutorial: Module 11: Earned Income Credit

This tax module explores what the earned income credit is and how taxpayers qualify for the credit.

Internal Revenue Service

Irs: Claiming a Child Tax Credit Lesson Plan

This lesson plan will help students understand the child tax credit and additional child tax credit.

Internal Revenue Service

Irs: Tax Credit for Child and Dependent Care Expenses Lesson Plan

This lesson plan help learners understand the tax credit for child and dependent care expenses.

Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

Digital History

Digital History: The Clinton Presidency

Short, but comprehensive, synopsis of Clinton's two terms as president. Included in the article is the 1992 campaign, successful and controversial legislation, and the scandals that would eventually become part of his presidential legacy.