Curated OER

Census Countdown

Students read and discuss the census and how the census is used by the government. In this census lesson plan, students use the data collected to compare different census's and their outcomes.

Curated OER

Fact and Opinion Pre-Test

For this fact/opinion worksheet, students complete 10 multiple choice questions. Students may click on a link to view correct answers.

Curated OER

Fact and Opinion: Post Test

In this fact and opinion worksheet, students identify sentences as being facts or opinions or choose the fact or opinion sentence. Students complete 10 multiple choice questions.

Curated OER

Academic Raceway 500

In this community government PowerPoint, students participate in a game with a race track format in which they answer questions about local government, the election process, and the decision making process used in a democracy.

Curated OER

Basic Budgeting

Students create a personal budget. In this creating a personal budget lesson, students create a list of 3 necessary things they need to survive. Students rank these things in order of importance and determine their...

Curated OER

The Reformation

Seventh graders explore the Reformation. In this World History lesson, 7th graders analyze primary sources on being Protestant and Catholic. Students discuss as a class the impact of the Reformation.

Curated OER

Doctor's Dilemma: Advocacy for Whom?

Students investigate why doctors feel torn between patients and insurance companies. They examine the health care system and how it affects patients. They discuss one's ability to afford health insurance as well.

Curated OER

The Future of the Arctic National Wildlife Refuge

Students research the governments role is preserving the Arctic National Wildlife Refuge. They discuss the proponents and the opponents side of the issue.

Curated OER

City Spotlights

Students discover the names and history of cities in San Mateo county. Using the Internet, they research the history of their city and share their information with their classmates. They also write an essay in which they reference...

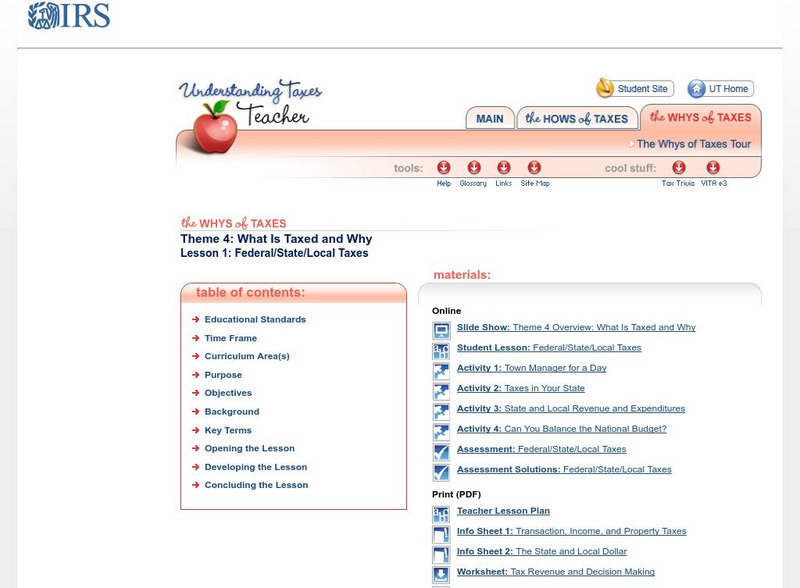

Internal Revenue Service

Irs: Federal/state/local Taxes Lesson Plans

This lesson plan will help students understand that federal, state, and local governments need revenues to provide goods and services for their residents.

Other

The Igen Blog: Ultimate Excise Tax Guide Definition, Examples, State vs. Federal

This is a fairly detailed explanation of state and federal excise taxes designed for the layperson, not for tax experts.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson takes a common situation and helps students...

Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

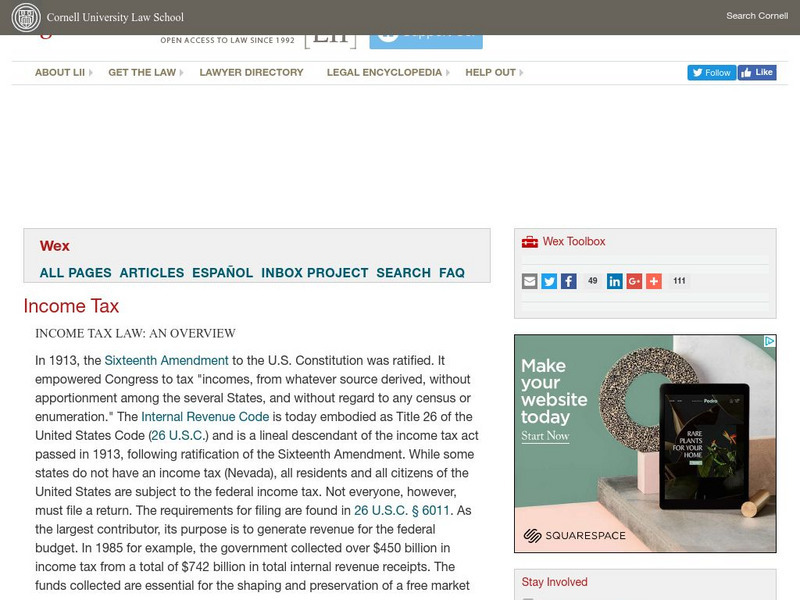

Cornell University

Cornell University: Law School: Income Tax Law: An Overview

A collection of resources for understanding income tax law, including its roots in the Constitution, federal and state statutes and regulations, judicial decisions, and links to the websites of government and tax agencies.

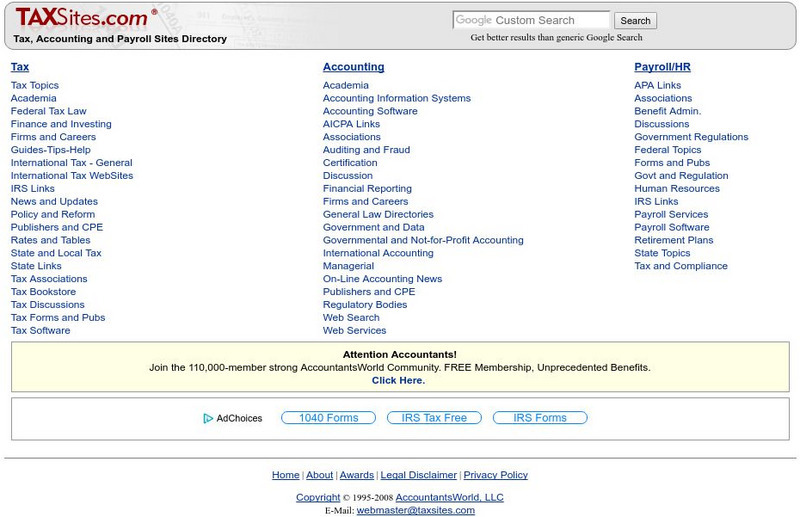

Other

Tax and Accounting Sites Directory

This is a tax and accounting site directory. Includes links to varied tax information.

Alabama Learning Exchange

Alex: Preparing for Tax Day

This unit is to expose students to different types of earnings, determine gross earning, calculate payroll deductions, and net pay. This project will have students journalize payment of payroll, employer payroll taxes, and payment of...

The Balance

The Balance: Sin Tax: Definition, Their Pros and Cons, and Whether They Work

Both the federal government and many state governments impose "sin taxes" that tax items and activities which are considered socially harmful. This article explains these taxes and shows how much states and the federal government raise...

Lectric Law Library

Lectric Law Library: Understanding the Federal Courts

This document provides an overview of the organization, operation, and administration of the entire federal court system. The article gives information on the federal judicial branch, the state and federal courts, the structure of the...

Annenberg Foundation

Annenberg Classroom: Federal Taxation

Check out this interactive timeline documenting the history of federal taxation in the United States.

Council for Economic Education

Econ Ed Link: Why Cities Provide Tax Breaks

Like the state and federal government, local governments offer tax incentives to businesses to help solve economic and/or environmental problems. In this lesson plan, students will explore three different cities and determine what...

Independence Hall Association

American Government: Financing State and Local Government

Taxes are collected by federal, state, and local governments to pay for a wide variety of services. This article helps students understand where their tax money goes.

US Government Publishing Office

U.s. Government Publishing Office: Constitution of the United States of America: 16th Amendment Income Tax [Pdf]

Read this text of the 16th Amendment, followed by the history of the Amendment and an analysis. (PDF)

Thomson Reuters

Find Law: u.s. Constitution: Annotation 1: Sixteenth Amendment

This article provides the background of the 16th Amendment, which established a federal income tax.

US Government Publishing Office

Ben's Guide to u.s. Government: Exclusive Powers of the National Government and State Governments

Presents a chart contrasting the powers of the National government to the powers of a State government. The powers shared by both levels of government are listed below the chart.