Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Internal Revenue Service

Irs: How Taxes Evolve? Lesson Plan

This lesson plan will help students understand that the legislative process of enacting federal income tax laws involves formal procedures based on the Constitution and informal procedures that blend and balance various interests.

Internal Revenue Service

Irs: Income Tax Issues Lesson Plan

This lesson plan will help learners understand how and why a federal income tax was implemented by Congress during the Civil War and in 1913.

Council for Economic Education

Econ Ed Link: Where Does the Money Come From?

With very few exceptions, the U.S. federal government does not have an "income" to spend providing goods and services. The money used for federal spending programs must be collected as federal taxes, or it must be borrowed. This lesson...

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Learners analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Wolters Kluwer

Business Owner's Toolkit: Federal Unemployment Tax

This article offers useful information regarding the correct payment of payroll taxes under the Federal Unemployment Tax Act.

Texas Workforce Commission

Texas Workforce Commission: Tax Information and Transactions

The Texas Workforce Commission provides "Unemployment Compensation and Tax Information" plus specific and general information about employment-related taxes. Click on any topic for lots of questions, answers, tips, and examples.

Wolters Kluwer

Business Owner's Toolkit: Employers' Responsibility for Fica Payroll Taxes

Explains requirements of FICA - Federal Insurance Contributions Act.

Other

Payroll taxes.com:federal Payroll Tax Forms and Filing Addresses

This site explains the purpose of the W-2 form, special situations that affect it, and where and when to file it.

ProProfs

Pro Profs: Do You Know Where Your Taxes Are Going?

On April 15, millions of Americans file their income taxes. Find out where your federal income taxes go. Note: This quiz looks only at federal income taxes, not payroll taxes.

Alabama Learning Exchange

Alex: Preparing for Tax Day

This unit is to expose students to different types of earnings, determine gross earning, calculate payroll deductions, and net pay. This project will have students journalize payment of payroll, employer payroll taxes, and payment of...

Internal Revenue Service

Internal Revenue Service (Irs)

The Internal Revenue Service is the nation's tax collection agency. Explore this site to find tax statistics, recent news, and specific tax information for individuals, businesses, charities, and nonprofits.

Wolters Kluwer

Business Owner's Toolkit: Determing Which Payroll Taxes Apply to Your Employees

This resource contains pertinent information regarding withholding exemptions for employees and how the tax is withheld. Links are also provided for additional information on related subjects.

US Government Publishing Office

U.s. Government Publishing Office: Constitution of the United States of America: 16th Amendment Income Tax [Pdf]

Read this text of the 16th Amendment, followed by the history of the Amendment and an analysis. (PDF)

Internal Revenue Service

Understanding Taxes: The Social Security Act of 1935

This very complete lesson plan explains the history of the Social Security Act of 1935, its history and importance to the elderly during the Great Depression, and its importance today. Everything necessary to teach the instructional...

US Senate

Joint Economic Committee

The Joint Economic Committee, composed of memebers from both the United States Senate and the House of Representatives, reviews economic conditions and recommends improvements in economic policy. The content of the website includes...

Federal Trade Commission

Federal Trade Commission: Consumer: Your Paycheck

When you work your employer pays you for doing your job with a paycheck. Learn how to cash it and the difference between gross pay and take-home pay.

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Internal Revenue Service

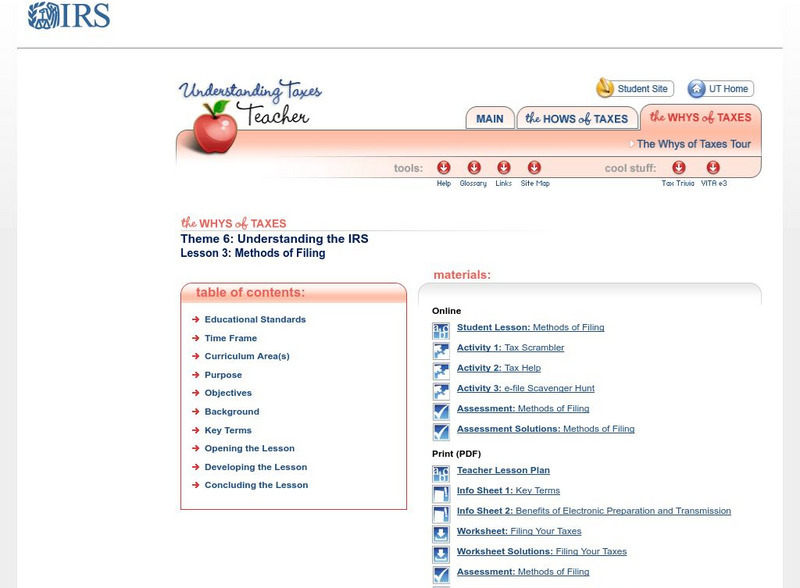

Irs: Methods of Filing Lesson Plan

This lesson plan will help students understand the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically.

Annenberg Foundation

Annenberg Learner: Economics Usa: Control the u.s. Debt!

Learn about the different types of expenses that the U.S. budget must pay for and try your hand at balancing the federal budget.

Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

Other

Ss Bulletin: Constitutional Background to the Social Security Act of 1935 [Pdf]

A very interesting discussion of the potential problems that plagued the implementation of the Social Security Act. Read about the cases brought before the Supreme Court which gave Congress the constitutional ability to tax and spend for...

Illinois Institute of Technology

Oyez Project: United States v. Butler (1936)

This U.S. Supreme Court case declared the first Agricultural Adjustment Act (AAA) of the New Deal illegal because of the issue of Federalism. This resource provides an abstract containing a concise summary, a link to the full text of the...