Curated OER

Family Profile Record Sheet

In this math worksheet, students learn real world math applications for budgeting expenses in a simulated family. Students make a family profile with profession choice and monthly income. Students then fill out detailed budgets which...

Curated OER

Life on the Run: A Budget for Claudia and Jamie

For this budget worksheet, students create a budget for 2 girls that are trying to escape and use their allowances as the income they have. Students create a budget based on their income and expenses. They also answer 7 short answer...

Curated OER

From the Mixed Up Files of Mrs. Basil E. Frankweiler

Students listen to From the Mixed-up Files of Mrs. Basil F. Frankweiler and discuss wants and needs. In this iincome and expenses lesson, students relate the adventures of the children in the book to a real life financial...

Curated OER

Why Would I Owe My Soul to the Company Store?

Sixth graders listen to "Sixteen Tons" by Tennessee Ernie Ford and discuss what it means to owe one's soul to a store. In this mathematics lesson, 6th graders determine what a miner's income was minus his expenses graphing findings in a...

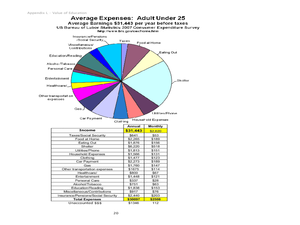

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific lesson which has pupils explore how to come up with a personal budget. They consider income, saving, taxes, and their...

PricewaterhouseCoopers

Planning and Money Management: Financial Plan

More planning goes into a budget than a high schooler thinks. Here, they learn about the expected expenses and incomes, along with outside factors such as natural disasters. Learners prepare their own budget and adjust it based on...

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Preparing an Income Statement

Tenth graders discuss the contents of income statements. In this accounting lesson plan, 10th graders are introduced to the parts of an income statement. Students practice filling out the four parts of an income statement,...

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Final Analysis

In this consumer mathematics worksheet, learners calculate the total amount of money they earned during a project given. Then they transfer the expenses from each month to find their totals. Students also calculate to find their final...

Curated OER

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. In this education and income lesson, students evaluate examples of occupations, their salaries, and education level needed for the job. Students calculate...

Curated OER

Parents of Teens Ride Waves of Expenses

High schoolers explore the concept of the cost of raising a child. In this cost of raising a child lesson, students read an article about the expenses associated with teenagers. High schoolers discuss ways in which parents maneuver...

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Curated OER

Show Me the Money

Pupils investigate financial applications of mathematics in this mathematics activity. They will investigate equations that represent a company’s income, expense, and profit functions and use those equations to identify break even points...

Curated OER

Profit and Loss

Students analyze the concept of profit and loss, the components of a simple profit and loss statement and the importance of a profit and loss statement. They calculate profits using gross income, total expenses and cost of goods sold....

Curated OER

Money Smart Choices

High schoolers make choices regarding money management. For this personal finance lesson, students explore budgets, incomes, and expenses as they learn vocabulary regarding personal finance and consider how to create personal...

Curated OER

It Has to Balance

Second graders use a price list and balance sheet to plan for a day of fun at the beach. They consider expenses, income, and balancing of resources.

Curated OER

Budgeting: You Can't Manage What You Don't Know

Young scholars discuss budgets. In this mathematics activity, students watch an episode of Biz Kid$ about budgeting, participate in a guided group discussion, and create a pamphlet to teach others how to budget their money. Extension...

Curated OER

Two Ways to Analyze Fiscal Policy

Challenge your class with this fiscal policy worksheet. Learners analyze graphs to answer questions about aggregate expenditures, the real national income, and the recessionary gap.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Budgeting Money

Young scholars explore the concept of budgeting. In this budgeting lesson, students pick an occupation and develop a list of needs and wants. Young scholars make a list of monthly expenses and budget their income to afford those expenses.

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Students explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Earned Income Credit

Learners distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

A Look at Individual Federal Income Tax

Learners investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...