Curated OER

Chapter 7: Measuring Domestic Output, National Income, and the Price Level

Young economists will enjoy this approachable and informative presentation. It is full of helpful graphs and definitions. Especially interesting will be the graph that measures the global perspective of the underground economy as a...

Mocha Bay Design

Monthly Expenses

Teach your class about finances and have them fill out real or simulated expenses on this sheet. Class members fill in amounts for rent, groceries, loans, car expenses, insurance, utilities, and more in order to determine the total cost...

Curated OER

Income and Outcomes

Bring financial literacy into your classroom. Learners use peer support to reflect on their spending and how it reflects their income and their values.

Curated OER

Building the Aggregate Expenditures Model

A good accompaniment to an economics lesson, this presentation explores the aggregate expenditures model, detailing the relationship between consumption and saving using graphs and charts. Additional information includes investments and...

Curated OER

Budgeting Your Financial Resources

Students explore the aspects of making a budget. In this money management lesson, students learn the importance of budgeting and what all goes into creating a budget by eventually creating a budget of their own including how much they...

Curated OER

Good News and Bad News: Income and Taxes

Students examine Internal Revenue Service (IRS) Form 1040, citing particular line items that are pertinent to an artist acting as an entrepreneur. They explore various sources of income and the importance of keeping accurate income records.

Curated OER

Financial Literacy - Income and Deductions

Students examine payroll process, determining ones income, deductions taken out of paychecks (taxes, insurance, charitable contributions, retirement), fixed and variable expenses to expect and money management.

Federal Reserve Bank

Your Budget Plan

What do Whoosh and Jet Stream have in common? They are both characters in a fantastic game designed to help young scholars identify various positive and negative spending behaviors. Through an engaging activity, worksheets, and...

Curated OER

Extra Credit: It’s No Fairy Tale

Students discuss their knowledge of payday loans and credit cards. In this Economics lesson, students complete a read an article and Q&A activity in groups, and play a vocabulary bingo game and a quiz game on payday loans. Students...

Curated OER

Learning to Spend, Learning to Give

Students create a monthly budget. In this finances lesson, students learn the terms budget, income and expenses. Students create a monthly spending plan and keep track of what they make and spend for the next 30 days. When complete,...

Curated OER

From the Mixed Up Files of Mrs. Basil E. Frankweiler

Students listen to From the Mixed-up Files of Mrs. Basil F. Frankweiler and discuss wants and needs. In this iincome and expenses lesson, students relate the adventures of the children in the book to a real life financial...

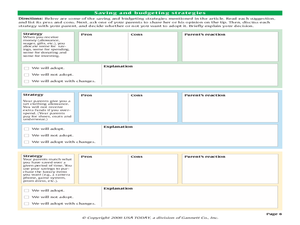

PricewaterhouseCoopers

Planning and Money Management: Financial Plan

More planning goes into a budget than a high schooler thinks. Here, they learn about the expected expenses and incomes, along with outside factors such as natural disasters. Learners prepare their own budget and adjust it based on...

Curated OER

Income Statement

Students demonstrate the proper way to prepare an income statement. They calculate a company's Gross Profit, Operating Expenses, Income from Operation before tax and Net Income, then determine the company's net income or net loss during...

Curated OER

Interest Income

Students identify taxable interest income, and report taxable and tax-exempt interest income.

Curated OER

Parents of Teens Ride Waves of Expenses

Students explore the concept of the cost of raising a child. In this cost of raising a child lesson, students read an article about the expenses associated with teenagers. Students discuss ways in which parents maneuver finances for...

Visa

A Plan for the Future: Making a Budget

From fixed and variable expenses to gross income and net pay, break down the key terms of budgeting with your young adults and help them develop their own plans for spending and saving.

Curated OER

Money Smart Choices

High schoolers make choices regarding money management. In this personal finance lesson, students explore budgets, incomes, and expenses as they learn vocabulary regarding personal finance and consider how to create personal...

Curated OER

Two Ways to Analyze Fiscal Policy

Challenge your class with this fiscal policy worksheet. Learners analyze graphs to answer questions about aggregate expenditures, the real national income, and the recessionary gap.

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Learners explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

A Look at Individual Federal Income Tax

Students investigate the concept of a personal federal income tax. They conduct research and participate in class discussion in order to deal some of the issues. They include why there is an individual income tax and how the money is...

Curated OER

Family Income

Students examine income statistics from the 2001 Census for four types of families in Canada. They appreciate the cost of running a household and the importance of tailoring expenses to match income.

Curated OER

Family Member

In this worksheet on family members, students describe what is meant by family, their duty to family, and family meetings. In addition, they create a budget for their family for one month keeping track of all expenses for 7 days....