Curated OER

Income and Expenses

Learners discuss income and expenses. In this lesson on money, students define income and expenses, after whith they keep track of their income and expense transactions on a basic ledger.

CK-12 Foundation

Area Between Curves: Income and Expenses

Use the area of polygons to calculate the area between curves. Pupils calculate areas under income and expense curves by filling the space with squares and right triangles. Using that information, they determine the profit related to the...

Mocha Bay Design

Monthly Expenses

Teach your class about finances and have them fill out real or simulated expenses on this sheet. Class members fill in amounts for rent, groceries, loans, car expenses, insurance, utilities, and more in order to determine the total cost...

Curated OER

Spending Log

In this money management worksheet, students will track their spending and income for one week. After tracking their income and expenses, students will complete 6 short answer questions about the results.

Curated OER

Monthly Income and Expense Worksheet

For this budget worksheet, students record monthly income and expenses on a chart. They include income and expenses such as utilities, charitable giving, food, transportation, and insurance. They determine the monthly surplus or deficit.

Curated OER

Income & Expense List

Students analyze a worksheet on income and expenses. They list all their monthly expenses and log them onto a working worksheet for evaluation. Evaluation of checkbooks is covered in depth.

PricewaterhouseCoopers

Buying a Home: Income vs. Monthly Payments

Purchasing a house takes more plan than elementary schoolers realize. Each buyer will look at monthly income to determine what they can afford for a mortgage and other expenses.

Curated OER

Budget Mania

Students examine several examples of budgets to develop a facility with the components of its formation. Income, expenses, and expenditures are considered and itemized for this lesson.

Curated OER

My Monthly Budget

Here's a nice layout to work on a monthly budget. There's a section to write income: where it comes from, the amounts, and any other notes. Then there's a section to write about expenses: what is purchased, the amount it costs, and...

Practical Money Skills

Living on Your Own

Independent living can be fun, but also overwhelming if you don't know how to budget your income and expenses. Go over the ways that kids can manage their money as they take a huge step into adulthood with a project-based lesson about...

Curated OER

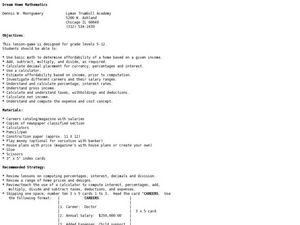

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Graphing It Out

Students create bar graphs. In this graphing lesson, students explore the concepts of net pay, gross pay, income and expenses. They create a bar graph to designate financial outlay during a specified period.

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Practical Money Skills

Budgeting Your Money

How do you make sure that your income doesn't disappear before you have a chance to save it? Use a creative budgeting activity to teach learners in both special education and mainstream classes how to keep track of their expenditures and...

Federal Reserve Bank

Your Budget Plan

What do Whoosh and Jet Stream have in common? They are both characters in a fantastic game designed to help young scholars identify various positive and negative spending behaviors. Through an engaging activity, worksheets, and...

Curated OER

Extra Credit: It’s No Fairy Tale

Students discuss their knowledge of payday loans and credit cards. In this Economics lesson, students complete a read an article and Q&A activity in groups, and play a vocabulary bingo game and a quiz game on payday loans. Students...

Curated OER

Learning to Spend, Learning to Give

Students create a monthly budget. In this finances lesson, students learn the terms budget, income and expenses. Students create a monthly spending plan and keep track of what they make and spend for the next 30 days. When complete,...

Curated OER

Learning to Spend, Learning to Give

Students explore the concept of personal finances. In this personal finances lesson, students identify their income and expenses. Students create a budget for their spending, saving, investing, and donating habits. Students draw graphs...

Curated OER

Family Profile Record Sheet

In this math worksheet, students learn real world math applications for budgeting expenses in a simulated family. Students make a family profile with profession choice and monthly income. Students then fill out detailed budgets which...

Curated OER

Life on the Run: A Budget for Claudia and Jamie

For this budget worksheet, students create a budget for 2 girls that are trying to escape and use their allowances as the income they have. Students create a budget based on their income and expenses. They also answer 7 short answer...

Curated OER

From the Mixed Up Files of Mrs. Basil E. Frankweiler

Students listen to From the Mixed-up Files of Mrs. Basil F. Frankweiler and discuss wants and needs. In this iincome and expenses lesson, students relate the adventures of the children in the book to a real life financial...

Curated OER

Why Would I Owe My Soul to the Company Store?

Sixth graders listen to "Sixteen Tons" by Tennessee Ernie Ford and discuss what it means to owe one's soul to a store. In this mathematics lesson, 6th graders determine what a miner's income was minus his expenses graphing findings in a...

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific lesson plan which has pupils explore how to come up with a personal budget. They consider income, saving, taxes, and their...

PricewaterhouseCoopers

Planning and Money Management: Financial Plan

More planning goes into a budget than a high schooler thinks. Here, they learn about the expected expenses and incomes, along with outside factors such as natural disasters. Learners prepare their own budget and adjust it based on...