Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Students analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Internal Revenue Service

Irs: Online Services and Tax Information for Individuals

In a conversational tone, the IRS answers many of the questions an individual would have when filing income tax returns for the first time. Many features are helpful even to experienced taxpayers, e.g., an IRS withholding calculator, a...

Wolters Kluwer

Small Business Guide: What Are Your Self Employment Taxes?

CCH Business Owner's Toolkit answers questions about self-employment taxes because "even if you don't hire anyone else to help you run your business, you're always going to have at least one employee, and that would be yourself."

Alabama Learning Exchange

Alex: Preparing for Tax Day

This unit is to expose students to different types of earnings, determine gross earning, calculate payroll deductions, and net pay. This project will have students journalize payment of payroll, employer payroll taxes, and payment of...

Other

Aicpa: Taxes: u.s. Federal Government

This resource contains links to federal tax information.

Other

Uncle Fed's Taxes: Tax Topic 401, Wages and Salaries

This site from Uncle Fed's Tax board explains withholding tax from wages and salaries. Mentions various forms that are used when filing taxes.

Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

Khan Academy

Khan Academy: Your Guide to Key Tax Terms by Better Money Habits

Knowing tax vocabulary can make filling out the paperwork less intimidating when it's time to file. This content is brought to you by our partner, Better Money Habits.

Bankrate

Bankrate: Tax Basics, Choosing the Correct Form

Description of the 3 forms, 1040EZ. 1040A and 1040. Explains who should use each form when filing taxes and why.

PBS

Pbs Teachers: Understanding the Bush Tax Cut Plan (Lesson Plan)

A lesson plans that requires learners to calculate income tax rates, interpret data tables and tax tables, critically analyze articles detailing a tax cut plan proposed by the Bush administration, and form opinions about the impact of...

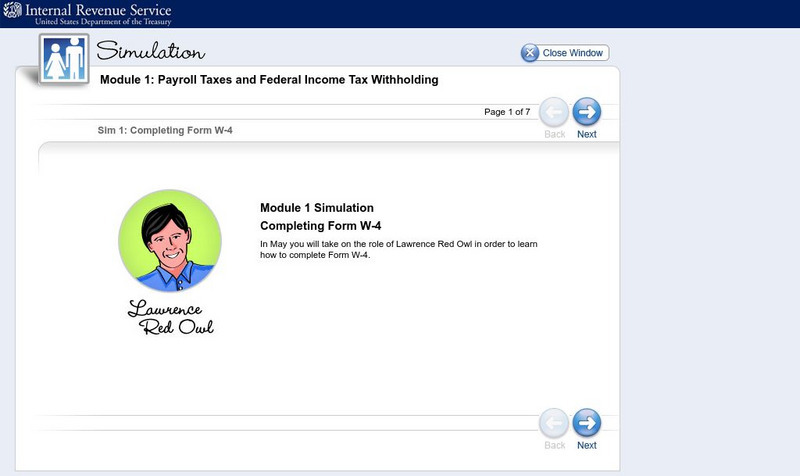

Internal Revenue Service

Irs: Completing a W 4

In May you will take on the role of Lawrence Red Owl in order to learn how to complete Form W-4.

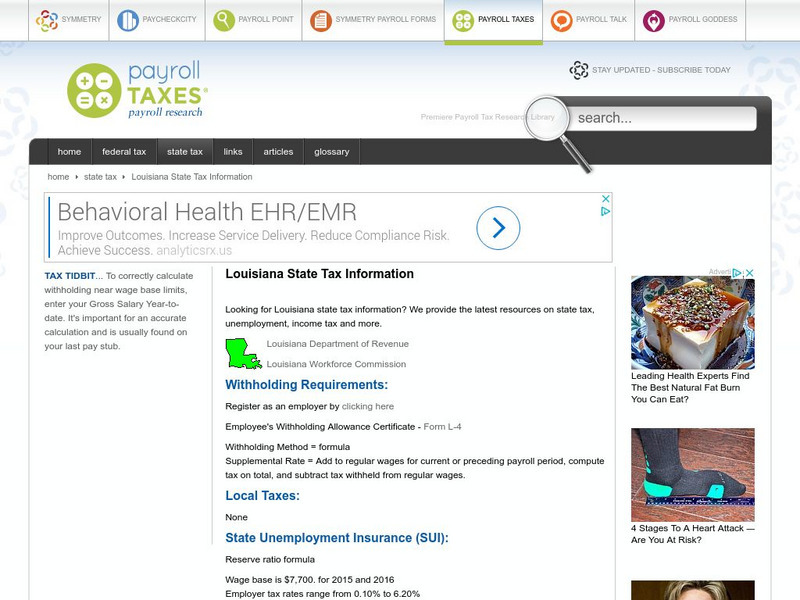

Other

Premier Payroll Research Library: Fringe Benefits

This article has the employer realize the importance of reporting fringe benefits to the IRS. This explains what fringe benefits are. Lists certain benefits that may be excluded from income as well as others which may not be excluded.

Other popular searches

- Completing Income Tax Forms

- Federal Income Tax Forms

- W2 Income Tax Forms

- Filing Income Tax Forms

- India Income Tax Forms