Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Visa

Financial Forces: Understanding Taxes and Inflation

Take the opportunity to offer your young adults some important financial wisdom on the way taxes and inflation will affect their lives in the future. Through discussion and review of different real-world scenarios provided...

College Board

2002 AP® Macroeconomics Free-Response Questions Form B

What would happen if the federal government replaced the income tax with a national sales tax? Learners consider the consequence and other economic scenarios using authentic College Board materials. Scholars also evaluate the role of...

Curated OER

Churches and Taxes

Churches have been tax-exempt since the founding of America, but should they be? Pupils ponder the question as they browse the website in preparation for a class debate or discussion. They research the history of tax-exemption for...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social...

College Board

2009 AP® Macroeconomics Free-Response Questions Form B

If a country is facing rising unemployment, should the president ride out the trend or decrease income taxes? Scholars confront two competing policy recommendations and must decide what to do in a practice exam from College Board. Other...

College Board

2000 AP® Macroeconomics Free-Response Questions

When a country faces a recession, the government has various options: decrease taxes to stimulate consumer spending or increase taxes to fund projects. Which works best? Young economists ponder this question, along with how an increase...

Curated OER

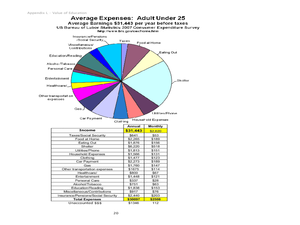

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. In this education and income lesson, students evaluate examples of occupations, their salaries, and education level needed for the job. Students calculate...

Curated OER

Methods of Filing

Students explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Practical Money Skills

Making Money

The first step in managing your money is making money! Learn about ways to find and interview for a job with a thorough lesson plan on personal finances. Kids learn about the ways to earn a paycheck and then manage the funds they receive.

Curated OER

Value of Education: Education and Earning Power

Students explore the concept a higher education yields higher earnings. Throughout the class, students visit six workstations and examine occupations, education, salaries, spending, banking, and taxes. As students rotate through the...

Curated OER

Accounting -- Preparing Payroll Records

Students review preparation of payroll records and practice these skills while playing games on the computer. They follow a student outline and complete online activities and quiz.

Curated OER

Exploring the Controversial Plan to Drill in the Arctic National Wildlife Refuge

Students examine the Bush Administration's plan to drill for oil in the Arctic National Wildlife Refuge from varying points of view. They work in small groups in order to perform their research, but they compose individual journal writes...

Curated OER

Slick Moves: Exploring the Controversial Plan to Drill in the Arctic National Wildlife Refuge

Middle schoolers recount their knowledge of natural resources and articulate their understanding of the multi- faceted debate that surrounds drilling in the Arctic National Wildlife Refuge. They then examine the complexity of drilling in...

Internal Revenue Service

Irs: Tax Tutorial: Module 13: Electronic Tax Return Preparation and Transmission

This tutorial explores e-filing your income taxes.