Curated OER

The Common Tragedy of Consumerism

Students evaluate the effectiveness of current climate change solutions. In this global warming lesson, students look at the current measures implemented and analyze whether they are beneficial to the environment or not. Advance reading...

Independence Hall Association

American Government: Financing State and Local Government

Taxes are collected by federal, state, and local governments to pay for a wide variety of services. This article helps students understand where their tax money goes.

Council for Economic Education

Econ Ed Link: Why Cities Provide Tax Breaks

Like the state and federal government, local governments offer tax incentives to businesses to help solve economic and/or environmental problems. In this lesson, students will explore three different cities and determine what incentives...

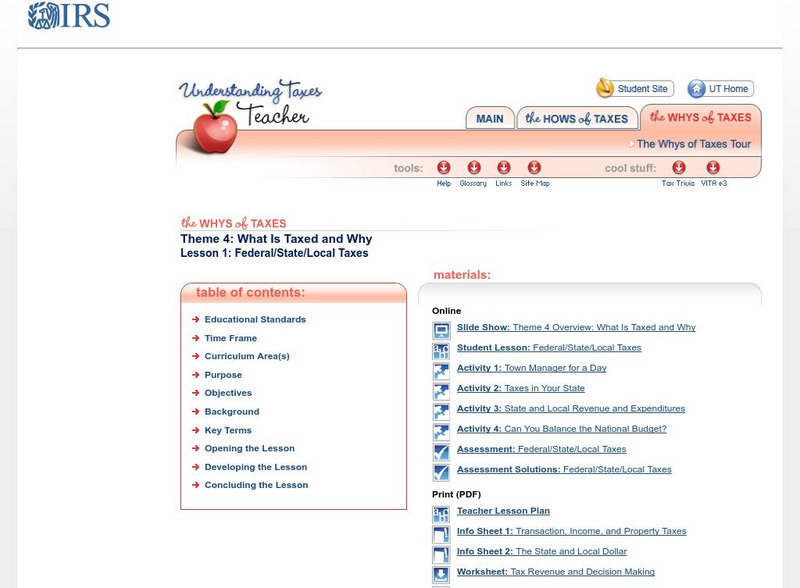

Internal Revenue Service

Irs: Federal/state/local Taxes Lesson Plans

This lesson plan will help students understand that federal, state, and local governments need revenues to provide goods and services for their residents.

Bankrate

Bankrate: Sales Tax: Definition, How It Works, and How to Calculate It

Forty-five states and many local government impose sales taxes on most goods and some services. This article explains the difference between sales taxes and income taxes, and how sales taxes are levied.

Digital History

Digital History: Local Control vs. National Authority [Pdf]

One of the debates at the Constitutional Convention centered on whether states or a national government would have greater authority. Read a reconstruction of speeches given by delegates to the convention concerning this important issue....

University of Groningen

American History: Biographies: George Walker Bush (1946 )

George W. Bush is the 43rd President of the United States. He was sworn into office January 20, 2001, after a campaign in which he outlined sweeping proposals to reform America's public schools, transform our national defense, provide...