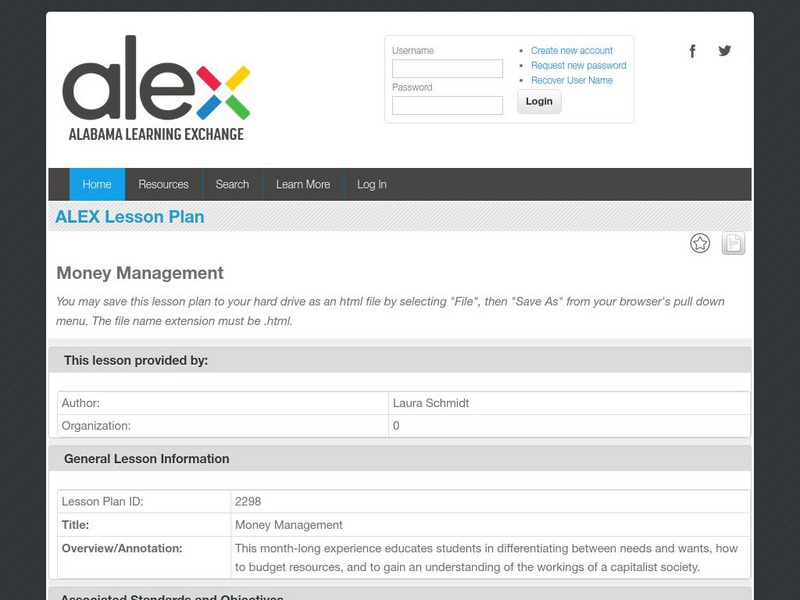

Alabama Learning Exchange

Alex: Money Management

This month-long experience educates students in differentiating between needs and wants, how to budget resources, and to gain an understanding of the workings of a capitalist society.

Practical Money Skills

Visa: Practical Money Skills: Lesson Plans for Grades 7 8

Fourteen financial literacy lesson plans for middle school students cover topics such as budgeting, living on your own, the influence of advertising, and saving and investing.

Scholastic

Scholastic: Adventures in Math: Lesson 1: Money Matters

The process of earning money is the cornerstone of financial literacy. In this lesson, students will identify key terms associated with earning money, explore ideas for earning money now, and evaluate various career options as sources of...

Practical Money Skills

Practical Money Skills: Lessons: College

Ten financial literacy lesson plans allow college students to build on their skills and cover topics such as budgeting, living on your own, managing credit cards, cars and loans, and saving and investing.

University of Missouri

University of Missouri: Wise Pockets: Berenstain Bears' Trouble With Money

Using a Berenstain Bears' book, students are introduced to concepts such as spending, goods, services, income, saving, and interest. Lesson is detailed and has good activities. Includes questions about the story that teach students about...

Alabama Learning Exchange

Alex: Becoming a Wise Consumer: Comparison Shopping

In this introductory lesson to money management for teens, students will use everyday math skills to comparison shop a variety of products. Students will learn several ways to save money, including using store discounts, coupons, and...

Other

Money Management International: The Berenstain Bears' Trouble With Money

A lesson plan featuring the Berenstain Bears that introduces the concepts of spending, goods, services, income, saving, and interest.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Avoiding Debt

Students read a short story and a handout to learn about excessive debt and ways to avoid or reduce debt.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Tracking Income and Benefits

Using a case study about an urban family, learners calculate monthly net income and explore how irregular income may make it challenging to manage monthly expenses.

Illustrative Mathematics

Illustrative Mathematics: A sse.b.4: A Lifetime of Savings

The purpose of this instructional task is to give students an opportunity to construct and find the value of a geometric series in a financial literacy context. Aligns with A-SSE.B.4.

Federal Reserve Bank

Katrina's Classroom: Teaching Money Skills for Life

Students will participate in Katrina's Classroom curriculum provided by the Federal Reserve Bank of Atlanta. The activity emphasizes the importance of being prepared for a financial emergency. This is a Commerce and Information...

Alabama Learning Exchange

Alex: Help How Do I Pay for My College Education?

This lesson is designed to guide students through the process of searching for financial aid information by utilizing technology. This lesson contains a financial aid component.

Alabama Learning Exchange

Alex: Liquidity for Success

This lesson will input values to calculate financial ratios and intepret the information derived from the calculations. This is a Commerce and Information Technology lesson plan.

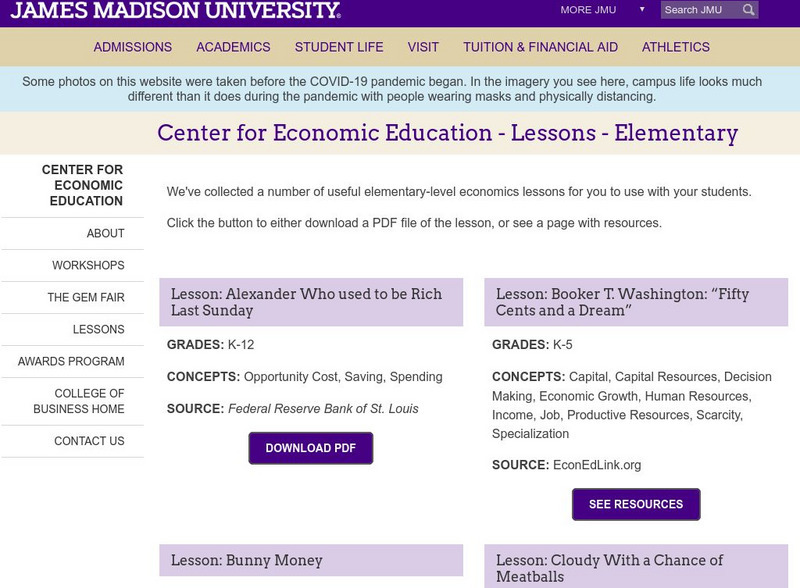

James Madison University

James Madison University: Online Elementary Economics Lessons

James Madison University has developed a variety of online economic lessons for elementary students. Explore basic economic and financial concepts.

Illustrative Mathematics

Illustrative Mathematics: Saving Money 2

The purpose of this task is for learners to relate addition and subtraction problems to money and to situations and goals related to saving money. A problem is given that will contain multiple solutions, this allows students to think...

Save And Invest

Finra Investor Education Foundation: The Emergency Fund

This lesson plan teaches students the importance of being financially prepared for unexpected expenses.

Save And Invest

Finra Investor Education Foundation: Debt Elimination

This lesson plan offers different strategies for eliminating debt and strengthening one's financial position and cash flow.

Other

Actuarial Foundation: Building Your Future: Financing [Pdf]

In book 2 from the Building Your Future series, students and teachers get resources and practice on how financing works, such as getting loans and buying insurance.

Other

Actuarial Foundation: Building Your Future: Investing [Pdf]

In book 3 of the Building Your Future series, students and teachers work on the concept of investing, including stock and bonds, mutual funds, risk and diversification, and inflation, through a combination of information and practice.

Other

Actuarial Foundation: Building Your Future: Succeeding [Pdf]

Through information, examples, and practice, students learn about the costs and advantages of post-secondary education, how to understand the potential earnings and benefits of a job, how to make a budget, and why it is important to...

Council for Economic Education

Econ Ed Link: Banks & Credit Unions (Part I)

Young scholars learn about banks and credit unions, identifying similarities and differences between the two types of financial institution. They also evaluate a local bank and credit union to determine which one would be better suited...

Consumer Financial Protection Bureau

Cfpb: Contrasting Long Term and Short Term Savings Goals

Middle schoolers learn the difference between short-term and long-term savings goals and apply their knowledge in an exercise-oriented game.

University of Regina (Canada)

University of Regina: Math Central: Stewart Resources Centre: Consumer Wise [Pdf]

A tenth-grade math unit, developed in 1993 by a Saskatchewan teacher, on budgeting.

Alabama Learning Exchange

Alex: I Owe, I Owe, So Off to Work I Go!

Students often attend college and are faced with the mounting debt incurred from student loans. This lesson plan will guide through calculating repayment for students loans, preparing a monthly budget, and researching options for...