Workforce Solutions

Plan a Vacation

Challenge scholars to plan a vacation with a $5,000 budget. Learners review costs of transportation, meals, and entertainment while considering the number of people and destination. Worksheets provide information and well-organized...

Visa

Living On Your Own

Learners gain a realistic understanding of what is required for independent living. They begin by setting up a budget based on needs and lifestyle, and then use worksheets and a presentation to practice such skills as reading a rental...

Curated OER

Dream Home Mathematics

Explore the concept of budgeting with sixth graders. They will pick a career on note card made by the teacher. They then use the information on the card such as salary, expenses, and career to create a life for themselves. They also...

Curated OER

Get-a-Pet Budget

In this itemized budget for the cost of a pet learning exercise, students predict and record the yearly costs for owning a pet and find the monthly costs. Students fill in blanks for 24 items.

Curated OER

A Family Spending Plan

Students investigate family expenditures. In this family budget lesson, students examine the wages and expenditures of family and then create a monthly budget for the family to follow.

Curated OER

Month 2 Budget

In this consumer mathematics worksheet, students complete a monthly budget by completing each category on the sheet. They fill in the blanks and calculate their totals for month two.

Curated OER

Planning A Household Budget

Students experience real life by utilizing math skills to plan a household budget and enhance their financial planning skills.

Curated OER

Budgeting Money

Students explore the concept of budgeting. In this budgeting lesson, students pick an occupation and develop a list of needs and wants. Students make a list of monthly expenses and budget their income to afford those expenses.

Curated OER

The Art of Budgeting

Students create a plan to achieve personal and financial goals. In this budgeting goals lesson, students identify their sources of income and discuss being financially independent. Students record their monthly expenditures and present a...

Curated OER

A Budget Can Help Young People Cut Their Spending

Students explore the concept of budgeting. In this budgeting lesson, students read an article about how a budget helps young adults keep track of their spending. Students discuss financial issues that young adults have to deal with as...

Curated OER

Budget Finances

Young scholars role play the role of a recent graduate of high school living on their own. Using play money, they are given one month's salary and they discover they own their own house or apartment and owe money on a car loan. They...

Practical Money Skills

Living on Your Own

Every teen dreams of living independently, but often without thinking about the details and costs involved with moving out. Three lessons in a unit about living on your own focus on moving costs, fixed and flexible costs associated with...

Curated OER

Month 3 Budget

In this consumer mathematics worksheet, students complete a monthly budget form by filling each of the categories. They fill in their total expenses for each category and calculate their budget for month three.

Curated OER

Month 4 Budget

In this consumer mathematics worksheet, students complete a monthly budget form by filling each of the categories. They fill in their total expenses for each category and calculate their budget for month four.

Curated OER

Learning to Spend, Learning to Give

Middle schoolers create a monthly budget. In this finances lesson, students learn the terms budget, income and expenses. Middle schoolers create a monthly spending plan and keep track of what they make and spend for the next 30 days. ...

Curated OER

Class of 2000 - Student Loans

Students determine how they will finance their postsecondary education. In this student loan lesson, students create spreadsheets that help them budget their first year of college. Students identify methods to fund the budgets and...

Curated OER

Calculating the Cost of Living

Bring Consumer Mathematics and Economics to life with this lesson, where learners investigate personal finance and budgeting. They use the newspaper’s classified section to determine a future job and potential earnings and determine a...

Curated OER

How to Get Rich Slowly

Fourth graders discover how to budget in order to live in today's world. Allocating their resources is of prime importance in the monthly budget. They utilize a worksheet imbedded in this plan to figure out their monthly budget.

National Security Agency

Money Maters: Integers are Integral!

A thoroughly-written lesson plan and a plethora of worksheets about integers comprise this resource. Neophyte number crunchers learn to recognize integers, add and subtract them, and apply the concepts to the designing of a personal...

Curated OER

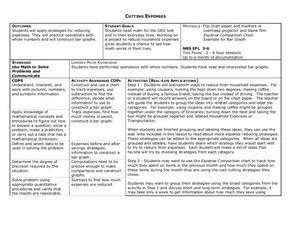

Cutting Expenses

Learners explore budgeting. In this finance and math lesson, students brainstorm ways in which households could save money. Learners view websites that give cost reducing ideas. Students complete an expense comparison chart and use the...

Curated OER

Extra Credit: It’s No Fairy Tale

Students discuss their knowledge of payday loans and credit cards. In this Economics lesson, students complete a read an article and Q&A activity in groups, and play a vocabulary bingo game and a quiz game on payday loans. Students...

Curated OER

Balancing a Budget

High schoolers investigate money management. In this secondary mathematics lesson, students participate in a cost-of-living budget simulation in which they calculate monthly and yearly projected costs. High schoolers investigate...

Curated OER

Final Analysis

In this consumer mathematics activity, learners calculate the total amount of money they earned during a project given. Then they transfer the expenses from each month to find their totals. Students also calculate to find their final...

Curated OER

Family Member

For this worksheet on family members, students describe what is meant by family, their duty to family, and family meetings. In addition, they create a budget for their family for one month keeping track of all expenses for 7 days....