Curated OER

Expensive Choices

Eighth graders work in pairs to discover how to prioritize expenses in a budget.

Curated OER

Buying and Financing the Car of Your Dreams

Eighth graders go to one of a number of web sites (provided by the teacher in a hotlist) to find a car they would like to buy if they were old enough. They would then be provided with the necessary information to compute monthly payments...

Curated OER

Solving Problems Involving Percents

In this math worksheet, pupils solve the problems that involve the percents. Then they apply the operations to the word problems.

Curated OER

Slow Times Mean Pay Cuts For Many

Learners explore the concept of a slowing economy. In this slowing economy lesson, students discuss the trickle-down effects of a slowing economy. Learners create an estimated budget for living expenses after high school. Students...

Curated OER

Visual 1: The Cost of Credit

In this money management worksheet, students examine an advertisement for a bike and respond to 3 questions that require them to calculate percentages

EngageNY

Credit Cards

Teach adolescents to use credit responsibly. The 32nd installment of a 35-part module covers how to calculate credit card payments using a geometric series. It teaches terminology and concepts necessary to understand credit card debt.

Curated OER

Financial Dieters Make Progress

High schoolers give financial advice. In this financial lesson plan, students read real-life financial problems. They explore the problem and make recommendations for a financial remedy.

Curated OER

Needs and Wants

Students examine the difference between psychological needs and wants to control spending.

Curated OER

Saving Makes Cents

Students identify ways families save money. For this financial lesson, students read the book A Chair for My Mother and discuss ways to save money. Students identify coin values and practice counting money.

Curated OER

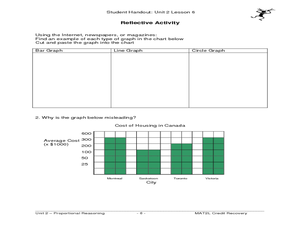

Elementary Statistics in Life

Students examine newspapers for graphs. They collect and sort data that is of interest to them. They enter data into a database and make comparisons using the information.

Curated OER

Proof Sheet

In this career worksheet, students identify and calculate their expenses if they had an apartment. They figure how much money they should save each month and budget.

Curated OER

EBT-rimental

Students engage in a instructional activity that gives them the tools needed to become knowledgeable credit consumers. The companion website for the ITV program TV-411 is used to provide learners with an interactive experience of what...

Curated OER

Under the Bed or in the Bank?

Students explore personal finance. In this consumer /financial mathematics lesson plan, students compare interest rates as they explore savings.

Curated OER

Family Financial Profile

Students investigate the cost of living. In this financial awareness lesson plan, students play a game to simulate various family situations and their incomes. Students choose activity cards and record information on their family profile...

Curated OER

Moving Out

Students determine their cost of living. In this determining their cost of living lesson, students think of ten necessary things they would need if they moved out of their parents house. Students research the cost of renting an...

Curated OER

Houses and Cars and Loans

Students create a spreadsheet to track their spending. In this algebra lesson plan, students use loan formulas to calculate the payback amount plus interest on a loan. They calculate how much money they would need to buy a car and house.

Curated OER

The Circle Graph

In this circle graph worksheet, students complete problems involving many circle graphs including a compass rose, degrees, and more. Students complete 7 activities.

Council for Economic Education

You Can BANK on This! (Part 4)

Students assess both negative and positive incentives associated with credit card use. They identify profit as an economic incentive for banks to offer credit cards.