Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Jobs, Teens, and Taxes

Students review Internal Revenue Service webpages and respond to questions to explore the relationship between working and taxes.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Taxes and Your Paycheck

Students analyze statements about taxes to better understand how taxes affect people's paychecks.

Federal Reserve Bank

Federal Reserve Bank of St. Louis: Income Taxes: Who Pays and How Much? [Pdf]

A lesson unit that teaches young scholars all about income tax: what it is, why we have it, how taxes are structured, factors that affect one's tax bracket, and what would happen if the tax structure were changed.

Council for Economic Education

Econ Ed Link: Preparing a 1040 Ez Income Tax Form

Many students in high school or in college have part time jobs and learn the concept of gross pay and net pay. Their employers take out taxes at the federal and state level. This lesson takes a common situation and helps students...

Internal Revenue Service

Irs: Evolution of Taxation in the Constitution Lesson Plan

This lesson plan will give young scholars an overview of the role and purpose of taxes in American history.

Other

Treasury Direct: Money Math: Lessons for Life: Math and Taxes:a Pair to Count On

Students have the opportunity to see how the money they earn is dependent, to a great extent, on the education they gain, by examining occupations and salaries. They then will use pay stubs and tax tables to learn what happens to the...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

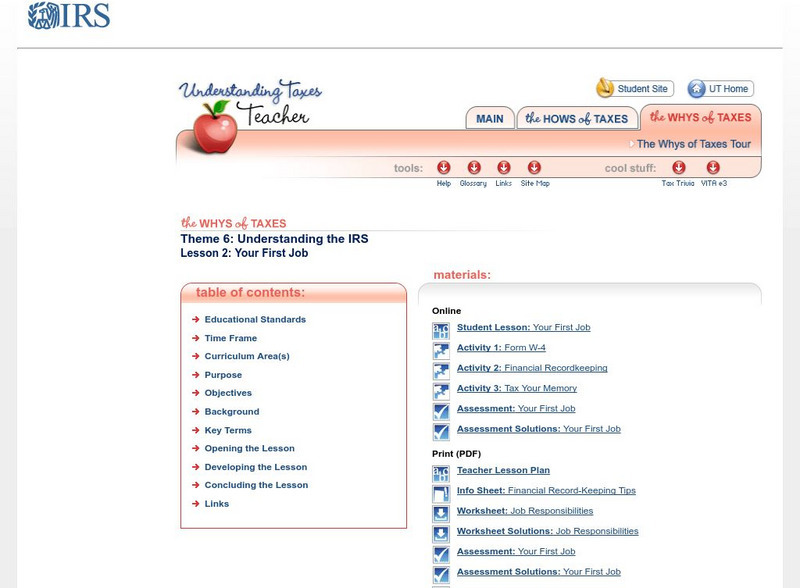

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

AdLit

Ad lit.org: The High Cost of High School Dropouts: What the Nation Pays

The social and economic implications of America's high dropout rate are staggering. In addition to the waste of human potential, the costs of dropouts include lower tax revenues from lower paying jobs, higher crime rates, higher demand...

Federal Trade Commission

Federal Trade Commission: Consumer: Your Paycheck

When you work your employer pays you for doing your job with a paycheck. Learn how to cash it and the difference between gross pay and take-home pay.

Calculator Soup

Calculator Soup: Gross Pay Calculator

Calculate gross pay, before taxes, based on hours worked and rate of pay per hour including overtime.

Illustrative Mathematics

Illustrative Mathematics: 6.rp Kendall's Vase Tax

Students use percentage and addition to answer this real-world math performance task: Kendall bought a vase that was priced at $450. In addition, she had to pay 3% sales tax. How much did she pay for the vase?

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Internal Revenue Service

Irs: How to Measure Fairness Lesson Plans

This lesson plan will help learners understand that people have difficulty agreeing on a fair tax because of different values and priorities.

Curated OER

Vat Theories Progressive or Regressive Who Pays What?

Explains progressive, regressive, and proportional taxes and applies them to the value added tax (VAT).

Internal Revenue Service

Irs: Your First Job Lesson Plan

This lesson plan will help young scholars understand that they are responsible for paying income taxes through withholding as they earn income and that it is important that they keep accurate records of their earnings and expenses.

Other

Iris: Hrm: How to Read Your Payroll Advice and Yearly W 2 Earnings Statement

This site provides an example of pay stub and explains each entry; it also explains a W-2 statement.

Other

World Bank: Doing Business: Argentina

This page provides a snapshot of Argentina's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business,...

Other

World Bank: Doing Business: Bangladesh

This page provides a snapshot of Bangladesh's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business,...

Other

World Bank: Doing Business: Chile

This page provides a snapshot of Chile's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business, getting...

Other

World Bank: Doing Business: Ecuador

This page provides a snapshot of Ecuador's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business, getting...

Other

World Bank: Doing Business: Ecuador

This page provides a snapshot of Ecuador's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business, getting...

Other

World Bank: Doing Business: Bolivia

This page provides a snapshot of Bolivia's ranking on the ease of doing business and on each of the ten topics that comprise the overall ranking. Data is also provided for the multiple economic topics such as starting a business, getting...