Curated OER

Closed Economy Expenditure Model Test

In this economics instructional activity, students answer questions relating to consumption, investment, and expenditures in a model of a closed economy. The eight page instructional activity contains forty multiple choice...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Assessment

Answer the following multiple-choice and true/false questions about payroll taxes and federal income tax withholding by clicking on the correct answers. To assess your answers, click the Check My Answers button at the bottom of the page.

Internal Revenue Service

Irs: Module 1: Payroll Taxes and Federal Income Tax Withholding

A tax tutorial that will cover payroll taxes, income tax withholding from employees' pay, and how to complete form W-4.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Employers withhold taxes from employees' pay. Gross pay is the amount the employee earns. Net pay, or take-home pay, is the amount the employee receives after deductions.

Consumer Financial Protection Bureau

Cfpb: Investigating Payroll Tax and Federal Income Tax Withholding

Learners analyze W-4 forms and paystubs in order to better understand payroll taxes and federal income tax withholding.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

The Balance

The Balance: Learn About Fica, Social Security, and Medicare Taxes

Without understanding FICA, many high school students who begin working are shocked when they get their first paychecks. This article clearly explains these payroll taxes and what they mean for both employees and employers.

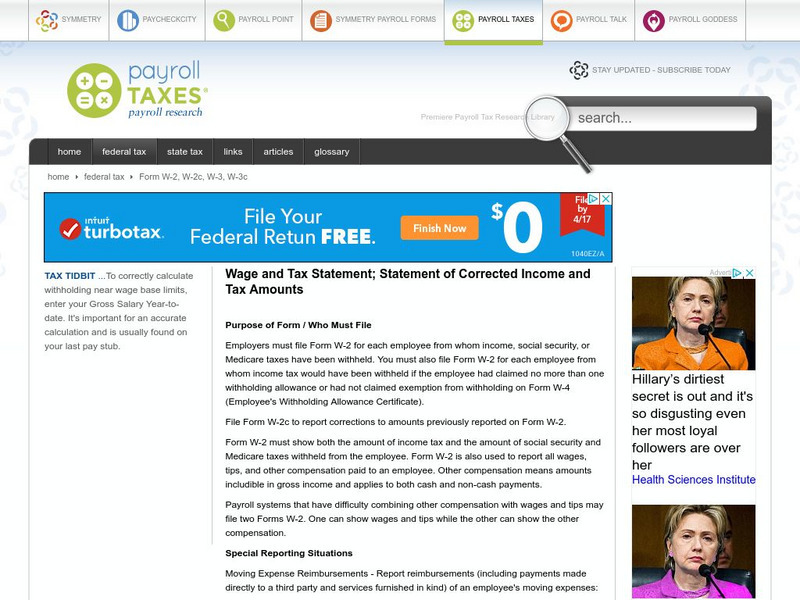

Other

Payroll taxes.com:federal Payroll Tax Forms and Filing Addresses

This site explains the purpose of the W-2 form, special situations that affect it, and where and when to file it.

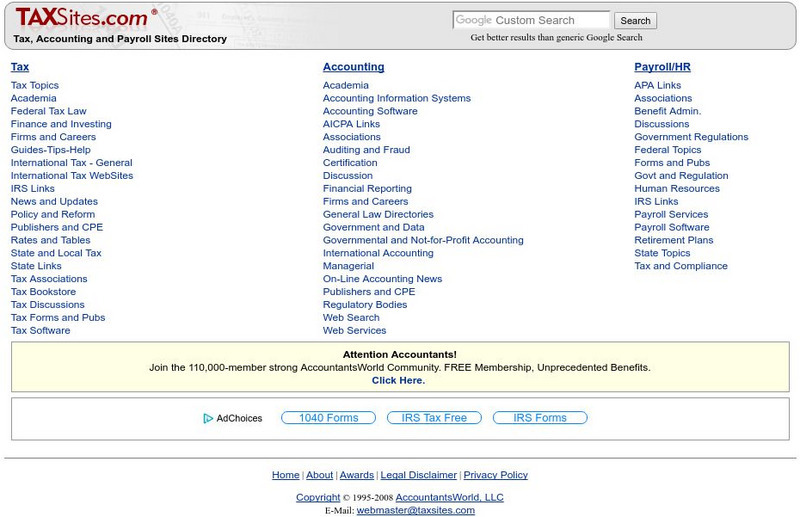

Other

Tax and Accounting Sites Directory

This is a tax and accounting site directory. Includes links to varied tax information.

Wolters Kluwer

Business Owner's Toolkit: Federal Unemployment Tax

This article offers useful information regarding the correct payment of payroll taxes under the Federal Unemployment Tax Act.

The Balance

The Balance: Do Tax Cuts Create Jobs? If So, How?

Learn about different types of tax cuts the government can use to help control unemployment. The article explains how tax cuts create jobs, but it also suggests other steps the government can take that may be more effective.

Alabama Learning Exchange

Alex: Preparing for Tax Day

This unit is to expose students to different types of earnings, determine gross earning, calculate payroll deductions, and net pay. This project will have students journalize payment of payroll, employer payroll taxes, and payment of...

Other

Entrepreneur: Taxing Matters

This Entrepreneur Magazine article provides "Everything you wanted to know about payroll taxes, and then some," and includes a good explanation of FICA (social security and medicare) withholding.

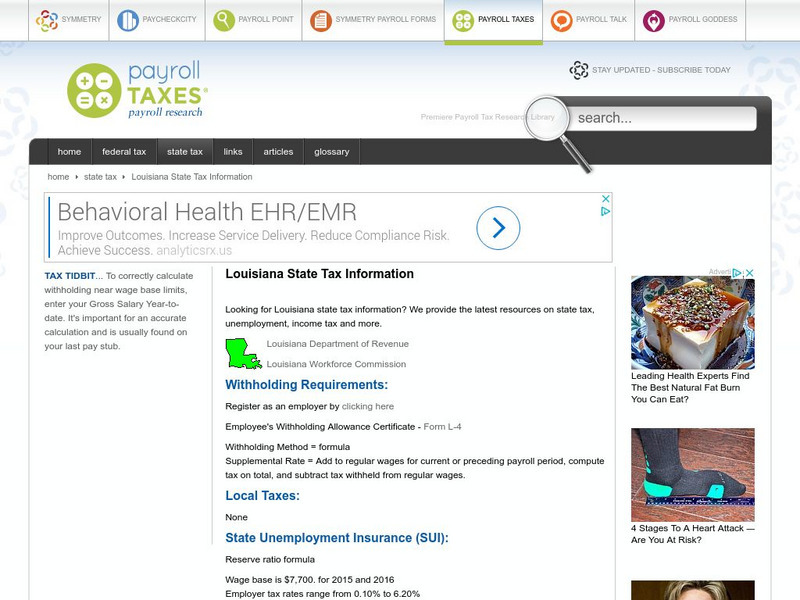

Other

State Taxes

This site provides tax information about each state in the United States simply by clicking on the name of the state. Links further down the page can be used to find specific state taxes, such as payroll and sales taxes.

Texas Workforce Commission

Texas Workforce Commission: Tax Information and Transactions

The Texas Workforce Commission provides "Unemployment Compensation and Tax Information" plus specific and general information about employment-related taxes. Click on any topic for lots of questions, answers, tips, and examples.

Wolters Kluwer

Business Owner's Toolkit: Employers' Responsibility for Fica Payroll Taxes

Explains requirements of FICA - Federal Insurance Contributions Act.

Wolters Kluwer

Business Owner's Toolkit: Determing Which Payroll Taxes Apply to Your Employees

This resource contains pertinent information regarding withholding exemptions for employees and how the tax is withheld. Links are also provided for additional information on related subjects.

ProProfs

Pro Profs: Do You Know Where Your Taxes Are Going?

On April 15, millions of Americans file their income taxes. Find out where your federal income taxes go. Note: This quiz looks only at federal income taxes, not payroll taxes.

Council for Economic Education

Econ Ed Link: Clean Land Thanks to Us! (Student Page)

How does the government raise money to fund government agencies like the EPA? Through taxes. This instructional activity looks at the different taxes that are paid by US citizens and how the money is used for things such as cleaning up...

Other

Iris: Hrm: How to Read Your Payroll Advice and Yearly W 2 Earnings Statement

This site provides an example of pay stub and explains each entry; it also explains a W-2 statement.

Internal Revenue Service

Understanding Taxes: The Social Security Act of 1935

This very complete lesson plan explains the history of the Social Security Act of 1935, its history and importance to the elderly during the Great Depression, and its importance today. Everything necessary to teach the instructional...

Other

Premier Payroll Research Library: Fringe Benefits

This article has the employer realize the importance of reporting fringe benefits to the IRS. This explains what fringe benefits are. Lists certain benefits that may be excluded from income as well as others which may not be excluded.