EngageNY

The Mathematics Behind a Structured Savings Plan

Make your money work for you. Future economists learn how to apply sigma notation and how to calculate the sum of a finite geometric series. The skill is essential in determining the future value of a structured savings plan with...

Visa

Allowances and Spending Plans

Help youngsters understand how to manage small amounts of money by discussing an allowance and the difference between spending, saving, and giving.

Visa

Cars and Loans

What's the best way to pay for a car? Should I buy used or new? Can I realistically afford a car? Pupils discover the ins and outs of buying a car, from how to shop for car insurance to the advantages and...

Alabama Learning Exchange

Comparing Fuel Economy

Compute fuel economy and gas mileage. Why? So you can teach rates and ratios, of course! Middle schoolers calculate the rate of miles per gallon for various vehicles. They research each vehicle, its mileage per gallon, and cost per...

Visa

Making Spending Decisions

By role playing real-world experiences, such as purchasing snacks and grocery/toy store shopping, your youngsters will begin to develop an understanding of how to make decisions and choose between alternatives. This is the first...

Curated OER

Building Wealth

Young scholars explore budgeting. in this building wealth lesson, students examine ways to invest and save money. They set financial goals and determine methods to reach the goals. Young scholars discuss managing debt,...

Visa

Make It Happen: Saving for a Rainy Day

Every little penny counts, especially when it comes to saving for emergencies or long-term goals. Pupils evaluate different saving and investment strategies, such as a CD or money market account, through worksheets and by...

Federal Reserve Bank

Creditors’ Criteria and Borrowers’ Rights and Responsibilities

Discover what criteria creditors use for making loans (the 3 Cs of Credit), and impress upon your young adults the rights and responsibilities related to using credit. Pupils role play as individuals seeking or providing credit, as...

Federal Reserve Bank

Invest in Yourself

What are the different ways that people can invest in their human capital for a better future? Pupils participate in an engaging hands-on activity and analyze data regarding unemployment, the ability to obtain an education, and median...

Curated OER

SPENDING: Maintaining the Skill of Money

Fourth graders explore the concept of maintaining money. In this personal finance lesson, 4th graders earn "money" for cleaning their classroom desks. Students spend the "money" in the classroom and practice making change.

Curated OER

The Business of Credit

Learn about credit ratings and how it plays a role in the function of small businesses. Learners use their knowledge of good and bad credit to role play and determine good credit vs. bad credit in the area of small businesses.

Curated OER

Budgeting for the Future

Eighth graders determine the net amount of an income for a fictional job. They must determine their net worth minus standard deductions. Students must then determine their monthly budget including, groceries, credit, and rent.

Visa

Making Decisions

What economic factors can influence personal and financial decisions? In an effort to understand opportunity costs and the time value of money, pupils engage in role-playing activities and discussion, as well as view a PowerPoint...

Curated OER

Money Management Intelligence

Students follow directions to help a client with his/her budget. After selecting their client, they download confidential data and listen to the challenge presented on the website. They adjust the budgets as needed. Then, they click play...

PwC Financial Literacy

Charitable Giving

Charitable organizations and monetary donations to these organizations are the focus of the financial literacy lesson plan presented here. Learners explore how donations benefit both the organization and the people it serves. Each pupil...

PwC Financial Literacy

Credit Reports

Middle schoolers discover why it's important to establish a positive credit history and understand the value of credit reports to lenders and borrowers. They apply legal guidelines to establish the uses of a credit report other than...

EngageNY

The Million Dollar Problem

Who wouldn't want to be a millionaire? The 34th installment of a 35-part module prompts young economists to calculate the monthly payments necessary to save a million dollars by age 40. As with car loans, annuity payments, and mortgages,...

Illustrative Mathematics

Field Day Scarcity

Introduce young mathematicians to concepts of financial literacy with this open-ended word problem. With seven dollars to spend during field day and given a list of available items and their prices, children must determine how they want...

Curated OER

Financial Planning For Catastrophe

Students explore the concept of financial planning for a catastrophe. In this financial planning lesson, students discuss the devastation that Hurricane Katrina wrought on the Gulf Coast. Students create budgets to plan for a...

Curated OER

Financial Dieters Make Progress

Students give financial advice. In this financial lesson, students read real-life financial problems. They explore the problem and make recommendations for a financial remedy.

Curated OER

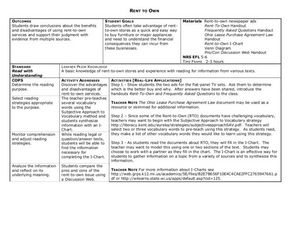

Rent To Own

Reading can be a good way to learn about many different things, like rent-to-own housing programs. Learners read informational resources about rent-to-own programs and how they work. They complete graphic organizers using the facts they...

Curated OER

Trip to the Greenbrier

Tenth graders explore the Greenbriar Resort. In this budgeting lesson, 10th graders plan and calculate the cost of trips from their home to the Greenbriar Resort.

Curated OER

Savings Account, Bill Paying, and Money Order Skills

What do you do after you get a paycheck? Help your mildly disabled learners how to bank wisely with a guided-skills activity. They practice cashing checks, withdrawing money, paying bills, and procuring money orders. The entire learning...

Curated OER

Savings Account Introduction Lesson

This teaching tool promotes a practical understanding of basic mathematical skills by having learners determine percents on interest. There are several worksheet options available as well as a guid on how best to use them.