Federal Reserve Bank

Your Budget Plan

What do Whoosh and Jet Stream have in common? They are both characters in a fantastic game designed to help students identify various positive and negative spending behaviors. Through an engaging activity, worksheets, and discussion,...

Curated OER

Spend, Save, Invest or Donate

Learners explore the concept of philanthropy. In this personal finance lesson, students consider economic choices and why people donate to causes. Learners investigate the processes of borrowing money and investing money in the lesson as...

Curated OER

How Media Shapes Perception

High schoolers analyze how media shapes their perception of events. In this media lesson, students research the home pages of assigned web sites to determine how media influences how they feel about tragic event. They look at head lines...

Visa

Banking Services

From writing and depositing checks to comparing ATM and debit cards, pupils develop financially savvy practices and build foundational knowledge of the financial service products available through banking institutions.

Visa

The Cost of College: Financing Your Education

With college tuition at an all-time high, high school students must consider the financial obligations of attending higher education, as well as the impact of college on future career opportunities. Pupils will complete worksheets,...

Visa

Make It Happen: Saving for a Rainy Day

Every little penny counts, especially when it comes to saving for emergencies or long-term goals. Pupils evaluate different saving and investment strategies, such as a CD or money market account, through worksheets and by researching...

Visa

Savvy Spending: Sharpening Money Decisions

Do you really need that new laptop/phone/dress/jacket/etc.? Financial decisions require us to distinguish between our wants and our needs. Through discussion and the evaluation of scenarios on provided worksheets, this resource will...

PwC Financial Literacy

Charitable Giving

Charitable organizations and monetary donations to these organizations are the focus of the financial literacy lesson plan presented here. Learners explore how donations benefit both the organization and the people it serves. Each pupil...

PwC Financial Literacy

Credit Reports

Middle schoolers discover why it's important to establish a positive credit history and understand the value of credit reports to lenders and borrowers. They apply legal guidelines to establish the uses of a credit report other than...

Visa

The Art of Budgeting

Class members learn how to set up and maintain a personal budget through discussion, financial planning worksheets, and a brief PowerPoint presentation.

Utah Education Network (UEN)

Decision Making

Making decisions, while maybe scary, is a skill that can be learned. Introduce teens to a five-step decision-making process that makes what may seem overwhelming possible. Pupils learn the steps and practice them by playing games,...

PricewaterhouseCoopers

The Stock Market

Keep or sell? Young learners simulate as buyers in the stock market while learning about the benefits and important factors to know when purchasing. The thorough resource allows for observation of case studies and provides an assessment...

PwC Financial Literacy

Evaluating Financial Information

Advertising is all around us. Sometimes those advertisements are directed at young people, so it's important for youngsters to recognize false advertising and fraud when they see it. That's what this instructional activity is all about....

PricewaterhouseCoopers

Saving and Investing: Building Wealth for Financially-Secure Futures

While spending is fun, saving for a retirement is the future. Young adults learn about the importance of saving and different opportunities to do so during their adulthood.

Curated OER

Money Smart Teens

Students plan positive goals for spending resources and understand why not to spend. In this financial planning instructional activity, students set up personal spending plans based on their resources and their long term plans. Students...

Visa

In Trouble

What are some of the financial risks associated with using credit? Pupils learn the warning signs of incurring financial hardship, and through PowerPoint presentations, worksheets, and discussion, discover the implications of such events...

Visa

Consumer Privacy

The availability of personal financial information is of greater importance now than ever before. Your pupils will discuss how public and private records are accessed by various organizations, particularly considering direct mail, credit...

Visa

Buying a Home

What is the difference between buying and renting a home? Learners become more informed consumers and financially literate adults after developing foundational knowledge of the home-buying process.

Practical Money Skills

Living on Your Own

Every teen dreams of living independently, but often without thinking about the details and costs involved with moving out. Three lessons in a unit about living on your own focus on moving costs, fixed and flexible costs associated with...

Visa

Using Credit Wisely

Receiving credit can be both a benefit and a curse. Prepare your learners to make wise credit choices by studying how credit influences credit scores, identifying the different components of credit cards, and exploring major consumer...

Visa

Nothing But Net: Understanding Your Take Home Pay

Introduce your young adults to the important understanding that the money they receive from their paychecks is a net amount as a result of deductions from taxes. Other topics covered include federal, state, Medicare and social security...

Nebraska Department of Education

Who Am I?

When people look in a mirror, they rarely see themselves as others see them. Tweens and teens can consider the significance of these disparities in a lesson that asks them to reflect on the kind of person they are and how they think...

Federal Reserve Bank

Lesson 4: Back to School

Based on your current level of human capital, how long would it take you to earn $1,000,000? What about your potential human capital? Learners explore the importance of education and experience when entering the workforce, and compare...

Curated OER

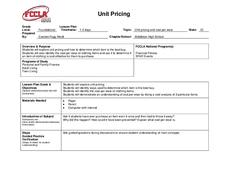

Unit Pricing

Students explore unit pricing to determine the best buy for their money. In this personal finance lesson, students calculate cost per wear examples and create a list of criteria for picking clothes. Students visit a story and use their...