Curated OER

Module 8-Tax Credit for Child and Dependent Care Expenses

Learners explain the tax credit for child and dependent care expenses. They distinguish between a tax deduction and a tax credit. They see how the tax credit for child and dependent care expenses affects the tax liability.

Curated OER

Utah's Tax Situation

Young scholars examine Utah's tax burden as relative to other states, explore types of taxes levied in Utah, including property, personal income, and sales taxes, define tax-related vocabulary, and conduct research to complete critical...

Curated OER

Math and Money

Students explore personal finance. For this middle school mathematics lesson, students investigate banking, income tax, and the cost of living. The lesson includes two bonus lessons on graphing their personal spending habits...

Curated OER

Your First Job

Students determine that they are responsible for paying income taxes through withholdings on earned income. They examine the Form W-4.

Curated OER

The Politics Of Taxation

Students explain that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes. They can explain why people of similar incomes often pay different tax rates and work in teams...

Curated OER

Earned Income Credit

Students distinguish between tax deduction and tax credit, explain how the earned income credit affects the tax liability, apply requirements to claim the earned income credit, and describe factors that determine the amount of the earned...

Curated OER

Value of Education: Education and Earning Power

Students explore the earning power of someone with a post-high school education. In this education and income instructional activity, students evaluate examples of occupations, their salaries, and education level needed for the job....

Federal Reserve Bank

It's Your Paycheck

Beyond reading and arithmetic, one of the most important skills for graduating seniors to have is fiscal literacy and responsibility. Start them on the right financial track with nine lessons that focus on a variety of important...

Curated OER

Methods of Filing

Pupils explain the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically. They identify the return method that is most appropriate for certain taxpayers.

Curated OER

Mueller v. Allen

Students investigate a First Amendment legal case involving religion, education, and reimbursement of tuition payments. They research the background of the cases and its precedents.

Curated OER

Exemptions

Learners explain how exemptions affect income that is subject to tax, and determine the number of exemptions to claim on a tax return.

Curated OER

Dependents

Students explain dependency exemption and how it affects taxable income, and apply the five dependency tests to determine whether a person can be claimed as a dependent.

PBS

Where Does Your Paycheck Go?

Upper elementary learners explore the concept of taxes taken out of an employee's paycheck. As they work through this lesson, young mathematicians discover the difference between gross pay and net pay. They also see what types...

Curated OER

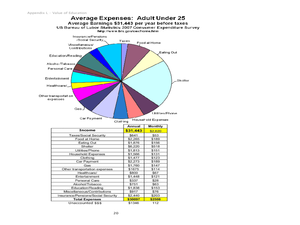

Money Math: Lessons for Life

Students develop a budget for a college student using all of the influences that the student would have. In this budgeting lesson plan, students use real life examples to create a budget spreadsheet. Students read and study...

Curated OER

Math and Money

Students explore financial literacy. In this middle school mathematics lesson, students investigate income, taxes, and costs of living. Students investigate banking and use straightforward computation to learn about savings,...

Curated OER

What's a Good Job?

Upper graders almost always stress about life after high school. To ease the transition to adult life, discuss how to select a job to meet personal needs. Two writing prompts are included to help learners consider what they'd like to do...

Visa

Making Money

From evaluating the current employment market to building a resume, pupils are introduced to the wide and varied elements of career planning.

Curated OER

Value of Education: Education and Earning Power

Students explore the concept a higher education yields higher earnings. Throughout the class, students visit six workstations and examine occupations, education, salaries, spending, banking, and taxes. As students rotate through the...

Curated OER

Money Math

Students define human capital and income earning potential. In this algebra lesson, students analyze the relationship between income and capital resources. They calculate tax rates and understand how to read a tax table.

Curated OER

Extra Practice 11: Applications With Percents

In this percent worksheet, students read short stories, determine the information needed, write an algebraic equation and evaluate the problem. Problems include simple interest, sale price, and tax rates. There are nine percent problems...

Curated OER

Making Money

Students consider career options. In this career planning lesson, students practice job interviewing skills, examine payroll checks and discuss employee benefits.

Curated OER

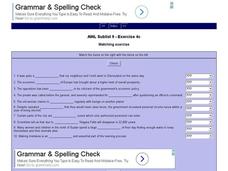

English Vocabulary Skills: AWL Sublist 9 - Exercise 4c

In this online interactive English vocabulary skills worksheet, students answer 10 matching questions which require them to fill in the blanks in 10 sentences. Students may submit their answers to be scored.

Curated OER

Fixing an Economy: Fiscal and Monetary Policy Worksheet

In this economics worksheet, students respond to 29 short answer questions regarding fiscal and monetary policy. Several notes and explanations are also included.

Curated OER

The Consumer Price Index: A Measure of Inflation

Students examine inflation over the years and learn to calculate how it changes over time. In this money management lesson, students learn how price changes affect their purchasing power, how to come up with strategies for dealing with...