Curated OER

Saving Money

After listening to the wonderful book, A Chair for my Mother, young mathematicians engage in an awesome lesson about coins and the value of saving money. The lesson is done in a classic style - everything is beautifully organized, and...

Curated OER

How Do You Spend Your Money?

Fifth graders examine ways to save and spend money. They look at ways that people earn, save, and spend money using chapters from Tom Birdseye's Tarantula Shoes. They add and subtract decimals to fill in a worksheet entitled, "Is It a...

Practical Money Skills

Saving and Investing

Learn the difference between saving money and investing money, as well as the advantages and disadvantages of each. Kids review banking and personal finance terms before studying the different ways that people can reach their financial...

Visa

Savvy Spending: Sharpening Money Decisions

Do you really need that new laptop/phone/dress/jacket/etc.? Financial decisions require us to distinguish between our wants and our needs. Through discussion and the evaluation of scenarios on provided worksheets, this resource will...

Visa

Money Responsibility

Introduce young learners to the important life skill of responsibly managing money and recording how much they spend and save.

Visa

Make It Happen: Saving for a Rainy Day

Every little penny counts, especially when it comes to saving for emergencies or long-term goals. Pupils evaluate different saving and investment strategies, such as a CD or money market account, through worksheets and by researching...

Federal Reserve Bank

Bunny Money

Teach your class about saving, spending, and goal setting with a story about a couple of bunnies who went shopping and related activities. Learners keep track of the bunnies' spending, practice identifying long- and short-term savings...

Curated OER

Buying New Stuff

Young spenders take a look at the best ways to save and spend money. This type of financial education is lacking in schools, so implementing this lesson would be of great value to your students. Things like bank checking account fees,...

PwC Financial Literacy

Planning and Money Management: Spending and Saving

Financial literacy is such an important, and often-overlooked, skill to teach our young people. Here is a terrific lesson plan which has pupils explore how to come up with a personal budget. They consider income, saving, taxes, and their...

Visa

Bank or Bust: Selecting a Banking Partner

Why shouldn't we just save all our money in our mattress? Couldn't our money disappear? Pupils discover the benefits of utilizing banks and credit unions for saving money, as well as how to evaluate different types of institutions by...

Curated OER

Scarcity and Choice

After reading the book A Bargain for Frances, young economists discuss how money is exchanged for goods or services. They demonstrate effective financial decision-making by listing ways to save money for a product they would like to buy.

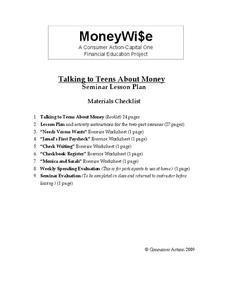

Consumer Action

Talking to Teens About Money

Your teenagers are probably very good at spending money, but how good are they at managing it? Teach class members about banking, checking accounts, interest rates, car insurance, and many other relevant concepts with a series of...

Practical Money Skills

Budgeting Your Money

How do you make sure that your income doesn't disappear before you have a chance to save it? Use a creative budgeting activity to teach learners in both special education and mainstream classes how to keep track of their expenditures and...

Curated OER

Short-Term and Long-Term Savings Goals

Fifth graders discover how saving money can apply to their lives. For this personal finance lesson, 5th graders use the book The Leaves in October, as a conversation starter on income, savings and setting goals. Students explore the...

Curated OER

Savings Accounts and Interest

First graders study money, banks, and getting interest on money. In this consumer math lesson, 1st graders listen to Stan and Jan Berenstain's, Berenstain Bears' Trouble With Money. They use the concepts in the book to discuss...

Curated OER

The Berenstain Bears Trouble with Money

Students will explore good and services, income and saving listening to the story The B. Bears Trouble With Money. For this early economic lesson, students discuss what it means to earn money doing services and save money to buy goods. ...

Curated OER

The Bernstein Bear's Trouble with Money: Financial and Academic Literacy

What do figures of speech have to do with financial literacy? Take an interdisciplinary look at The Berenstain Bears' Trouble with Money to find out. Young analysts read about the cubs' spendthrift ways and how Mama and Papa Bear teach...

Curated OER

Saving and Investing

Fifth graders participate in activities to promote understanding of investing and saving. In this saving and investing lesson, 5th graders design a portfolio, play a card game and write a skit about the importance of investing.

Curated OER

Personal Savings: Saving Money for Those Items you Really Want

Young scholars explore how to save money to buy the things they want.

Curated OER

What Can You Do With Money?

Students watch a Biz Kidz video about money, learn what they can do with money, and fill out worksheets on what they learn. Students learn about spending, saving, donating, and investing.

Curated OER

Hooray for Hand-Me-Downs!

Youngsters learn how "hand-me-downs" can help save money while practicing math word problems with this fun learning center activity.

Curated OER

Savings and Earnings

Fifth graders complete several activities to learn about earning, budgeting, and saving money. In this saving money lesson, 5th graders read a book about saving money and complete a 'Savings and Earnings' worksheet. Students work in...

Curated OER

Saving Makes Cents

Students identify ways families save money. In this financial lesson, students read the book A Chair for My Mother and discuss ways to save money. Students identify coin values and practice counting money.

Curated OER

Saving and Creating a Personal Budget

Fifth graders brainstorm ways to save money. In this financial awareness lesson, 5th graders read a chapter from the book, From the Mixed-Up Files of Mrs. Basil E. Frankweiler and create a personal budget for themselves.