Curated OER

Uncle Jed's Barbershop

Fourth graders examine productive resources. For this economics lesson, 4th graders read a book about a man who saves money to buy his own barbershop. After reading, students get into groups to play a game to learn about savings.

PwC Financial Literacy

Saving and Investing: Investing for the Future

A fine lesson on saving and investing is here for you and your middle schoolers. In it, learners explore the values of time and money, and discover how small amounts of money invested over time can grow into a large "pot of gold." They...

Curated OER

Savers & Borrowers: Financial Markets in the United States

Investigate the current financial market and have your class explore savings, borrowing, financial markets, mutual funds, and the stock market. This four-part activity is designed to help students become knowledgeable and informed...

Curated OER

Money and Credit: Making Good Decisions

Middle schoolers participate in activities that teach them how to manage money. In this managing money lesson plan, students set long and short term goals for economic success by having discussions, identifying benefits of saving, and...

Curated OER

Having a Savings Plan

Students discover the importance of saving and spending. In this finance lesson, students read the book Kermit the Hermit and discuss the differences between needs and wants. The students complete worksheets concerning money in their...

Alabama Learning Exchange

Coins to Bills!

Students practice using money at a grocery store. For this money lesson, students get familiar with grocery store ads and work in pairs to use these ads to select food items to purchase using money manipulatives. Students practice being...

Curated OER

Inflation and Money

Students examine the relationship between inflation and money. Defining key terms, they define money in terms of its functions and give examples of money. They discover what happens when inflation occurs unexpectedly. They also examine...

North Carolina Department of Public Instruction

What Is A Bank?

You're never too young to learn about banking and personal finance. Use a set of seven banking lessons to teach middle schoolers about checking and savings accounts, interest rates, loans and credit cards, and safety deposit boxes.

Conneticut Department of Education

Personal Finance Project Resource Book

Balancing a budget, paying taxes, and buying a home may feel out of reach for your high schoolers, but in their adult years they will thank you for the early tips. A set of five lessons integrates applicable money math activities with...

Curated OER

Money: Count Pennies, Save a Dollar

Students determine how to make the largest sum of money using the least amount of coins. In this mixed currency lesson, students listen to a reading of If You Made a Million by David M. Schwartz before participating in money counting...

Curated OER

Thinking About Money

Students evaluate various approaches to spending money.For this spending money literacy lesson, students broaden their financial goals by reading "Alexander Who Used to Be Rich Last Sunday" and "A Chair for My Mother."Students use a Venn...

Curated OER

Money Vocabulary

Explore the monetary system by completing worksheets in class. Learners will identify the monetary units of England and collaborate in groups to solve money word problems. They also identify several money-related vocabulary terms before...

Curated OER

Money Management Part III: Savings Accounts and Cash vs. Credit

Help your class understand the importance of saving and managing their money. Here is part three to a unit on credit, cash, and savings. Learners discuss savings accounts and the idea that a budget plan can help them avoid costly credit...

EngageNY

The Mathematics Behind a Structured Savings Plan

Make your money work for you. Future economists learn how to apply sigma notation and how to calculate the sum of a finite geometric series. The skill is essential in determining the future value of a structured savings plan with...

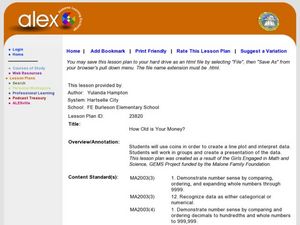

Alabama Learning Exchange

How Old is Your Money?

Elementary learners explore coin mint dates. First, they listen to the book Alexander Who Used to be Rich Last Sunday by Judith Viorst. They then sort a collection of coins according to their mint date and put them in order from oldest...

Visa

Dream Big: Money and Goals

Whether their objective is independent living, going to college, or buying a car, pupils will participate in discussions and complete worksheets to gain an understanding of how short- and long-term goals play a large role in helping...

Curated OER

Saving Money On Household Items

Young scholars use sale ads to compare and contrast prices on groceries, electronics, appliances and other goods. Working in groups, students brainstorm ways to save money on these items. This lesson is intended for young scholars...

Curated OER

Savings and Budget

Second graders investigate the concept of developing a budget. In this financial awareness lesson, 2nd graders read the book The Case of the Shrunken Allowance and brainstorm ways they can save and budget money. Students create their own...

Curated OER

How Much Do We Save?

Students use coupons to save. In this saving lesson students practice their addition, multiplication and estimating skills with dollars and cents. They investigate grocery coupons and look for ways to save money.

Curated OER

Keeping Track of Our Money

Second graders complete activities to learn how to manage money. In this managing money activity, 2nd graders read the book How the Second Grade Got $8,205.50 to Visit the Statue of Liberty and complete two related worksheets.

Curated OER

The Hundred Penny Box

Students compare how people save money in financial institutions, after reading the story, The Hundred Penny Box. They analyze the advantages of regular saving and how savings grow with compounding.

Visa

Kindness Counts: Understanding Charitable Giving

Financial literacy is generally focused on personal spending and saving, but consider an opportunity to talk to your pupils about how charitable giving can also factor into money management and how it can enhance life for both oneself...

Federal Reserve Bank

Savvy Savers

What are the benefits and risks of saving in an interest-bearing account? Pupils explore concepts like risk-reward relationship and the rule of 72, as well as practice calculating compound interest, developing important personal finance...

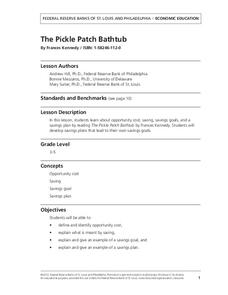

Federal Reserve Bank

The Pickle Patch Bathtub

What do your pupils want to save up their money for? Based around the book The Pickle Patch Bathtub, this lesson covers opportunity cost, saving, and spending. Learners participate in a discussion and practice making their own savings...