Visa

Make It Happen: Saving for a Rainy Day

Every little penny counts, especially when it comes to saving for emergencies or long-term goals. Pupils evaluate different saving and investment strategies, such as a CD or money market account, through worksheets and by researching...

Practical Money Skills

Saving and Investing

Learn the difference between saving money and investing money, as well as the advantages and disadvantages of each. Kids review banking and personal finance terms before studying the different ways that people can reach their financial...

Practical Money Skills

Budgeting Your Money

How do you make sure that your income doesn't disappear before you have a chance to save it? Use a creative budgeting activity to teach learners in both special education and mainstream classes how to keep track of their expenditures and...

Curated OER

Take Time to Save Now

Students brainstorm reasons to save money, investigate impact of saving regularly using interactive, on-line calculators, explain how compounding interest affects savings, explore different strategies for saving money, and write personal...

Curated OER

How Much Do We Save?

Students use coupons to save. In this saving lesson students practice their addition, multiplication and estimating skills with dollars and cents. They investigate grocery coupons and look for ways to save money.

Curated OER

Budgeting

Students explore what butgeting means. In this mathematics lesson, students determine that certain things need to be part of a budget like food and clothing by answering real-life types of questions on whether one should save money and...

Curated OER

Shopping for Savings

Fourth graders calculate savings and identify the best value items from a list of products. They rotate through five studying stations, completing various math activities involving calculators and solving problems related to shopping...

Curated OER

Show And Tell

Have you ever saved your money to buy something you really wanted? Elementary schoolers share how they saved their money for things they wanted, and they bring in one or two items that they bought with their personal savings.

Alabama Learning Exchange

Coins to Bills!

Students practice using money at a grocery store. For this money lesson, students get familiar with grocery store ads and work in pairs to use these ads to select food items to purchase using money manipulatives. Students practice being...

Curated OER

Managing Your Money

Students use the internet to gather information on saving money. They describe the history of money and the responsibilities of the United States Mint. They list their own personal goals and keep a journal as they operate a lemonade...

Curated OER

Describe How Money Barter, and Credit Were Used in Colonial Virginia

Fourth graders listen as the teacher lectures about bartering. They work in small groups to define and create a skit about one term related to bartering. Students create an Economic Terms booklet. They review that tobacco was a cash crop...

Curated OER

Marriage and Financial Goals, Budgeting Strategies

There is no more useful life skill to learn than budgeting and setting financial goals. It's math that is used by every person, everyday. Learners examine the responsibilities and costs involved in family economics. Through a series of...

Curated OER

Invest In Yourself

Students learn about budgeting, saving, dept, financial management, opportunity cost, and self-regulation. In this financial management lesson, students apply their knowledge of finance components and create their own web based plan...

Curated OER

Money Talks Canadian Money

Students use newspapers, games and journal writing activities to examine the importance of money and the role it plays in daily life. They complete several math problems, fill out worksheets and practice changing varying amounts.

Curated OER

Making Choices to Save Money on Food

Students review lists of coupons and complete a worksheet to analyze the benefits of the specials. For this household budget lesson, students determine which foods are nutritional and the advantages of using coupons or specials to save...

Curated OER

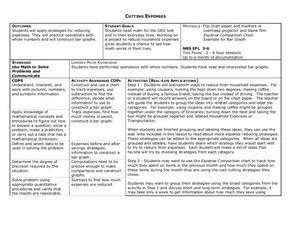

Cutting Expenses

Students explore budgeting. In this finance and math lesson, students brainstorm ways in which households could save money. Students view websites that give cost reducing ideas. Students complete an expense comparison chart and use the...

Curated OER

Strategies for Success

Students share opinions about common bad habits, read about behavior economics by reading and discussing article "Your Plate Is Bigger Than Your Stomach," identify goals and strategies designed to improve negative behaviors, and test...

Federal Reserve Bank

Retirement Planning

It's never too early to start saving for retirement. In fact, the earlier one starts, the better! Use this retirement planning activity to teach the importance of a retirement strategy and why to start at a young age.

Curated OER

The Berenstain Bears' Mad, Mad, Mad Toy Craze

Students use the book, The Berenstain Bears' Mad, Mad, Mad Toy Craze, to explore spending, collecting, opportunity cost, saving, and speculating.

Curated OER

The Great Cookie Company

Fourth graders implement real life application of money, problem solving, economics, and consumer awareness. In this three week economics unit, 4th graders operate a business, write checks, balance accounts, and market their product.

Curated OER

How do You Stack Up? Revisited

Students estimate the thickness of coins. For this stack up lesson, students stack pennies, nickels, dimes and quarters. They calculate and record the thickness of each coin. Students stack coins and estimate the height of the stack.

Curated OER

Lemonade Stand: Making Money the Old-Fashioned Way

Students run their own lemonade stand and are to figure out what to sell the lemonade at to gain the maximum profit.

Curated OER

How to Protect Your Money

Pupils review the basics of investing. They discuss saving strategies and investing fundamentals. Afterward, they consider a scenario from different investment perspectives.

Visa

Money Matters: Why It Pays to Be Financially Responsible

What does it mean to be financially responsible? Pupils begin to develop the building blocks of strong financial decision making by reviewing how their past purchases are examples of cost comparing, cost-benefit analysis, and budgeting.