Consumer Action

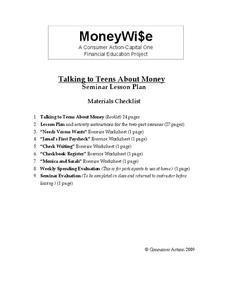

Talking to Teens About Money

Your teenagers are probably very good at spending money, but how good are they at managing it? Teach class members about banking, checking accounts, interest rates, car insurance, and many other relevant concepts with a series of...

Visa

Money Responsibility

Introduce young learners to the important life skill of responsibly managing money and recording how much they spend and save.

Youthlinc

Financial Literacy: Money Attitudes Lesson Plan

Going once, going twice, sold! An auction provides class members with an opportunity to examine their attitudes toward money. After bidding on and purchasing items, individuals complete an attitude survey and then identify a...

Curated OER

Money Vocabulary

Explore the monetary system by completing worksheets in class. Learners will identify the monetary units of England and collaborate in groups to solve money word problems. They also identify several money-related vocabulary terms before...

Federal Reserve Bank

Creating a Budget

Learning to create and maintain a budget is an important life skill. Guide individuals in the discovery of their spending habits and how to track them. They then use what they learned to create a budget and make decisions on where they...

Curated OER

Using Credit and Spending Money Wisely

Students discuss how to spend money wisely. In this consumer math instructional activity, students read the book, Mr. Popper's Penguins and discuss how much it costs to take care of a pet. Students complete a worksheet to calculate the...

Curated OER

Avoiding Consumer Fraud: Financial Scams and Schemes

Young consumers get a hefty dose of information on how fraud can put their financial health at risk. The resource provides detailed lecture notes, scaffolded notetaking sheets, vocabulary worksheets, transparencies, and seven links to...

Curated OER

Consumer Borrowing and Spending

Credit can be confusing for teens, some of whom are already using credit cards. Clear up misconceptions with this group research activity which has a solid outline with a lot of room to adjust to your needs and resources. Groups are...

Learning to Give

Five Thousand Dollars!

How does consumerism affect global poverty? Upper graders find out about cost benefit, wants and needs, and making good consumer choices as they explore this global topic. They role-play an impulse spending experience and work through...

Curated OER

Smart Consumers, Smart Choices

Students see what it means to be a smart consumer by engaging in a level-headed analysis of budget, opportunity costs and self-regulation. They compare prices within a service field, and weigh the choices of spending money on that item.

Curated OER

Savings Accounts and Interest

First graders study money, banks, and getting interest on money. In this consumer math lesson, 1st graders listen to Stan and Jan Berenstain's, Berenstain Bears' Trouble With Money. They use the concepts in the book to discuss...

Federal Reserve Bank

Expense Tracking

Where does all your money go? Individuals keep a record of the money they spend over the course of 30 days. They then categorize where they are spending their money and write an essay detailing their findings.

Curated OER

Marriage and Financial Goals, Budgeting Strategies

There is no more useful life skill to learn than budgeting and setting financial goals. It's math that is used by every person, everyday. Learners examine the responsibilities and costs involved in family economics. Through a series of...

Illustrative Mathematics

Discounted Books

Adolescents love to shop, especially when an item is discounted. Here, shoppers only have a set amount of money to spend. Will they be able to make a purchase with the discount and tax added in? Percent discounts can be calculated...

Beyond Benign

Final Budget

Be sure you have enough money to build a house. The 14th lesson in a 15-part series teaches young learners to use checkbook registers. They write checks for the amounts they spend on various housing materials and keep track of...

Curated OER

The Bakery - Word Problems

Pupils solve money word problem questions regarding buying items at the bakery.

Curated OER

Clothing Store Word Problems

Learners practice answering money word problems on shopping at the clothing store.

Curated OER

Using Credit: Not for a Billion Gazillion Dollars

Fifth graders explore the concept of credit. For this consumer education lesson, the teacher uses the book Not for a Billion Gazillion Dollars to lead the class in a discussion about credit, debit, and income. Students then analyze their...

Curated OER

Meet Molly An American Girl

Learners examine concepts of personal finance. In this personal finance lesson plan, students use Valerie Tripp's, Meet Molly, An American Girl, to learn about saving and spending after World War II. They compare financial decisions...

Curated OER

Kids Are Consumers Too

Students investigate a chosen product. They use television, radio, print, and internet sources to investigate how the product is advertised. Students create a market research survey to determine which brand is preferred by their peers...

Federal Reserve Bank

Income Taxes

Most adults dread April 15 — tax day! Tax preparation can be intimidating even for adults. Build confidence by leading individuals through the process and then give them a scenario to practice. The exercise uses tax vocabulary to give...

Curated OER

Give it Back from a Snack

Learners conduct and analyze a survey about snacks. In this graphing lesson, students ascertain which snacks would be the best choice for the community. Learners hold a sale and decide how the money could best be spent for the school...

Curated OER

The Price is Right

Students, through various activities, explore online databases. Using the internet, students explore the distributors websites. They collect specific information on selected products. An spreadsheet with price comparisons is developed....

Curated OER

The Teenage Consumer

Students think critically regarding teenage spending. In this data collection instructional activity, students discuss teenage consumers and their spending habits. Students note their own spending habits for comparison purposes.