Curated OER

Hey, Mom! What's for Breakfast?

Students examine how he world eats breakfast. In this food choices lesson, students work in groups to list breakfast foods and their ingredients and find goods and consumers on the list. The, students use the Internet to complete a...

Curated OER

The Treaty of Kanagawa

In this world history worksheet, students read a selection about the Treaty of Kanagawa as well as Internet articles about the topic and then respond to 8 short answer questions.

Curated OER

Erutan

Students discuss that governments exist for many purposes. They describe that governments maintain social order, provide public services, provide national security, manage conflict, establish justice, and manage resources.

Curated OER

Modals of Necessity: Must, have Got to, Have to

In this English grammar worksheet, students differentiate between the usage of the words "must," "have got to," and "have to." Students complete 9 fill in the blank questions and self check answers using...

Curated OER

Interpret the Quotient Quiz

In this interpret the quotients quiz, students complete a set of 15 division word problems. Answers are included on page 2; a references web site is given for additional activities.

Internal Revenue Service

Irs: Electronic Tax Return Preparation and Transmission

This lesson plan will help students understand the electronic preparation and transmission of tax returns.

Internal Revenue Service

Irs: Tax Tutorial: Module 13: Electronic Tax Return Preparation and Transmission

This tutorial explores e-filing your income taxes.

Next Gen Personal Finance

Next Gen Personal Finance: Taxes Data Crunch

Data Crunches feature one chart or graph followed by five scaffolded questions to guide students through analyzing the data and drawing conclusions. These sets of data help students understand tax concepts.

Internal Revenue Service

Irs: Tax Tutorial: Module 12: Refund, Amount Due and Recordkeeping

Learn about how refunds are processed in a tax return with this module.

Internal Revenue Service

Irs: Online Services and Tax Information for Individuals

In a conversational tone, the IRS answers many of the questions an individual would have when filing income tax returns for the first time. Many features are helpful even to experienced taxpayers, e.g., an IRS withholding calculator, a...

CNN

Cnn Money: Tax Guide

Information about taxes including paying taxes, filing a return, audits, tax planning.

Bankrate

Bankrate.com: Taxes

This site explores the basics of taxes including finding your tax bracket, income tax calculator, earned income tax, state taxes, states with no income tax, and capital gains.

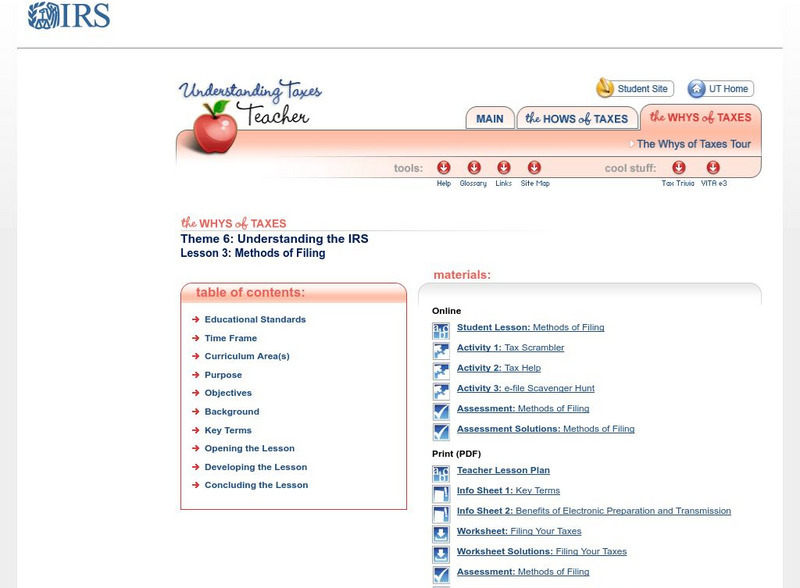

Internal Revenue Service

Irs: Methods of Filing Lesson Plan

This lesson plan will help students understand the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically.

Internal Revenue Service

Irs: The Taxpayer's Rights Lesson Plan

This lesson plan will help students understand the rights of taxpayers and the procedures the IRS uses to process tax returns.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau: Understanding Jobs, Teens, and Taxes

Learners review Internal Revenue Service webpages and respond to questions to explore the relationship between working and taxes.

Bankrate

Bankrate: Tax Basics, Choosing the Correct Form

Description of the 3 forms, 1040EZ. 1040A and 1040. Explains who should use each form when filing taxes and why.

Other

Spiegel and Utrera: Rules Allowing You to Avoid Gift Taxes

Rules for planning to avoid gift taxes are outlined on this page.

Wolters Kluwer

Biz Filings: Due Dates for Returns and Payments Depend Upon Business Form

Explains what various types of businesses, including sole proprietorships, partnerships, or limited liability companies (LLC), C corporations or S corporations must do when filing their taxes.

Internal Revenue Service

Irs: 1040 Ez [Pdf]

This site provides help with as well as an explanation of the IRS tax form, 1040EZ.

University of Groningen

American History: Outlines: Colonial Economy

Whatever early colonial prosperity there was resulted from trapping and trading in furs. In addition, the fishing industry was a primary source of wealth in Massachusetts. But throughout the colonies, people relied primarily on small...

Wolters Kluwer

Biz Filings: Compare Business Types

Chart comparing features of C corporations, S corporations, and limited liability corporations (LLC's).

Council for Economic Education

Econ Ed Link: What Happened to Railroads?

Between the Civil War and World War II, railroads were one of the nation's most important businesses and an integral part of people's lives. In this instructional activity, students assume the role of detectives investigating why the...

Other popular searches

- Income Tax Returns

- Partnership Tax Return

- Federal Tax Returns

- Prepare a Tax Return

- Preparing a Tax Return