Internal Revenue Service

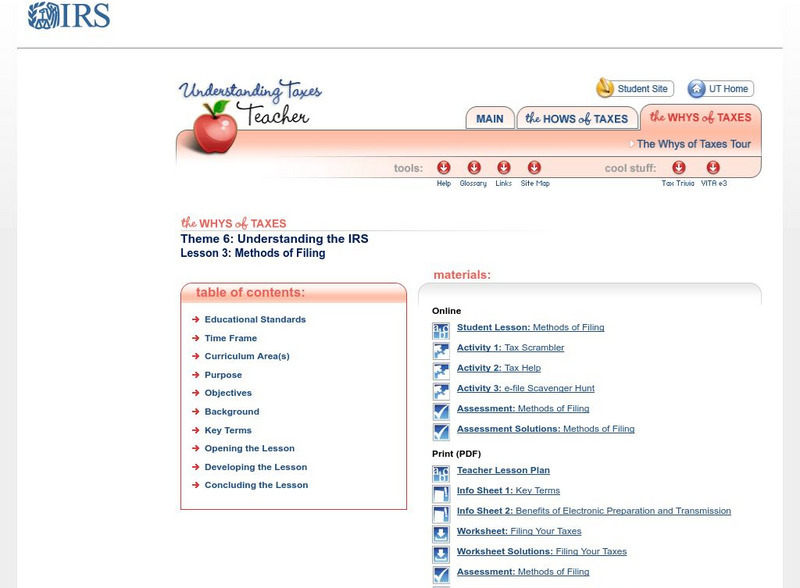

Irs: Methods of Filing Lesson Plan

This lesson plan will help students understand the methods of filing tax returns and the advantages of preparing and transmitting tax returns electronically.

Internal Revenue Service

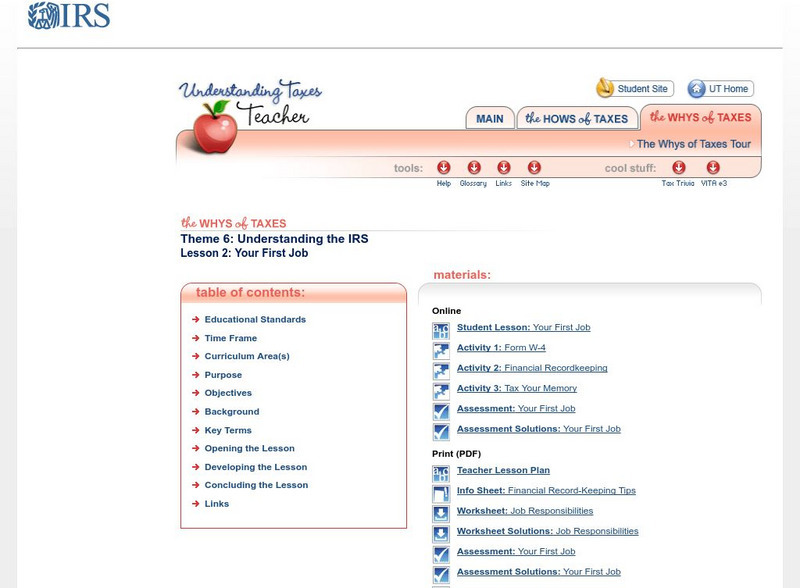

Irs: Your First Job Lesson Plan

This lesson plan will help students understand that they are responsible for paying income taxes through withholding as they earn income and that it is important that they keep accurate records of their earnings and expenses.

Internal Revenue Service

Irs: The Irs Yesterday and Today Lesson Plan

This lesson plan will help students understand why the Internal Revenue Service was instituted, how it functions, how it has changed over the years, and the ways it helps taxpayers today.

Internal Revenue Service

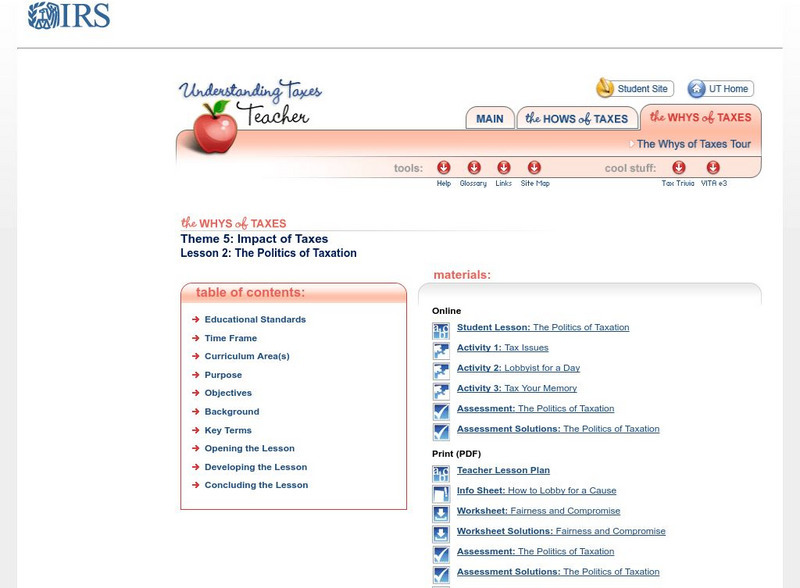

Irs: The Politics of Taxation Lesson Plan

This lesson plan will help students understand that taxation involves a compromise of conflicting goals and that lobbyists can influence lawmakers' decisions about taxes.

Internal Revenue Service

Irs: How Taxes Influence Behavior Lesson Plan

This lesson plan will help learners understand how taxes may influence the way people spend and save their money.

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf]

This lesson will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

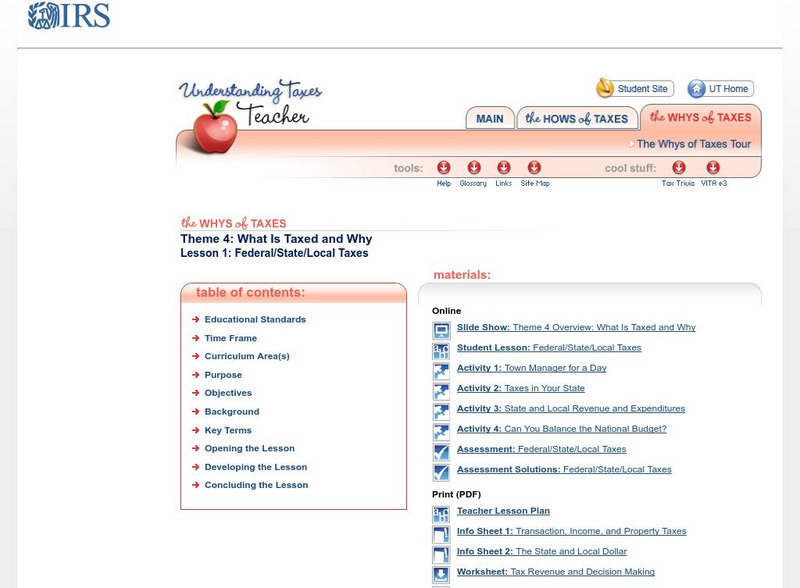

Irs: Federal/state/local Taxes Lesson Plans

This lesson plan will help students understand that federal, state, and local governments need revenues to provide goods and services for their residents.

Internal Revenue Service

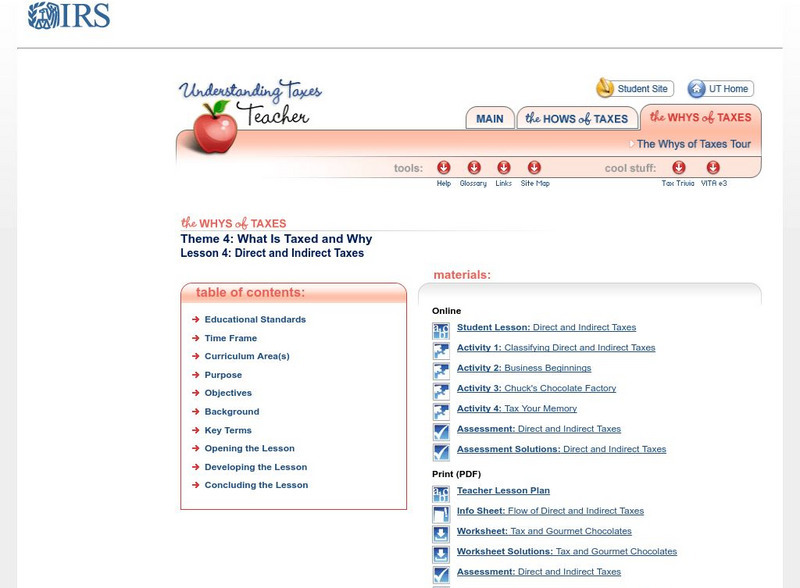

Irs: Direct and Indirect Taxes Lesson Plan

This lesson plan will help students understand that a tax levied on one person or group may ultimately be paid by others.

Internal Revenue Service

Irs: Wage and Tip Income Lesson Plan [Pdf]

This lesson plan will help students understand that wage and tip income is taxable.

Internal Revenue Service

Irs: Interest Income Lesson Plan [Pdf]

This lesson plan will help students understand that most interest income is taxable.

Internal Revenue Service

Irs: Dependents Lesson Plan [Pdf]

This lesson plan will help students understand who is a dependent and how the number of dependents affects taxable income. Requires Adobe Reader [PDF].

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding

Payroll taxes include the Social Security tax and the Medicare tax. Social Security taxes provide benefits for retired workers, the disabled, and the dependents of both. The Medicare tax is used to provide medical benefits for certain...

Internal Revenue Service

Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan

This lesson plan will help students understand the withholding of payroll and income taxes from pay.

Internal Revenue Service

Irs: Wage and Tip Income

This lesson plan will help students understand that wage and tip income is taxable.

Internal Revenue Service

Irs: Standard Deduction Lesson Plan

This lesson plans will help students understand the standard deduction and how it affects income that is subject to tax.

Internal Revenue Service

Irs: Claiming a Child Tax Credit Lesson Plan

This lesson plan will help young scholars understand the child tax credit and additional child tax credit.

Internal Revenue Service

Irs: Dependents Lesson Plan

This lesson plan will help students understand who is a dependent and how the number of dependents affects taxable income.

Internal Revenue Service

Internal Revenue Service (Irs)

The Internal Revenue Service is the nation's tax collection agency. Explore this site to find tax statistics, recent news, and specific tax information for individuals, businesses, charities, and nonprofits.

Internal Revenue Service

Irs: Online Services and Tax Information for Individuals

In a conversational tone, the IRS answers many of the questions an individual would have when filing income tax returns for the first time. Many features are helpful even to experienced taxpayers, e.g., an IRS withholding calculator, a...

Internal Revenue Service

Irs: Earned Income Tax Credit (Eitc)

The IRS provides a collection of articles and factsheets regarding the Earned Income Tax Credit (EITC). Content includes an overview of the EITC, the way to find out if you qualify, information for employers, law changes and more.

Internal Revenue Service

Internal Revenue Service: Frequently Asked Questions and Answers

Hundreds of questions about taxes are answered here. FAQs are sorted by category, subcategory, and keyword.

Internal Revenue Service

Internal Revenue Service: Sole Proprietorships

A definition of a sole proprietorship, along with links to the relevant forms that must be filed with the IRS.

Internal Revenue Service

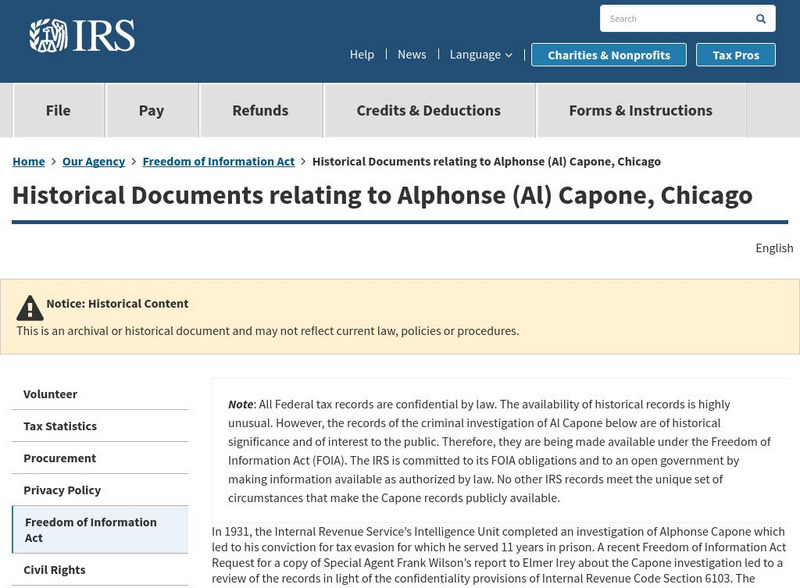

Internal Revenue Service: Historical Documents Relating to Alphonse (Al) Capone

Access the documents held by the Internal Revenue Service related to the prosecution of Al Capone for tax evasion.

![Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan Irs: Payroll Taxes and Federal Income Tax Withholding Lesson Plan [Pdf] Lesson Plan](https://d15y2dacu3jp90.cloudfront.net/images/attachment_defaults/resource/large/FPO-knovation.png)